Read More

Read More

Richard Scrope

Fund Manager

As markets reach new all-time highs, many companies are finding that their share prices are reaching levels that many investors simply cannot afford. Take Berkshire Hathaway A Shares at $616,000 a share, or Chocoladefabriken Lindt & Sprungli at CHF 10,500 a share, as two examples of companies that many retail investors find difficult to invest in. Berkshire Hathaway, at least, does have a B share option at a more affordable $410 a share, but those wanting to own a Swiss chocolate maker have no such option, and miss out on the free gift box that the company sends to shareholders who exercise their voting rights each year.

One course of action open to company boards is to conduct a share split. Although the action does not increase the value of an investor’s holding in the company, by increasing the number of shares on offer and a corresponding reduction in the share price, increases the attractiveness to retail investors.

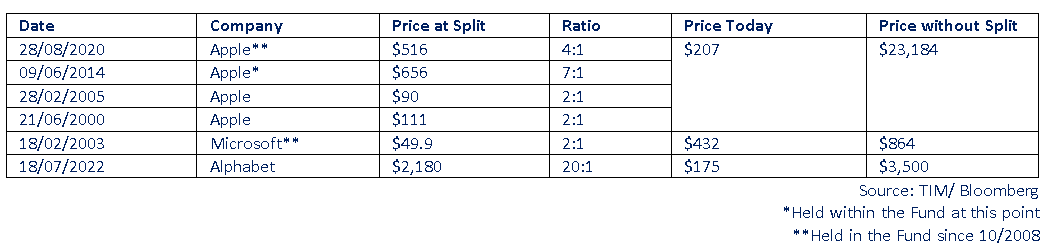

Commonly companies conduct splits after periods out outperformance, and as such the hyperscalers are good examples of companies that have conducted such actions since the turn of the century (although Microsoft conducted eight splits between 1987-1999, Apple one further in 1987 and Alphabet one in 1998):

Time will tell at what price the boards of the hyperscalers will decide to conduct another spit, however with them reaching new all-time highs we would be surprised if they do not do so. As we go to press Broadcom has just announced a 10:1 split.

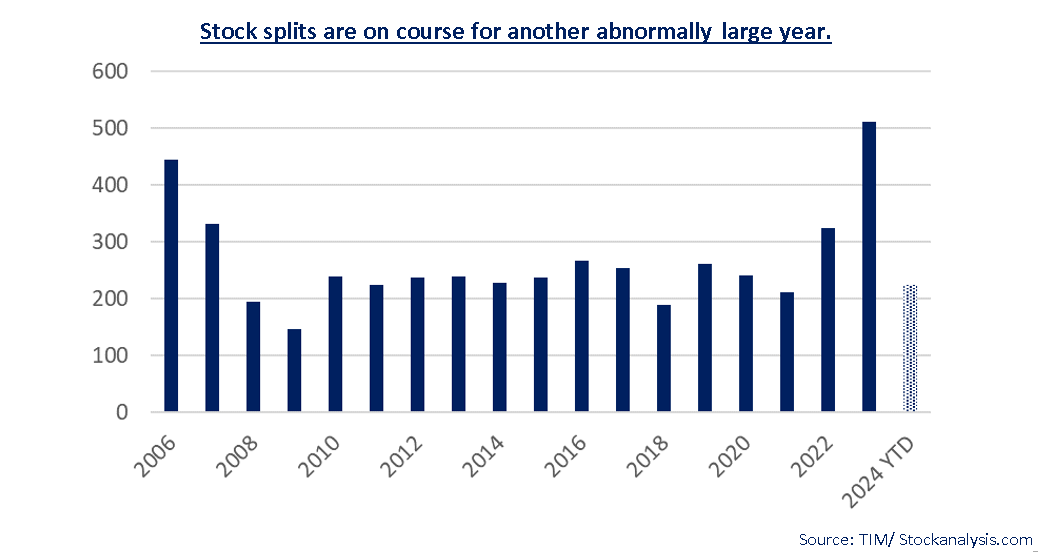

It is, however, not just the hyperscalers who are performing this form of corporate action, and we have recently seen a significant increase in the number of splits being announced. So far 225 stock splits (reverse and forward) have been announced in the US this year, and 512 were announced in 2023.

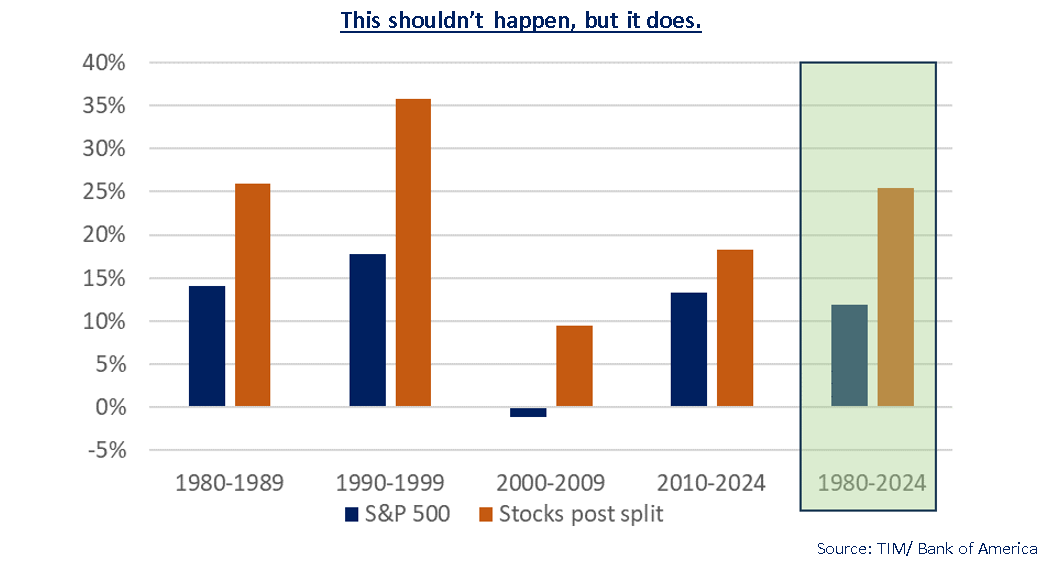

Within the Fund we have seen our holdings in Amphenol (2:1), Canadian Natural Resources (2:1) and Nvidia (10:1) all conduct stock splits this month. Apart from increasing the number of shares in these companies that we hold, increasing liquidity and possibly making them more attractive to retail investors, stock splits should not make a considerable amount of difference. However, the data suggests differently. Recently Bank of America conducted a study looking at the 12-month performance of companies that operate a stock split and found that those who do generate, on average, significantly better returns than that of the market.

Given that companies are more inclined to undertake this action after a period of strong performance, perhaps this can be explained by momentum investors. Alternatively it could be explained by it often happening when the company has strong expectations in the future growth of the company. Nonetheless the outperformance is striking.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not