Read More

Read More

Richard Scrope

Fund Manager

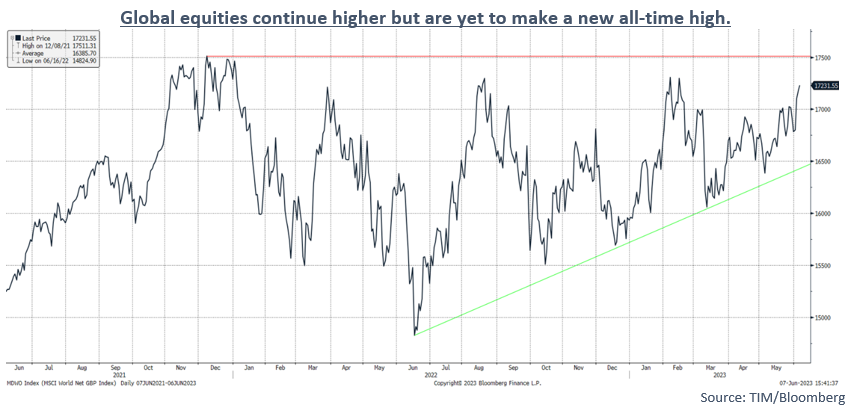

Despite all the negative news that fills the column inches of the financial press, such as Europe entering a technical recession, the lack of any meaningful rebound in China and the imminent implosion of the US economy, companies on the ground continue to report a more positive outlook on the prospect for the global economy, and equity markets have reacted in a way that suggest that they are minded to believe the latter. This week marks exactly a year since the global index (in Sterling) made its last major low, and since then is up 15% and has been making higher lows, which is traditionally seen as a bullish sign by technical analysts.

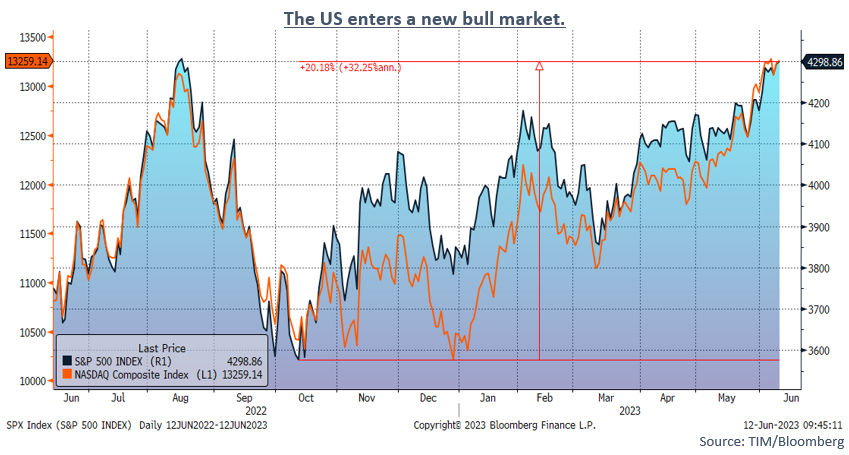

US Equity markets are following a similar trend, with the S&P 500 having made a low in mid-October, and is now up 20% since the low, which is the traditional definition of a new bull-market. The Nasdaq composite made a major low in late December, since when it is up a further 29.5%.

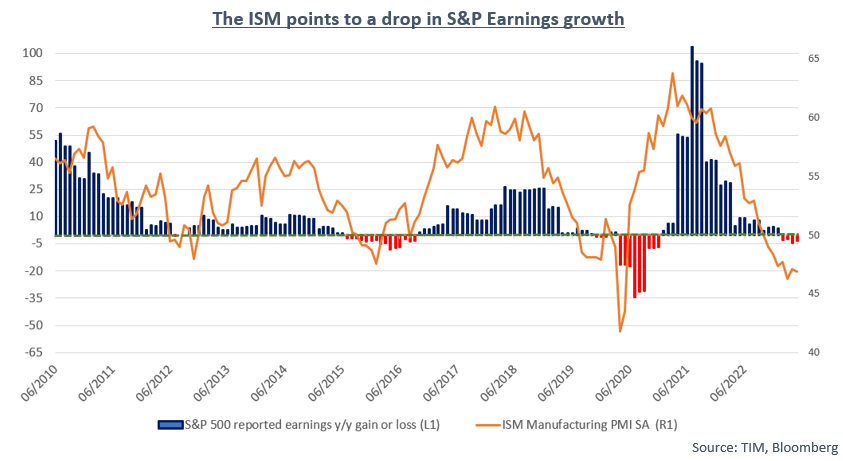

The US Manufacturing ISM is regarded as the most important bellwether of the state of the US economy, and it remains in negative territory, and the latest reading registered a further drop. The correlation between the level of the ISM and year over year earnings growth or contraction in the S&P cannot be ignored, however in reporting their first quarter earnings US corporates saw US corporate profits after Tax come in above that of the previous quarter, in contrast to the analyst community’s expectations of a deep contraction.

Despite confidence surveys such as the Philadelphia Fed Index and the University of Michigan consumer sentiment index at low levels, and declining in the case of the latter, the business outlook part of the Philadelphia survey increased to -10.4, from in May from a low of -31.3 in April, the survey is constructed as a balance of 125 Chief Executive Officers. Raoul Pal of Global Macro Investor creates his own Financial Conditions Index which has a strong leading correlation with the ISM and this turned in the autumn, around the same time as the S&P index and suggests that the ISM should start to turn upwards in the near future.

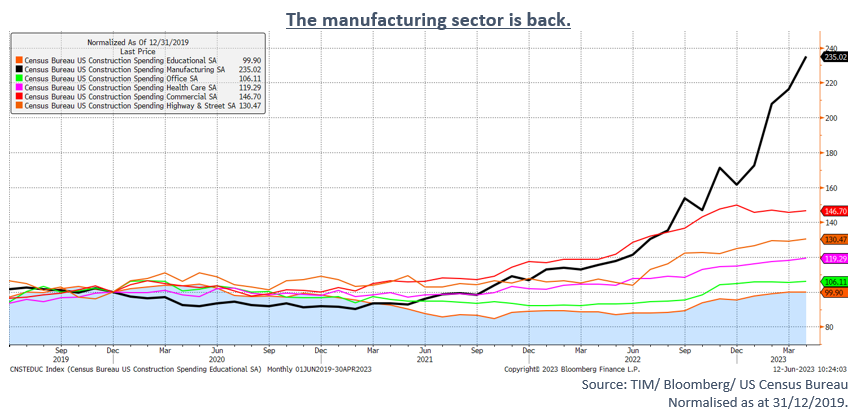

The suggestion that manufacturing is not dead on its knees in the United States is also backed up by the data from the US Census Bureau, which shows that, helped by the Inflation Reduction Act and the Chips Act in the US, manufacturing spending is increasing at an unprecedented rate to levels well above those before the pandemic.

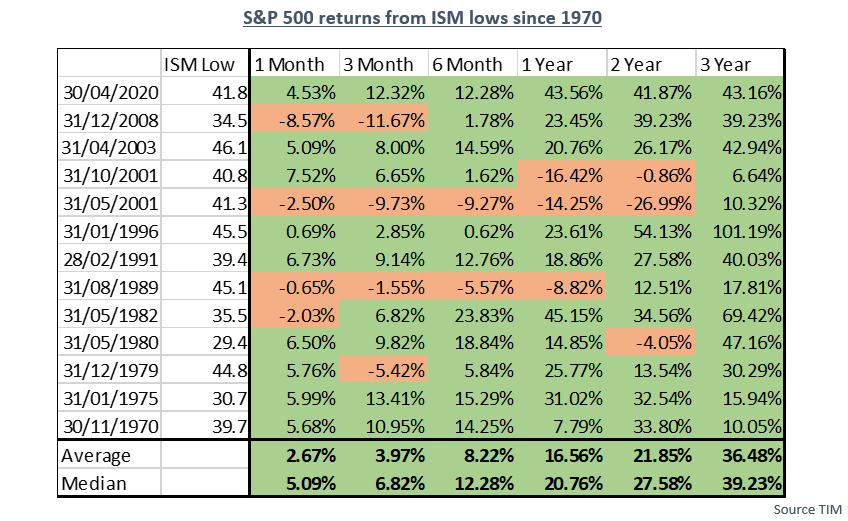

Identifying the low point in the ISM and acting on it has mixed returns for equity investors, as the table below shows. There have been 13 instances in the past 50 years that the ISM has been at similar levels to where we stand today and in aggregate the market has produced positive returns over all time periods since the low, although this has not always been the case, as in 2001 when the low in the ISM was quickly followed by another. The Industrial sector, however, does normally outperform once the ISM turns, with the major part of returns as the rate of change improves, and not necessarily waiting for the index to turn above 50.

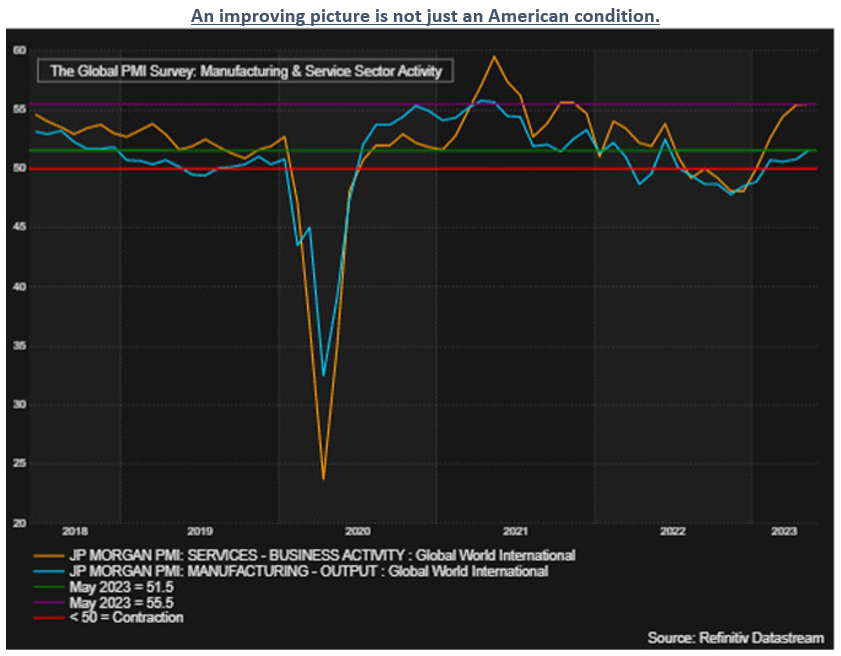

Although Europe has just registered two consecutive quarters of negative growth, thereby being in a technical recession, this measures the economy by backward looking data, and when one looks at global rather than just US data, it can be clearly seen that both the service and manufacturing sectors are in robust shape and improving, with the bottom being formed in late 2022 and positive results coming through early in the current year.

While we remain concerned by the narrow nature of the markets at present, evidence does suggest that we may be close to the bottom of the ISM, and with global and US equity markets up siginificantly from the lows of last year, they may well have further to run.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not