Read More

Read More

Felix Wintle

Fund Manager

There has been a decent rally in tech and growth over the last two weeks. From bottom to top, the Nasdaq rallied around 16% from the 14th of March to the 29th of March. A nice move and one that has got some investors wondering whether the worst is over and if it’s now time to buy the sector again. I would caution against this view and, in fact, would warn that moving forward tech stocks are likely to revisit their lows and possibly undercut them.

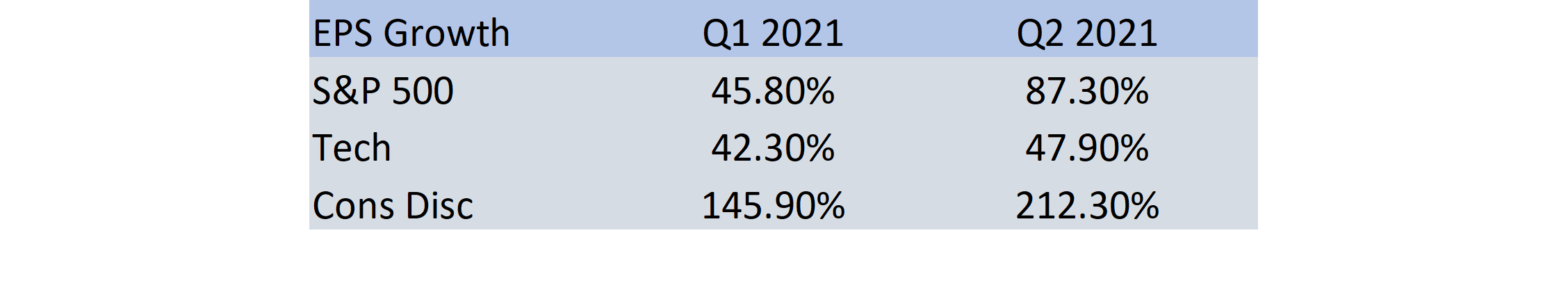

Here's a quick reminder of some of the difficult EPS comparisons that the market will have to go through for the next two quarters:

In Q1 2021 S&P 500 EPS grew 45.8% and in Q2 2021 grew 87.3%. Those are huge numbers and it’s close to mathematically impossible for growth in Q1 2022 and Q2 2022 to be higher, hence the slowing environment and weakness in many corners of the market. Bear markets always have big bounces however, and that’s what I think we’ve just witnessed in technology and the Nasdaq. This view is backed up by examining the anatomy of the bounce. Former darlings of the sector, like semi-conductors, moved higher but have not done so as leaders and, as at the time of writing, are already rolling over. Breadth has not been convincing either and leadership has switched to the defensive sectors like Utilities and REITs, which have been breaking out despite the relentless march higher in bond yields. Whilst the bounce in semis has been tepid with only 40% of the index constituents trading above their 200 day moving average, the one in Utilities has seen 69% of its members currently trading at 52 week highs.

The other sector that is struggling to perform is Consumer Discretionary. It has even bigger EPS comparisons of 145% in Q1 and 212% in Q2. This is due to the free money that was being handed out this time last year, producing a one-off spending spree that won’t be repeated. We are very underweight this sector as well and want to wait on the side-lines until this difficult period is over and the economy can renormalise. The good news is there are plenty of opportunities outside of these two sectors, in Healthcare, Staples, Energy and Materials, and that is where we have the fund positioned. We remain materially underweight Tech and Discretionary and still own none of the mega cap FANMAG stocks. Whilst some of these have held up better, like Apple and Microsoft, they are very over- owned, and should there be any persistent selling in the passive space due to weaker markets, they will correct too. Apple and Microsoft are in the top 15 of over 300 ETFs, so the concentration risk goes far beyond just the S&P 500.

Once we have cycled through these toughest ever comps there will be great opportunities to pick up Tech and Discretionary stocks at lower prices, but until then we remain defensive as we risk-manage the next few months.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not