Read More

Read More

Felix Wintle

Fund Manager

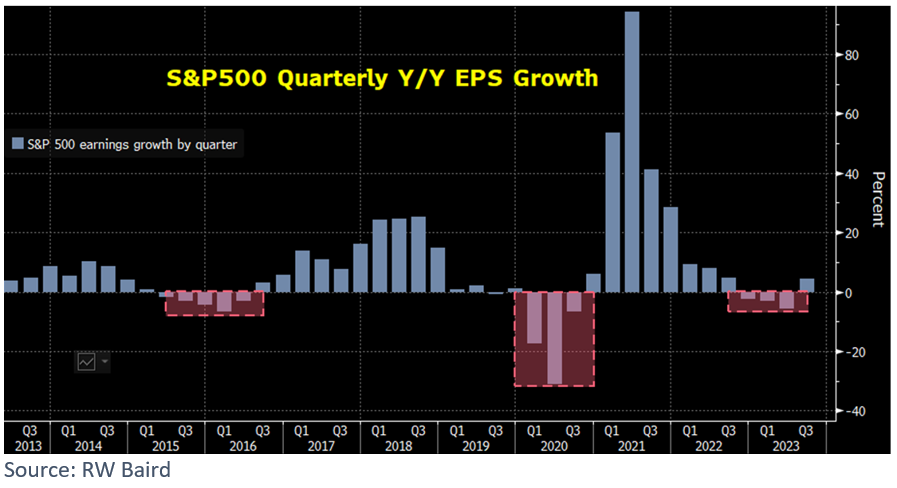

In this first note of 2024, I’d like to map out five reasons why 2024 sets up bullishly, in my view. The first is earnings, and as can be seen in the chart below, the earnings comparisons versus 2023 are easy, as earnings growth was negative for the first three quarters of last year and only slightly positive in Q4:

Secondly, our macro process supports this positive earnings environment. Our data led macro process is rate of change focused and it is indicating that growth will inflect in Q1 and then trend higher, which is positive for risk assets, equities in particular. This should lead to our third point which is broader participation in equity markets.

As has been well documented, the S&P 500’s return was dominated by the mega caps last year, but as the economy improves this should spread out into other areas of the market, offering investors more choice in where they invest. The performance skew to mega caps away from small and mid-caps has been extreme and this is likely to reverse as things improve. In fact, this is already under way; the strong rally in the last two months of 2023 saw broad participation and we expect this to continue in 2024.

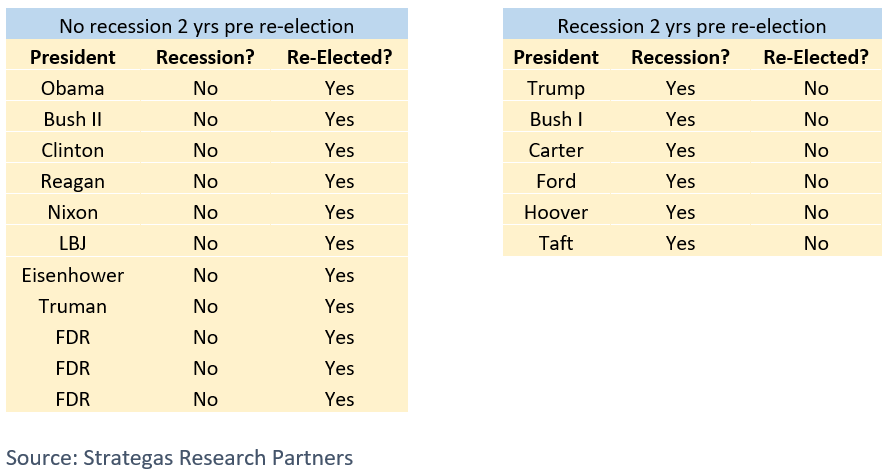

The fourth point is the election cycle. Historically election years have tended to be good years for stock market returns, but re-election years are even better. In data going back to 1960, in presidential re-election years the S&P 500 has outperformed open election years by 13%. This is due in large part to the incumbent president’s attempts to make the economy look good and keep voters happy with promises of better times ahead, low gasoline prices and full employment etc.

As the lists below show, most elections are decided on economic factors, so keeping voters happy is paramount ahead of the election in November.

Which brings us to the fifth point; liquidity. One of the ways that the administration can keep voters, and investors, happy is by continuing with the generous pay outs and accommodative policies that have become a cornerstone of Bidenomics. State handouts, debt forgiveness and tax breaks have been and still are stimulative factors in the US economy today, despite the Federal Reserve’s tightening program, which itself has most likely come to an end.

Janet Yellen, the head of the Treasury has also added some stimulus. She decided in November to switch the funding of the deficit from longer term debt to T Bills and this was a big factor in bringing yields down so sharply and this in turn boosted the equity market. It was the determining factor in where equity markets went after a torrid 10% decline in the three months prior. Will rate cuts be the next tool used?

So, with these five bullish factors at play, I believe 2024 will be a good year for equities, and for stock pickers in particular, as investor focus moves to new and interesting parts of the market.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not