Read More

Read More

Simon Murphy

Fund Manager

A mercifully short commentary this week as we return to a subject we have covered numerous times before, namely investor apathy towards UK equities and the lack of any potential ‘catalysts’ for change. We noted previously that understanding a problem is the first stage in an eventual resolution of the issue, and certainly there are many more discussions taking place in public policy circles now, concerning the state of UK capital markets and potential ways to reinvigorate them.

In the Chancellor’s budget statement on the 6th March 2024, we have arguably seen the first concrete proposals aimed at addressing some of the issues. As was widely anticipated, the government announced proposals for a ‘British ISA’, an additional ISA allowance of £5,000 for investment in UK equities. Further measures include a requirement for pension funds to publish details of their level of UK equity investment, and “the government will review what further action should be taken if this data does not demonstrate that UK equity allocations are increasing”.

The somewhat predictable initial response to these proposals has been lukewarm at best. Commentary around the British ISA has focused on what exactly will be an eligible investment, after all if it includes FTSE 100 companies, most of which are global businesses, how will that directly benefit the UK economy? Equally, what will be the actual quantum of new investment, given most investors do not currently utilise the full £20,000 per annum allowance anyway? Panmure Gordon estimate it may generate c. £1bn - £2bn of inflows, welcome of course, but minimal in the context of the £13.5bn of outflows from UK equity strategies over the last twelve months.

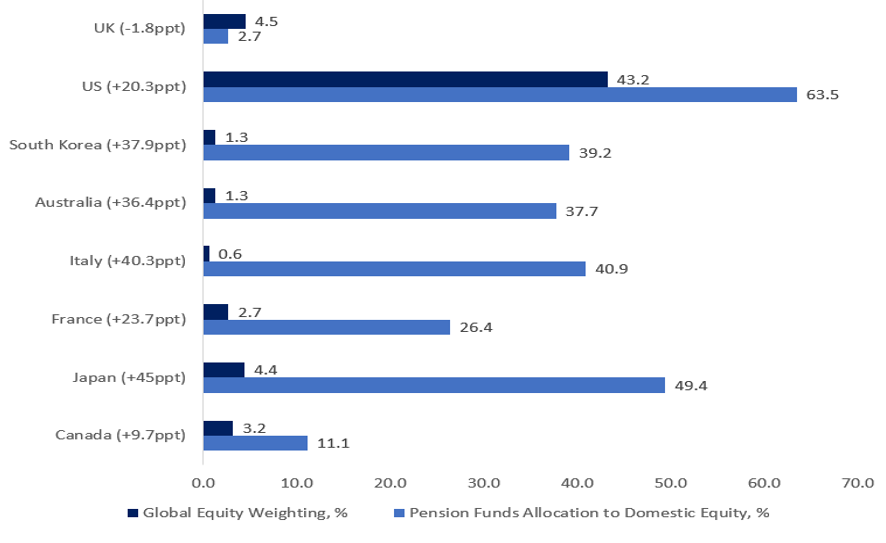

Commentary around the pension disclosure proposals has been equally muted, although the chart below from the Capital Markets Industry Taskforce, November 2023, certainly illustrates why this has become a potential ‘hot topic’.

The chart illustrates the weighting of various countries in global equity indices and the current asset allocation of domestic pension funds to their own equity markets. As can clearly be seen, in many countries the pension fund industry is vastly more supportive of their home equity market, by a considerable margin, than the UK industry appears to be, irrespective of the country’s size in the global market. To what extent additional disclosure rules will encourage a change to this position in the UK remains to be seen of course.

Whilst the devil in these proposals will undoubtedly be in the detail, and the consultation period for the British ISA remains open until 6th June 2024, we feel the collective industry ‘shrug of the shoulders’ potentially misses the point, particularly as we strongly suspect this is just the start of the process rather than the ultimate end goal. In that regard we are reminded of what, to us at least, ought to be considered one of the greatest investment quotes of all time, written by Jeremy Grantham of GMO during the heat of the global financial crisis in March 2009.

“Be aware that the market does not turn when it sees light at the end of the tunnel. It turns when all looks black, but just a subtle shade less black than the day before.”

Most UK equity investors will attest to just how black the outlook has been for a long time now. Whether 6th March 2024 will prove to be the day the outlook for UK equities became just a subtle shade less black than the day before, only time will tell.

If it does, and of course we sincerely hope it will, we equally hope that at least a few readers will look back and remember that it certainly did not seem to be the ‘catalyst’ at the time, notwithstanding all those who will surely be proclaiming that it was so obvious of course, with the wonderful benefit of hindsight.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund