Read More

Read More

Richard Scrope

Fund Manager

All that glitters is not gold.

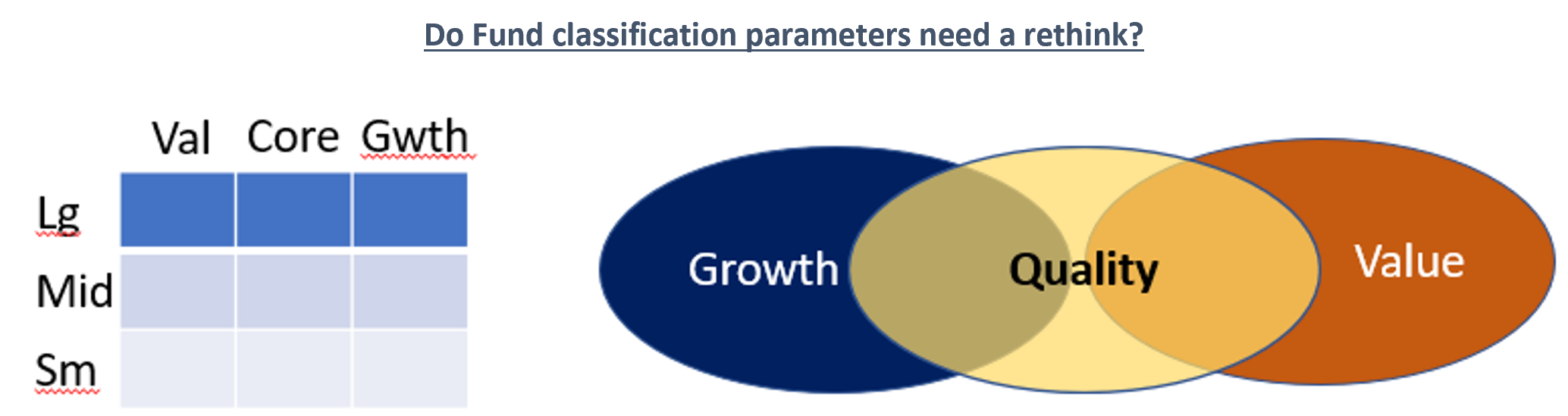

As many a fund manager will know, one of the most regular questions asked is whether they would classify themselves as a ‘growth’ or a ‘value’ investor, which we believe misses a third style. This elite group encompasses both holdings which may be classified at times ‘value’ but more often ‘growth’, namely ‘quality’. Too often ‘quality’ is mistakenly thought of as synonymous with ‘growth’. Part of this misunderstanding is due to the rating agencies who try to pigeonhole every fund into a box for investors to understand – however a Venn diagram may be a more appropriate way of depicting where on a chart a particular fund sits as a ‘quality’ fund may have more of a ‘value’ or ‘growth’ tilt, but not be exclusively ‘quality growth’.

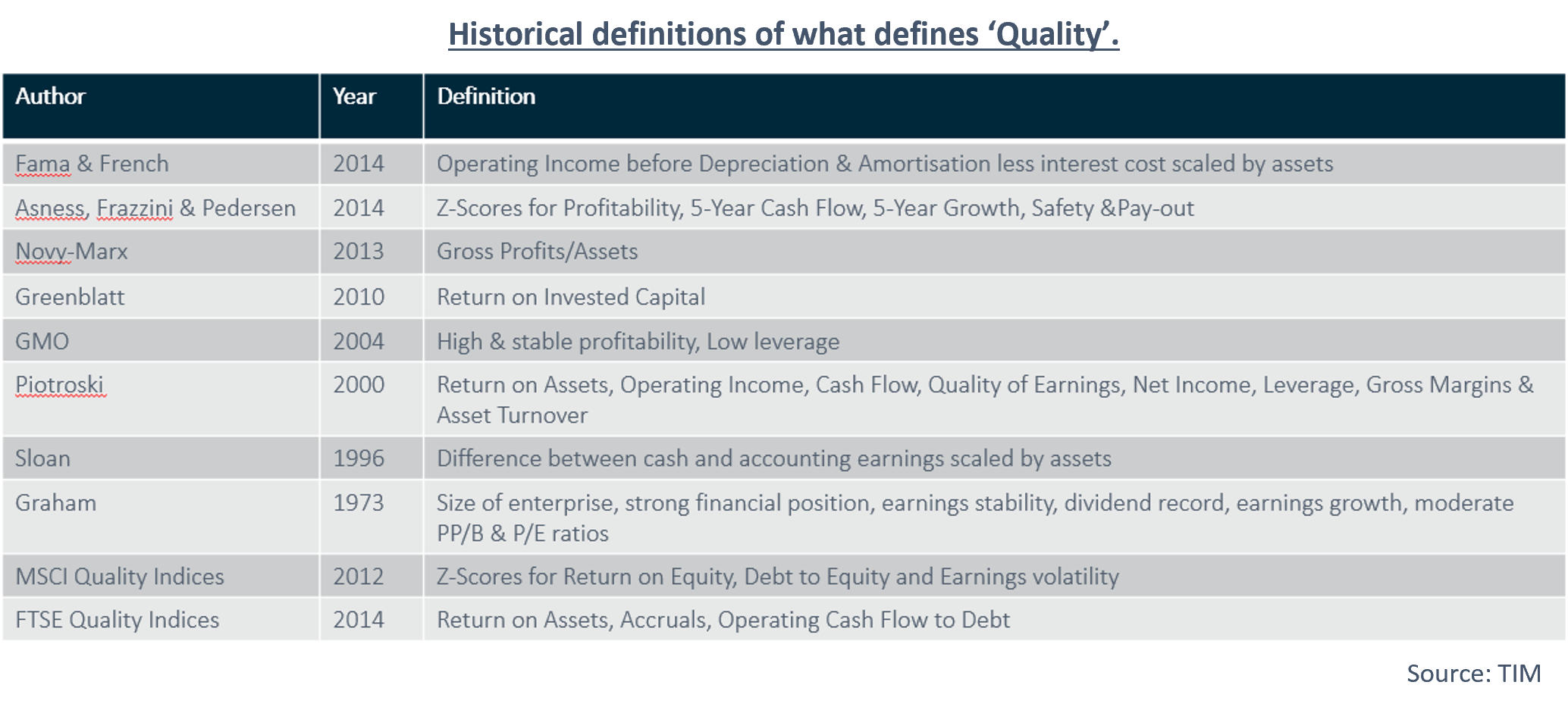

Over the years there have been many attempts to classify and define what qualifies a company to be included within this third sector. Every quality investor is likely to have their own tilt on the metrics and characteristics they look for, so the list below is by no means exhaustive, but goes some of the way as to understanding why people have difficulties in classifying a company as to a particular sector.

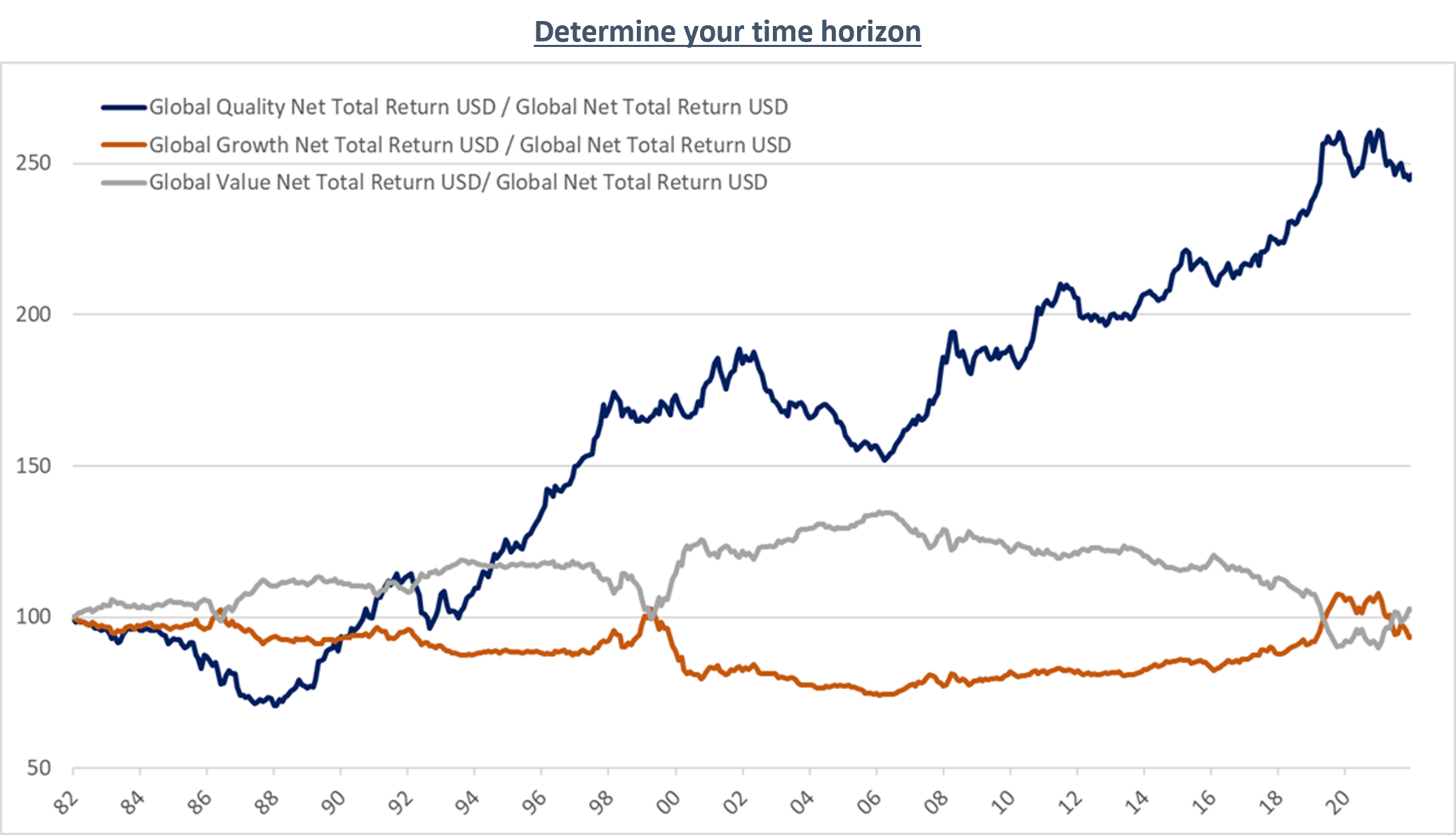

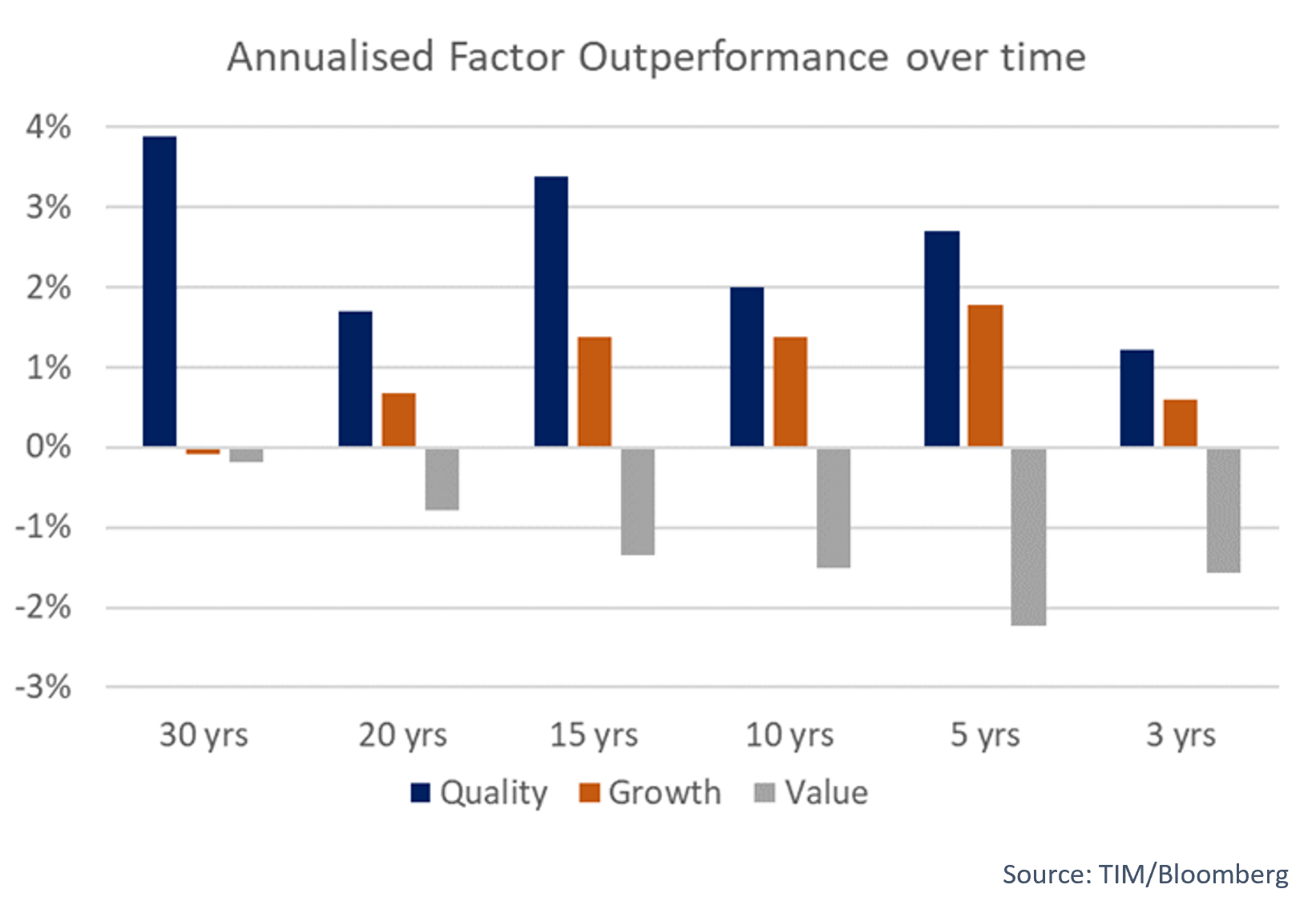

One might question why ‘identifying a company as a quality company’ is important, as over the years there have been many very successful value and growth investors, and there are definitely periods in time when either style has outperformed. As the chart below shows, throughout the 1980’s and the early noughties, it would have paid dividends to have a heavy value tilt in a fund - however since the Financial Crisis these gains would have almost totally disappeared.

For the long-term investor, who is prepared to look through the times when the market sentiment shifts from one style to another, there is one style that uses the power of compounding to stand head and shoulders above the others.

The experience of the past 10 years does value investing a disservice, as global macroeconomic policy laid the foundations for many pure-growth companies, often with no profits on show, to flourish and investors flocked to the promise of continuous year-on-year top line growth, however the outperformance of quality companies also continued. 2022 has seen the normalisation of interest rates, and with that, the discount rates applied to future growth have increased, leading to sizable underperformance of both quality and growth.

We would argue that, while valuations had become somewhat overstretched by the end of 2021, it is not time to sell out of quality companies, despite this period of underperformance.

The qualities that have led them to be classified as such, are the very reason why they will exit the current doldrums in a better shape than their peers and capture more of the growth on offer. They have the ability to make opportunistic acquisitions and exhibit higher operating margins and free cash flows than the pack, all of which lead to a virtuous circle of productivity and widens the economic and product moats that protect them from disruption and competition.

We believe that quality investing is the application of common sense to identifying and selecting stocks, and companies should be analysed on a ‘through-the-cycle basis’ not only on a one-to-two-year view - trading after all is a tax on performance. Macroeconomic conditions come and go (as do geo-political concerns) and bottom-up investing should be informed by macro, not controlled by it.

The overriding qualities that we believe form the starting point for identifying whether a company can be placed within the select basked of truly quality companies are:

- 1. Exceptional companies with established business models and durable competitive advantages

- 2. A high percentage of recurring revenues

- 3. Solid balance sheets

- 4. Visible and sustainably high cash flows

- 5. Demonstratively higher returns on invested capital than cost of capital

- 6. Exceptional management teams with a strong record of investing capital wisely

- 7. A Strong focus on consumer outcomes.

Even though a company may fulfil all the characteristics above, it does not necessarily mean that it falls within the quality bucket, and we can find companies that are traditionally placed within the value or growth buckets that also satisfy these characteristics, as well as the additional factors that we assess. As such fund classification is not as binary as some would have you believe.

Although this year has been a difficult one for true quality managers and their clients, and we are no exception, we have belief that if a manager has the freedom to minimise heuristic tendencies and adhere to his philosophy and process than as the old Persian adage goes, “This too shall pass”.

Data source (unless otherwise stated): Bloomberg

Not for retail distribution – this document is intended for professional clients only

Disclaimer

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not