Read More

Read More

Felix Wintle

Fund Manager

Consumer spending is always closely watched as a barometer of the health of the US economy, and this year’s data had been expected by some to slow given all the headwinds the consumer is facing. But consumers have defied economists all year, and Black Friday and Cyber Monday have proved to be better than last year.

According to Adobe Analytics, online shoppers spent a record $9.8 billion on Black Friday, which surpassed forecasts of $9.6 billion and marked a 7.5% increase from last year. U.S. retail sales for both online and in-store rose 2.5% from last year. Sales on the Shopify ecommerce platform rose 22% over last year to a record $4.1bn. Amazon too had a record result, reporting that the period 17 Nov – 27 Nov was its biggest ever compared to the same 11-day period in previous years, with customers buying over 1 billion items globally.

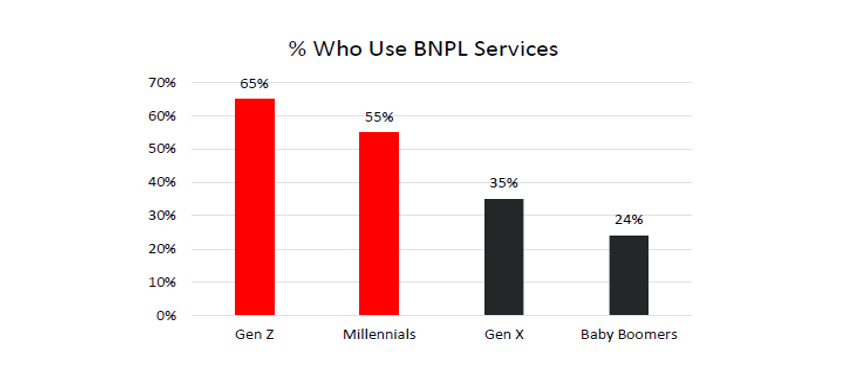

Black Friday and Cyber Monday have become marquee shopping days in America and shoppers do ‘seize the day’ when it comes round as the bargains on offer are so attractive. While the headlines make for good reading, there are some less positive elements to consider. Some retailers have started their promotions earlier than in previous years and this has probably meant that some of this record volume has been pulled forward. On that point we’ll have to see, and it will depend from retailer to retailer. One of the other interesting factors to note is the increase in Buy Now Pay later (BNPL) which is up 20% from last year, according to Adobe Analytics. The BNPL technology splits the cost of an item into 3 or 4 equal instalments and skews very much towards the younger consumer, as the chart below shows.

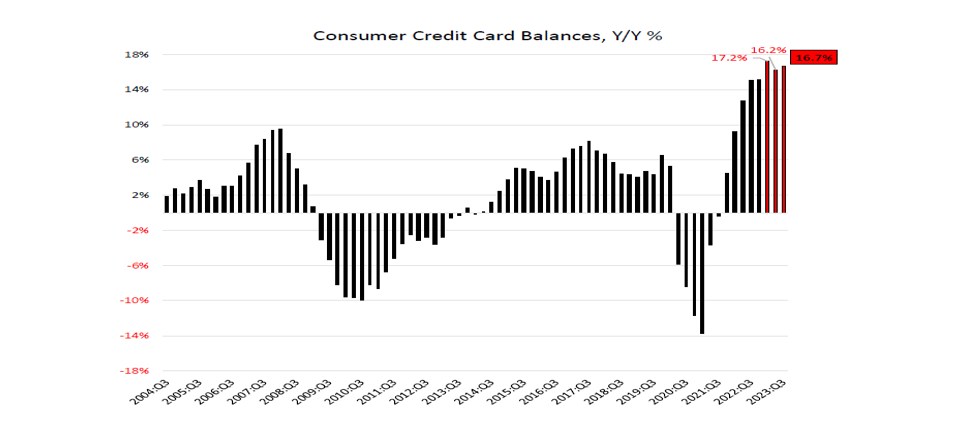

BNPL is offered not just on large ticket items but on practically any item and the typical delinquency of a BNPL payment is much higher than a normal credit arrangement, with 40% of BNPLs having a late payment. Consumer spending has been supported by strong employment and wage increases but the underlying credit picture shows an increase in credit card delinquencies and a decrease in lenders’ willingness to lend. The two charts below show that credit card balances have increased significantly in recent months:

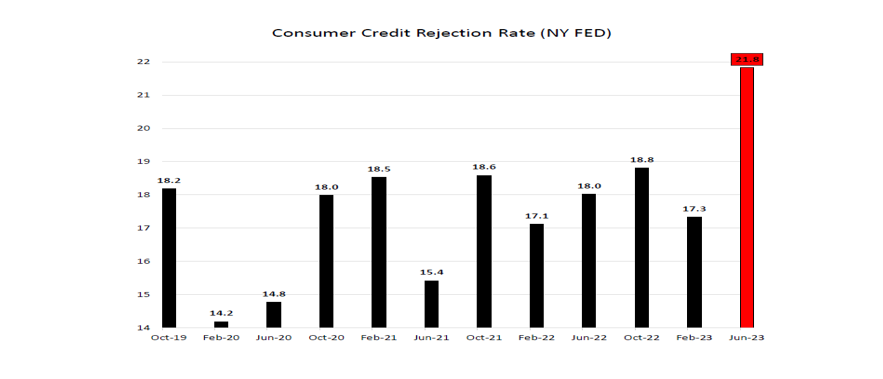

And the credit card rejection rate has also shot up:

Retail stocks have not performed well in 2023, unusually the higher end has been particularly weak, and we believe that a cautious approach to consumer spending is warranted given these credit dynamics. Our exposure to retail in the fund focuses on the discount players and believe that the trade down trend will continue as the true cost of living remains higher for longer, despite the fall in reported CPI.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not