Read More

Read More

Simon Murphy

Fund Manager

So close and yet so far. And so, the eternal wait for another major international tournament win for the England men’s football team continues for at least another 2 years. Despite never quite managing to set the tournament alight in terms of attacking play, England somehow managed to find their way into a second successive European Championship final only to be pipped at the post once more. Congratulations must go to Spain who, to our untrained eyes, appeared worthy winners on the night.

Whilst we might be making a leap drawing parallels, our wait for some positivity towards the UK equity market has, at times, felt decades long too, particularly in our preferred area of mid-market equities.* As regular readers will be aware, on numerous occasions recently we have postulated that sentiment towards the UK was so poor that it surely could not get any worse, only for it to go and do so!

Now however, we are starting to see what we hope will be a definitive positive change in the outlook for our much-beleaguered asset class. Our long-standing reasons for positivity remain, including a much more resilient economy than expected, depressed sentiment, exceptionally cheap valuations and ongoing corporate M&A activity - $47bn in UK M&A deals so far in the year to 24th June 2024 compared to $25bn for the whole of 2023 (source: Deutsche Numis).

In addition to the above, the potential for a sustained period of political stability under the new Labour government, prioritising economic growth as a key policy initiative, appears increasingly appealing in the context of an ever more volatile political picture abroad. Throw in rebounding consumer confidence, headline inflation back to target, and potential interest rate reductions in the months ahead, then the positive narrative becomes even more compelling.

Whilst it has, of course, been an extremely difficult few years in the UK mid-market universe, the chart below, showing the relative performance of the MID 250 Index (excluding Investment Trusts) to the wider market over the last 25 years, offers a reminder as to why we remain such enthusiasts – significant, sustained, relative outperformance being the ‘norm’ historically.

Zooming in on the most recent 5 years relative performance, the chart below is suggestive, to us at least, that likely as a result of the factors mentioned above, the period of mid-market underperformance is coming to an end.

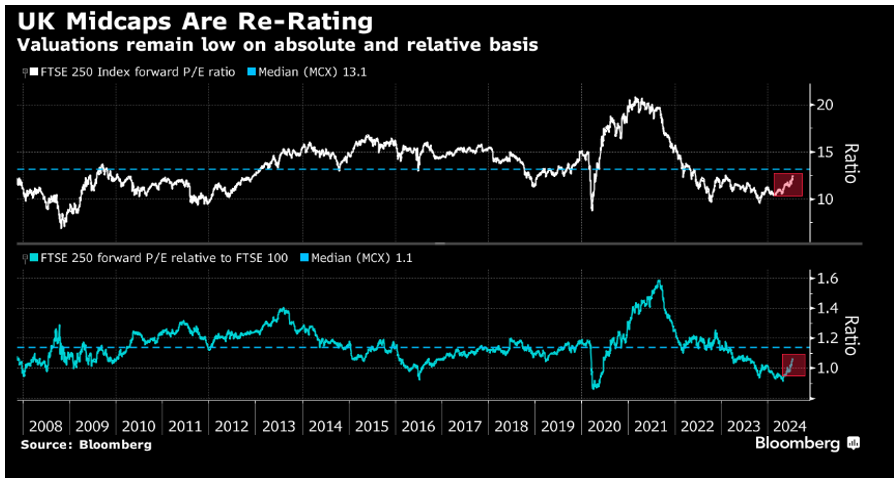

As is often the case at the start of new major moves, assets tend to rerate ahead of underlying fundamental improvements and indeed this appears to be happening in UK midcaps now, as the chart below highlights. As can also be seen, both from an absolute and relative valuation standpoint, there would appear to be plenty of scope to rerate further in due course.

Indeed, whilst the ‘mood music’ towards UK equities, and mid-caps in particular, has been improving noticeably of late, our contention is that if this is the start of a fundamental reassessment of the attractions of UK equities there is much further to go in the months and years ahead.

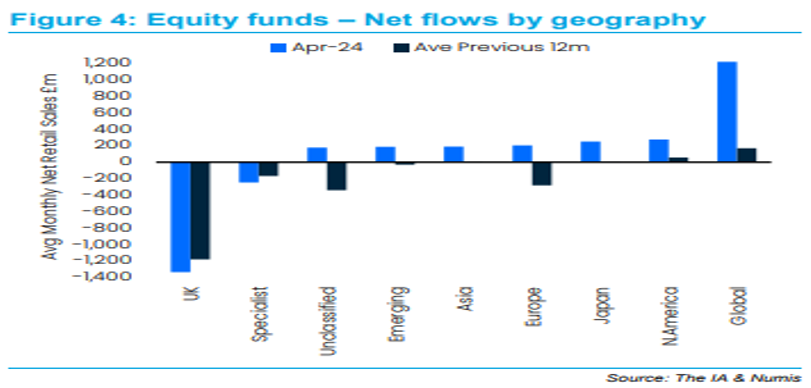

From an international perspective, Bank of America’s latest global fund manager survey showed that exposure to UK equities increased eight percentage points in July. Whilst that represents the highest allocation in two years, it still shows a net 4% underweight the UK. Meanwhile, from a domestic retail perspective, as the chart below demonstrates all too clearly, there has been absolutely no let-up in the relentless outflows from UK focussed retail equity funds so far, with over £1.3bn taken out in the month of April alone.

So, will this recent improvement in sentiment prove to be another triumph of hope over experience or the start of a sustained, material reappraisal of the attractiveness of UK equities? Only time will tell of course, but we are certainly of the view that, after what has also felt like an eternity, positivity towards UK equities, and the mid-market specifically, is coming home.

*We define mid-market UK equities as companies that have a market capitalisation of between £1bn - £10bn. As of 28th June 2024, the VT Tyndall Unconstrained UK Income Fund had 77.1% exposure to companies in this market capitalisation range.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund