Read More

Read More

Felix Wintle

Fund Manager

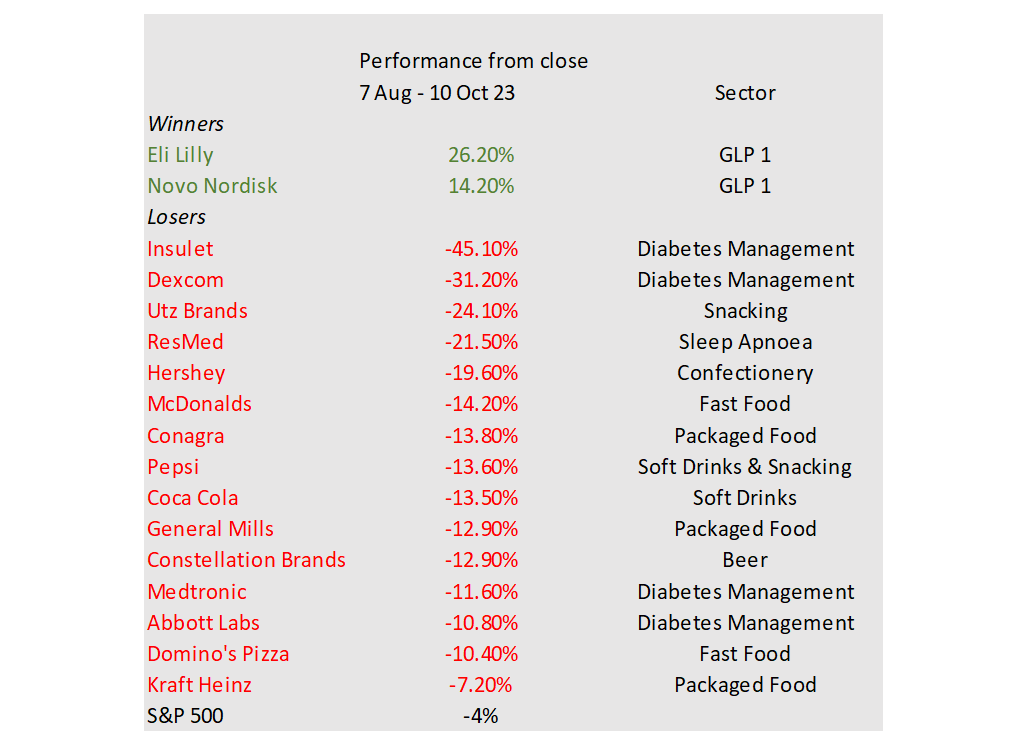

I wrote my last market update on the new weight loss drugs that are taking the world by storm. There has been so much off-label use that diabetic patients who have been diagnosed as needing these drugs have found supplies hard to come by. From an investment perspective the two companies involved, Eli Lilly and Novo Nordisk, have performed well, as you might expect, given the fact that this is very likely to become the biggest class of drugs ever. The real game changer however was data from Novo Nordisk’s SELECT trial back in August. This showed that there was a cardiovascular benefit from taking Wegovy, its anti-obesity drug. In high-risk patients, those who had already had a cardiac event, were less likely to have another episode (heart attack or stroke) if they were on the drug. You’d expect Novo and Lilly to respond well to this news but what is interesting is how investors have treated the perceived losers in the obesity game: ie: food stocks, fast food companies and traditional glucose monitoring companies. The list below shows how harshly these stocks have been sold off since the SELECT trial data became available on 8 August.

Whilst it’s impossible to say that all of the declines in these stocks are due to fears over what GLP 1s might do to their business, it is clear that it has had a big impact, as all these stocks started breaking lower on 8 August. Rising interest rates have also weighed on the sector as many of these companies are in the Consumer Staples sector, one that has underperformed as rates have risen.

It's also interesting to hear the CEO of Walmart call out the impact that weight loss drugs are having on his business. In an interview on 5 October, he said that shoppers were buying fewer items and they had noticed that baskets contained lower calorie items. It’s hard to prove the correlation here, as there may be other reasons for shoppers to be buying fewer items. There is also the question of affordability, can the typical Walmart customer afford an out-of-pocket monthly expense of $1,000 for a weight loss drug? That is to be determined, but what is for sure is that the biggest food retailer in the world has felt it necessary to call out this change in behaviour. And as can be seen in the table above, investors are shooting first and asking questions later as it relates to exposure to the fast food and packaged food industries and that is down in very large part to the weight loss drugs of Eli Lilly and Novo Nordisk*.

*The VT Tyndall North American Fund owns Eli Lilly and Novo Nordisk ADRs.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not