Read More

Read More

Simon Murphy

Fund Manager

When it comes to investing, or nearly anything else for that matter, we are loathed to focus overtly on the turn of the calendar and the start of a new year. It is, after all, just another day. However, given

the extraordinary events that took place around the world in 2020, the quote above, from T.S. Eliot’s Little Gidding, seems particularly appropriate as we contemplate prospects for 2021 and beyond.

For UK equity investors specifically, this particular turn of the year does actually represent the beginnings of something new – our new trading relationship with the European Union, forged as is customary these days, in a flurry of last minute activity, despite the c. 4 ½ years of preparation time that has passed since the shock 2016 referendum result.

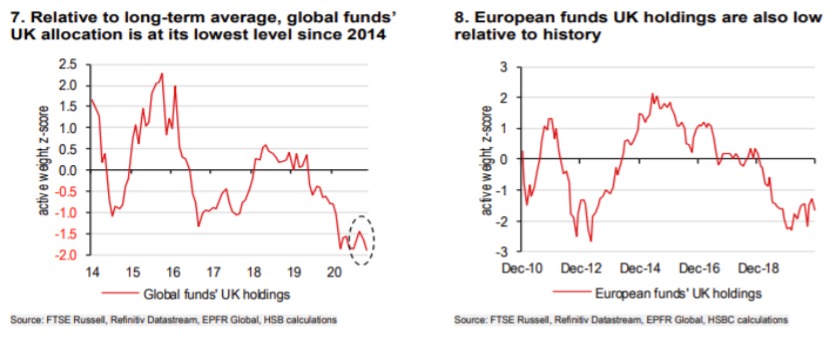

If you believe, as we do, that the uncertainty surrounding Brexit, and the potentially chaotic consequences of a ‘no deal’ exit, has been one of the dominant factors in the poor relative performance of UK equities in recent years then perhaps, just for once, the new year really is time for investors to look afresh at UK equities. Indeed, the charts below would suggest there is plenty of scope for investors to become more positive!

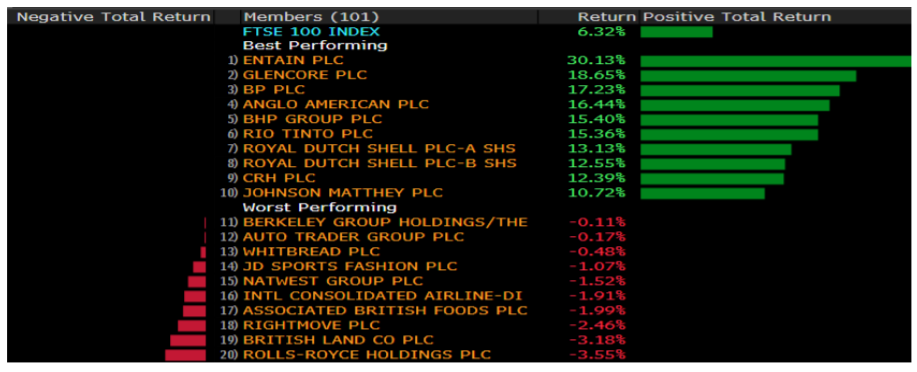

Early in the year as it is, this may be the signal we are seeing from markets already, as the FTSE 100 finished the first full trading week of the year with a gain of +6.3%, one of the strongest moves of all

the major global markets.

Of course, it is not only Brexit that has dominated the worry list for UK equity investors. Whilst the dreadful Covid-19 pandemic has had a devastating impact on people and economies around the globe,

the UK economic hitseems to have been particularly acute in 2020 relative to most developed nations.

Further, as we write, confirmed Covid-19 cases have been accelerating sharply throughout the UK, leading to renewed, tighter, economic restrictions and building pressure on the Health Service.

However, looking forward (whilst in no way belittling the current situation) we see reasons for cautious optimism in the UK’s early approval and accelerated roll-out of several vaccines.

The latest data suggests some 2 million people have already received their first dose, with around a third of all over 80s now vaccinated. If the roll-out continues as planned (best case) the UK will have vaccinated more than 14 million people by mid-February, comprising the over-70s, the clinically vulnerable and health and social-care workers. Just how quickly this progress will enable a reopening of the economy remains to be seen – but a certain degree of optimism is, we feel, warranted.

Another persistent headwind for UK equities in recent years has been the perception of ‘a lack of growth companies’, ‘too many old economy value stocks’ etc. Again, ultra-short-term caveat aside, the FTSE 100 leader board last week was, we thought, fascinating.

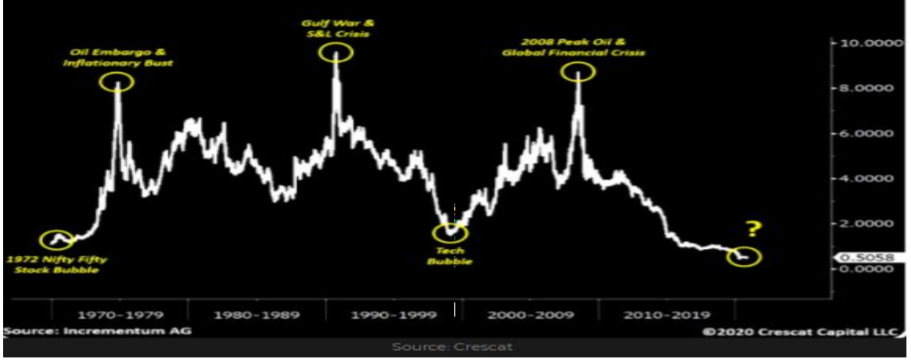

The preponderance of ‘old economy’ resource stocks (mining, oil & gas etc) is notable, particularly when you consider the long-term performance of commodities relative to equities in the chart below. The UK, as we know, is heavily exposed to the resource sectors.

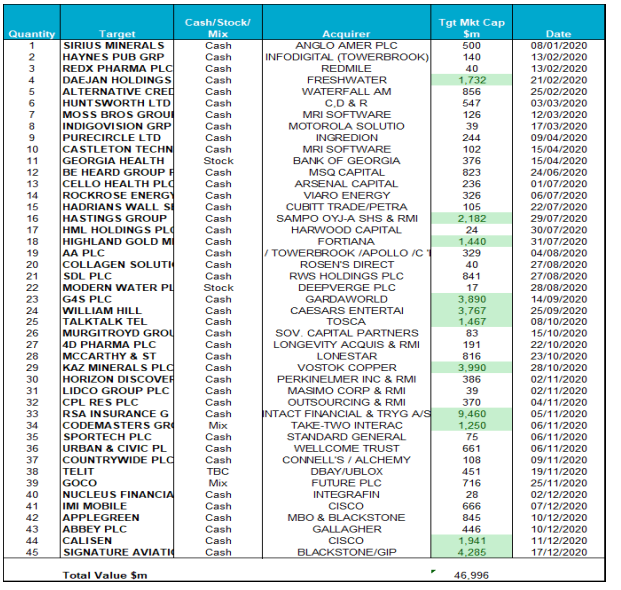

Entain Plc (GVC to most of us!) was top of the leader board last week having received a takeover approach from their US joint venture partner MGM Resorts. Indeed, corporate activity in the UK market has accelerated sharply, particularly in the second half of 2020, as the table below from Numis Securities highlights – some 45 deals to the tune of $47bn in value in 2020.

So, calendar change misgivings aside, we start this new year with a renewed sense of enthusiasm in our outlook for UK equities. The Brexit related uncertainty is resolving, vaccine related optimism is warranted, investor positioning is light and the ‘old economy’ may just be ripe for a period of performance. It looks to us as though corporates have already twigged that there is tremendous value in many areas of the UK market. If other investors don’t respond, expect M&A activity to accelerate further through 2021.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund