Read More

Read More

Simon Murphy

Fund Manager

Most investors, we feel sure, will be only too glad to see the back of the first half of 2022, which delivered numerous ‘records’ for the first six months of a year, and nearly all of them negative. The list of worries is as long as we can recall in our time in markets, and includes uncontrollable inflation, global recession, imminent earnings collapse, cost of living crisis, energy crisis, climate crisis, political upheaval, ongoing pandemic, war and no doubt a host of other issues we haven’t mentioned.

Whilst it may seem foolhardy against such a backdrop, we feel it is important to remember that there will almost certainly be better times in our future. Whether those better days are a way off yet or just around the corner only time will tell, but for this week’s piece we thought it a useful exercise to consider where some positives might come from, from a market perspective at least, as we head into the second half of an already tumultuous year.

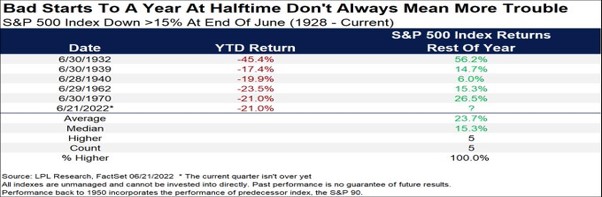

Whilst not exactly a large sample size, let’s start with some factual data. As the chart below shows, going back to 1928, whenever the S&P has been down over 15% for the first half of the year it has always rallied, sometimes significantly, in the second half. Will it be different this time?

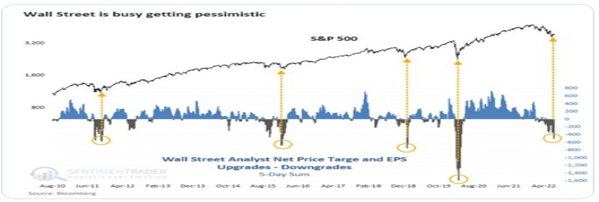

In no small part due to the litany of worries outlined above, stock market analysts have become increasingly pessimistic recently, as the chart below highlights clearly. What’s interesting however, is that previous episodes of extreme bearishness, in a very short period of time, have tended to coincide with meaningful bottoms in the market rather than significant further weakness.

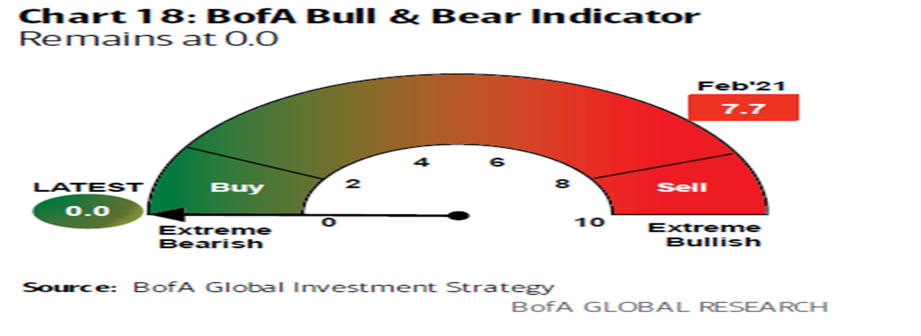

The same can be said of investor sentiment, which at extreme readings, is frequently a contrarian indicator. As you can see from the chart below, at least according to this indicator, sentiment can’t really get any more bearish and the most likely direction of travel, in due course, is at least somewhat more optimistic.

If sentiment is as sour as the above would suggest, what might provide catalysts for adopting a more positive outlook? We will leave aside the big geopolitical issues such as the ongoing war in Ukraine, and highlight a few ‘fundamental’ charts we feel are worthy of consideration.

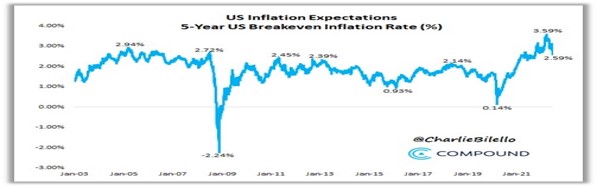

Firstly, on the hugely important topic of persistent inflation, it is encouraging to note that there are meaningful signs of medium-term inflation expectations starting to decline, as the chart above highlights for the US.

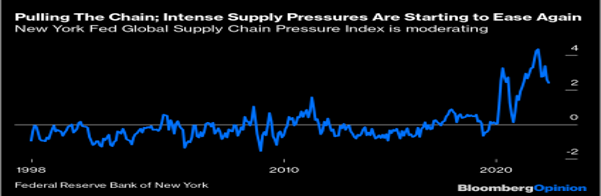

Perhaps a significant contributor to the above can be seen in the chart below, where it would seem that supply chain pressures, whilst still elevated, are finally starting to ease materially.

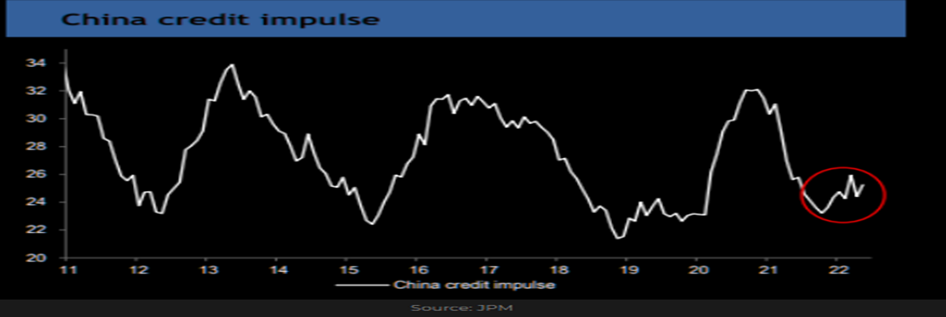

China’s growth outlook, an increasingly important factor for global growth, has been a huge cause for concern of late, particularly with the rolling series of Covid related lockdowns. Whilst they could yet cause further disruption, the chart below is encouraging as it suggests a renewed degree of credit growth and, in due course, activity growth to follow.

Whilst concerns persist over the health of the US economy, and manufacturing activity is starting to slow as can be seen below, it is certainly not, yet at least, slowing to anywhere near the degree we might expect for an imminent recession ahead.

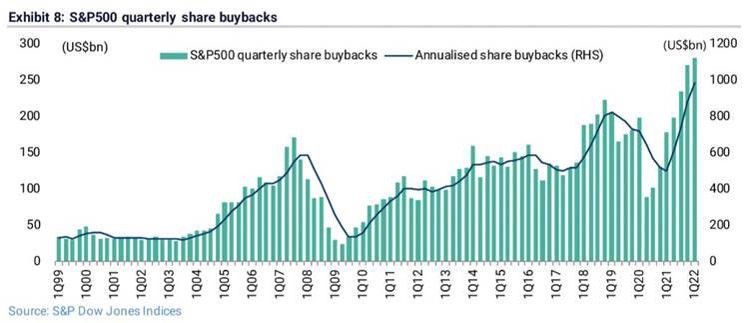

What’s more, for all the concerns over the outlook for corporate profits, companies themselves remain pretty confident in their cash generating capabilities, as highlighted in the chart of share buybacks below.

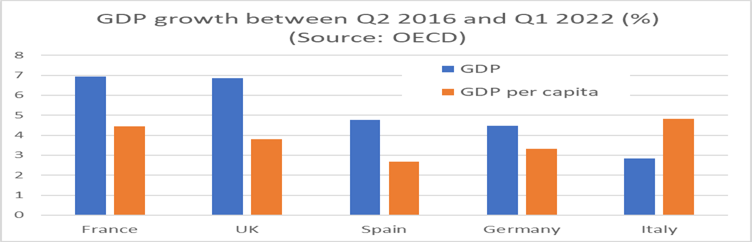

Finally, a couple of ‘UK specific’ charts that might surprise readers given the overwhelming level of pessimism that seemingly pervades all things UK related. The first highlights that, since the UK voted to leave the EU in 2016, GDP growth has more than held its own in a wider European context.

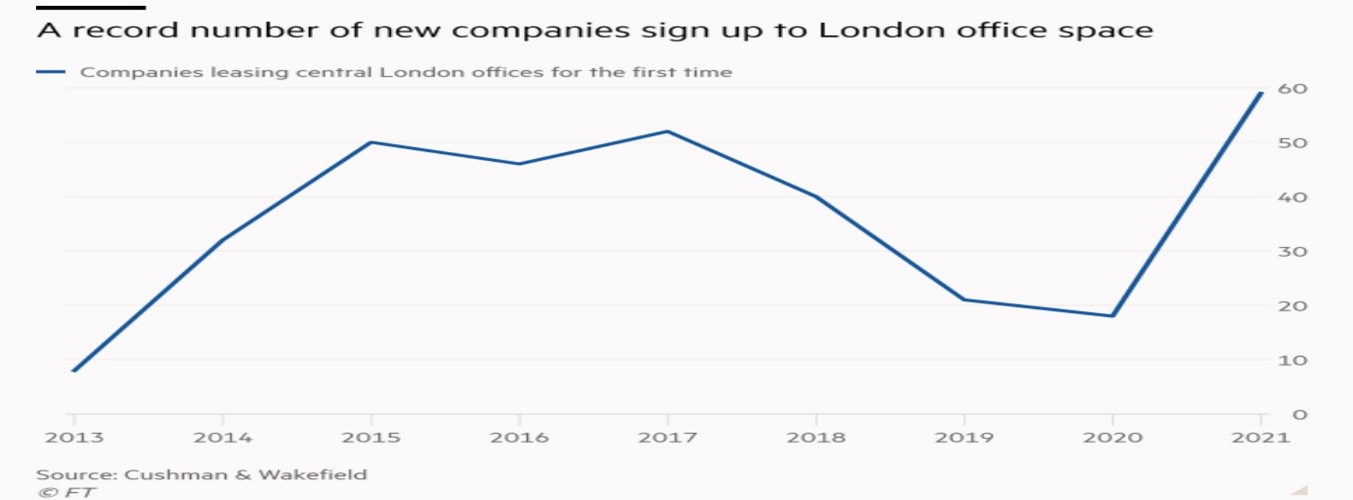

The second highlights that, notwithstanding both Brexit and the ‘working from home’ era, London still remains an attractive business and financial hub.

As always, there are almost no guarantees in life or in investing. It is entirely possible that the environment, on both counts, gets more difficult in our immediate future, but then again, it might not. We for sure would bet on it getting better in the medium-term, which is the time period over which our investment decisions are made.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund