Read More

Read More

Richard Scrope

Fund Manager

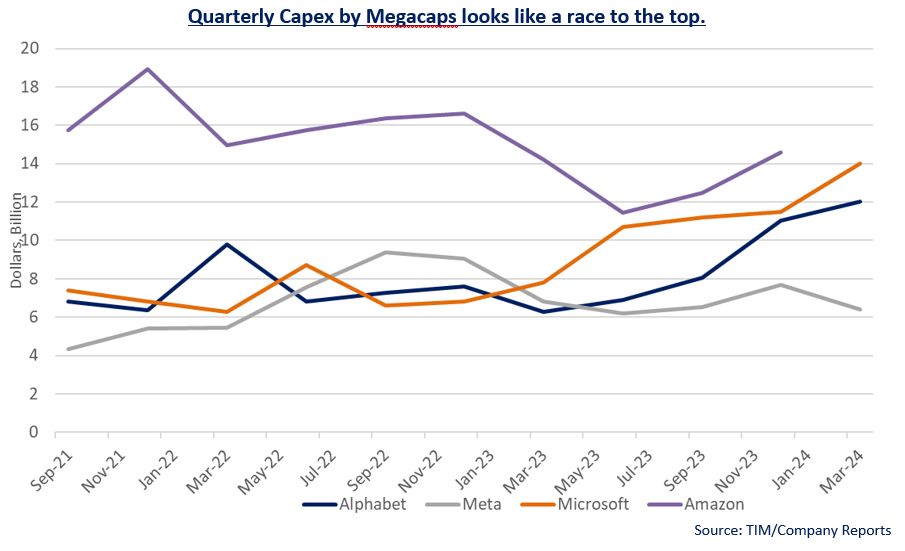

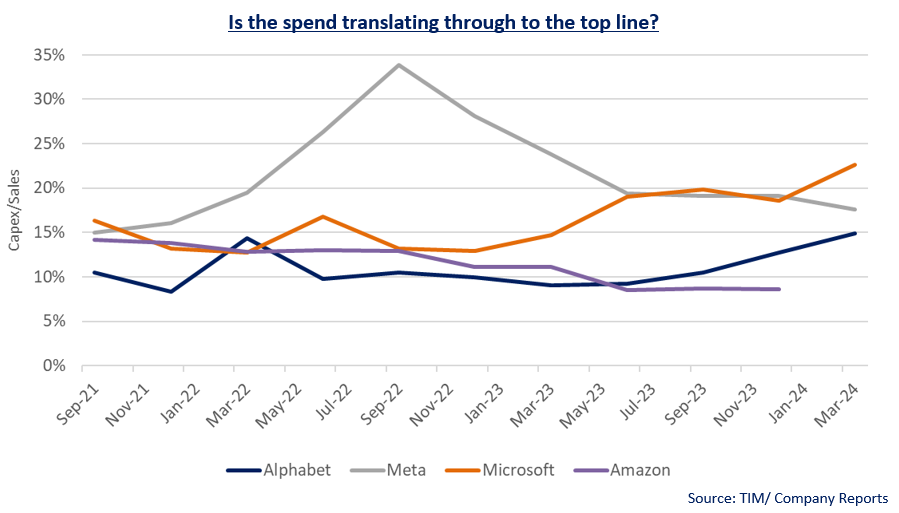

The Megacaps are in the midst of open warfare trying to remain at the forefront of the AI race and the sums involved are becoming ever more eyewatering. Although L’Oréal’s marketing department proved to be very successful declaring ‘because you’re worth it’, the question remains as to whether this capex really is worth it.

At the time of writing, Amazon is yet to report its latest quarterly numbers, however we expect that the number will remain well ahead of Microsoft’s record $14bn spent on capex last quarter.

The cloud providers are accelerating the integration of AI into their offerings. Microsoft claims that over 65% of the Fortune 500 now use Azure OpenAI services and that the average spend by customers is increasing. Simultaneously the number of customers signed up to Azure AI continues to climb, with AI services contributing 7% to the 31% growth reported by Azure and cloud services last quarter, thus giving a degree of visibility as to how Microsoft is starting to monetise their investments.

In their conference call, Alphabet singled out AI monetisation as one of their key priorities which they intend to do through a mix of Ads, Cloud and subscriptions. Google One now has 100m paid subscribers and in the last quarter they introduced a new AI platinum plan using Gemini Advanced. While Microsoft details Fortune 500 customers, Alphabet point out the 60% of generative AI startups and 90% of generative AI unicorns are Google Cloud customers as they believe that the AI Hypercomputer has the edge as a cost-effective platform for companies to train and serve their models.

Amazon is likely to outline where they are gaining customers for their AWS cloud offering later this week, but in their full year results they talked about having three distinct layers to their generative AI stack, describing them each as ‘gigantic’.

They split customers into those building their own models, those who seek to leverage an existing large language model and customise it with their own data and finally, those that use as an application layer where AWS can help companies with coding. They believe that these avenues will ultimately drive ‘billions of dollars of revenue over the next several years’.

The outlier here is Meta, which appears to have the best profile in capex/sales terms, but is not one of the leading cloud providers; Mark Zukerberg aims to invest to build more advanced models to become ‘the largest scale AI company in the world’. This was reiterated by their CFO, Susan Li, in the latest quarter where she raised the forecasted capex to $35-40 billion in 2024 to support their ambitions in AI research and product development. Having spent $26 billion in the past 12 months in capex, this is a significant increase, and questions will remain as to how they will sufficiently monetise this through search, advertising and reels. Investment of this size would rapidly transform their capex/sales profile to the worst in the chart above.

Meta’s share price had outperformed all but Nvidia of the former ‘magnificent seven’ as investors rewarded it for cutting costs and focussing on efficiency. This profligacy in AI spend appears to be a return to the norm for Meta, and we believe the market will worry that Mark Zuckerberg might have overinvested in his Metaverse dream without a clear path to return on investment.

The VT Tyndall Global Select Fund holds positions in Microsoft and Amazon.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not