Read More

Read More

Richard Scrope

Fund Manager

As the reaction to the US CPI print showed last week, the market has an unhealthy fixation with the path of interest rates and the timing of likely cuts in the headline rates. For a whole generation of investors, the current levels of interest rates are seen as unsustainably high, and inflation is too.

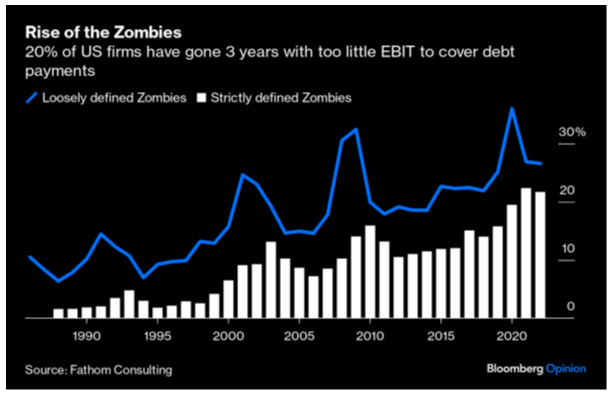

The period of near-zero rates post the Financial Crisis of 2008/09, led to excess borrowing, and unprecedented levels of liquidity being pumped into the system, despite warnings at the time that this would store up an inflationary shock in the future. However, as time wore on and inflation appeared under control, central bankers continued to see liquidity as their cure to all evils. The corporate world came to believe, as evidence suggested, that the system would bail them out should they come into difficulties, and with access to cheap debt, many felt that the risk of leveraging their balance sheets was low, even if their cash flows did not support such actions.

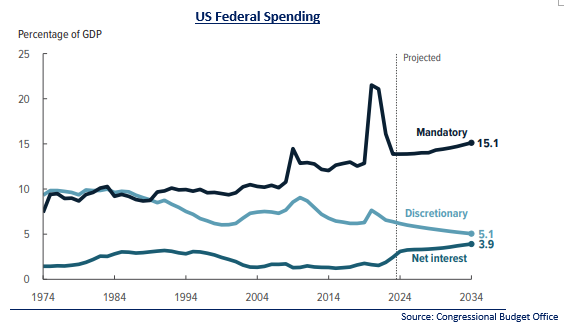

For those companies living on the life support of low interest rates, the sharp rise in interest rates over the past 18 months has proven to be problematic as they come to refinance their debt, let along pay the interest on that debt. The corporate sector is not alone in this issue as the Congressional Budget Office now predicts that the net interest payments of US government as a percentage of GDP will rise to the highest level since records began in 1940.

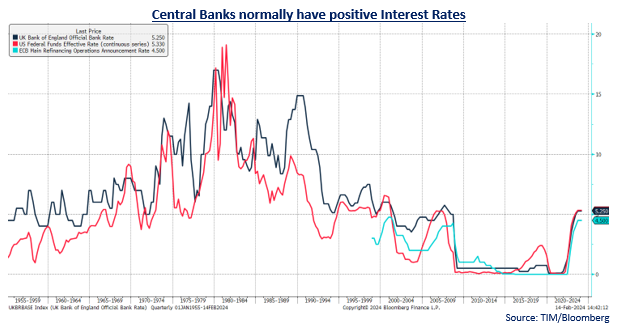

As the chart below shows, the period since 2009 should be seen as abnormal and we would be very worried if we were to return to such levels again. The average level of interest rates for the Bank of England since 1955 is 6.2% and for the US Federal Reserve 4.6%, so not too different from the current levels. We would suggest that investors would do well to accept that the era of low rates is over, and that we are more likely to be in an era of more normal levels, and the fixation of when, and by how much interest rates will be cut in unhealthy; if they are invested in good companies with solid balance sheets and cash flows an interest cycle should be of minimal concern and eminently manageable by corporate management teams.

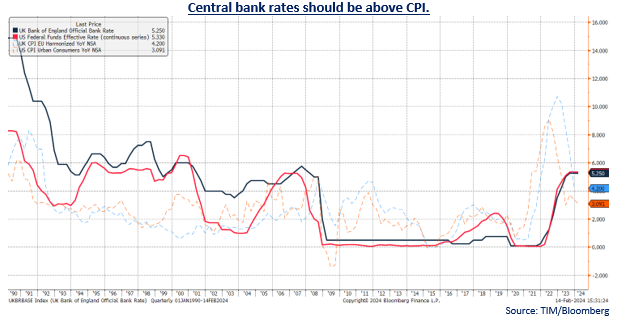

What should also be noted is that, quite logically, normally central bank rates are set at a level greater than the rate of inflation, and today there is persistently high levels of ‘sticky’ inflation, which remains in the 4-6% range. As we have only recently seen the level of inflation drop below the level of interest rates, so there is little impetus to cut rates dramatically, unless the global economy shows signs of grinding to a halt, which is not the outlook being painted by most corporates this quarter.

Those who are invested in companies that Warren Buffett would describe as ‘swimming naked’ may be concerned about when and by how much interest rates should come down, however, long-term fundamental investors know that tides come in and go out, and manage themselves not to be unnecessarily exposed and therefore should be unperturbed by interest rate cycles and not hang on every CPI print or forecast that come from central bankers, who after all have a questionable track record of being ahead of the curve.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not