Read More

Read More

Richard Scrope

Fund Manager

The current Tokyo Olympics sees many historic rivalries play out as the world’s best vie each other for a coveted gold medal. If the market reaction to the latest quarterly results from the large cloud vendors are anything to go by then Google Cloud (Alphabet) sits at the top of the podium and Amazon Web Services (Amazon) in the bronze medal position with Azure (Microsoft) in the middle.

The US regulators have proposed splitting up the separate business silos of the mega-cap tech companies, but to date they have not put their words into action. Nonetheless it is worth investigating the strengths of the relative businesses and whether the market reaction to a rare warning from Amazon was justified.

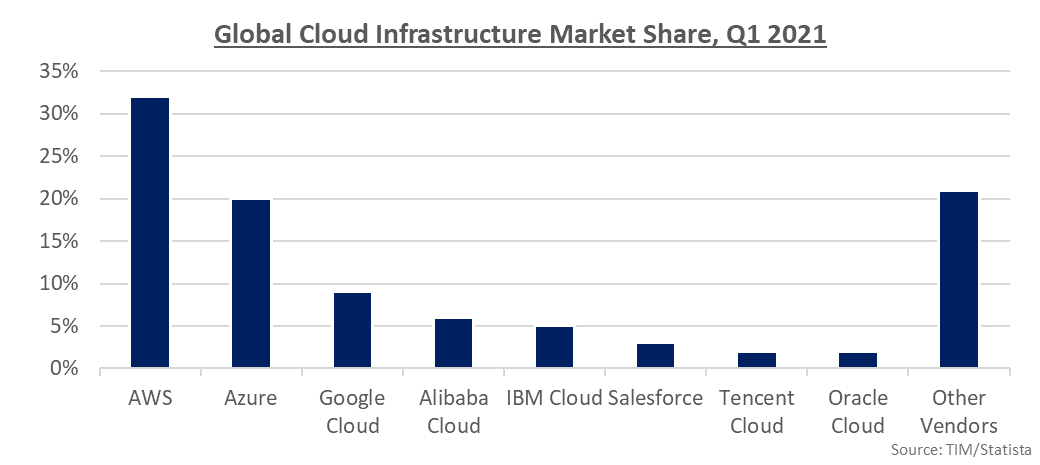

On speaking to Microsoft, a couple of years ago, they commented that, on pitches for cloud contracts, they only came across AWS and occasionally Google, primarily when the third party did not want Amazon to have control over their data; the multitude of other cloud vendors who all claim to have decent niches and offerings hardly registering. They also mentioned that many of the contracts that Google was winning was at prices that they believed would be loss-making, although with the court battle launched by AWS against Azure being awarded the Pentagon’s $10bn Jedi contract, the pricing discipline between the two largest players may not be as robust as they may lead the market to believe.

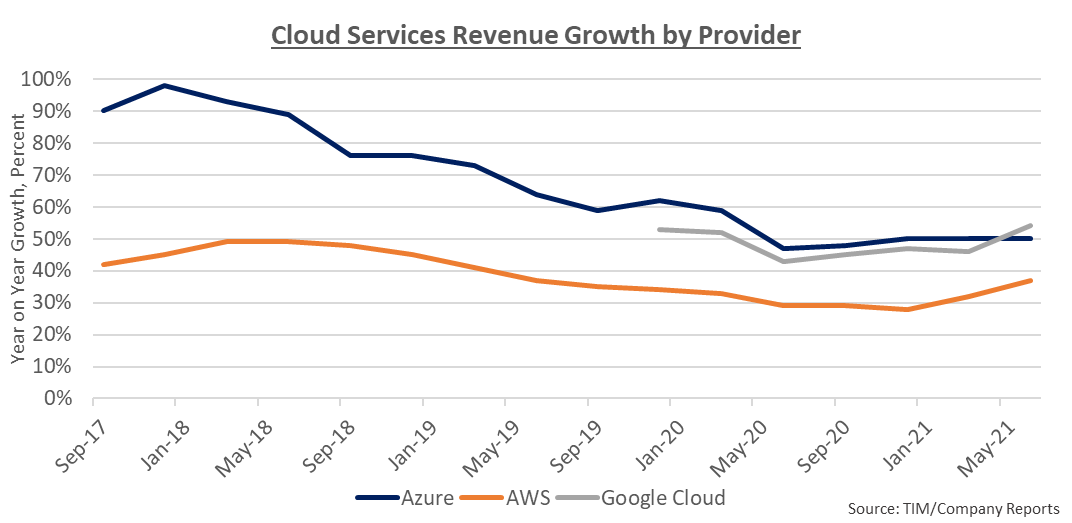

Microsoft is the only one of the three main players not to specifically split out the revenues and margin attributed to their cloud platform, instead disclosing the growth rate per quarter and the revenues and margin of their total Intelligent Cloud division, however given the margin progression and the growth rate of Azure compared to the rest of the division, it can be estimated that the margins are similar to those of AWS, despite the smaller scale. The claims of Microsoft about Google taking on unprofitable contracts seem to have had some founding in the past, as Google Cloud still makes a negative 12.8% operating margin (an improvement on -47.4% at the same point last year) compared to AWS’s 29.5% margin. From the combination of better pricing discipline from Google and the benefits of scale, we expect that their division will also turn profitable by either then end of this year or early next year.

Although Google Cloud is growing at a faster rate than either Azure or AWS, this is an optical effect of the law of large numbers, as the net revenue additions at AWS last year amounted to $10.3bn compared to $4.1bn at Google Cloud. Notably in the recent quarter it appeared that there are signs that the falling growth rate of AWS actually reversed, and Azure remained stable at 50%.

The global cloud market is estimated by the Synergy Research Group to exceed $150 billion this year, and they also expect that, with the investment behind expanding their global data centre footprints, while at the same time enhancing their cloud service portfolios, the big three will continue to gain market share. The VT Tyndall Global Select Fund has holdings in Amazon and Microsoft.

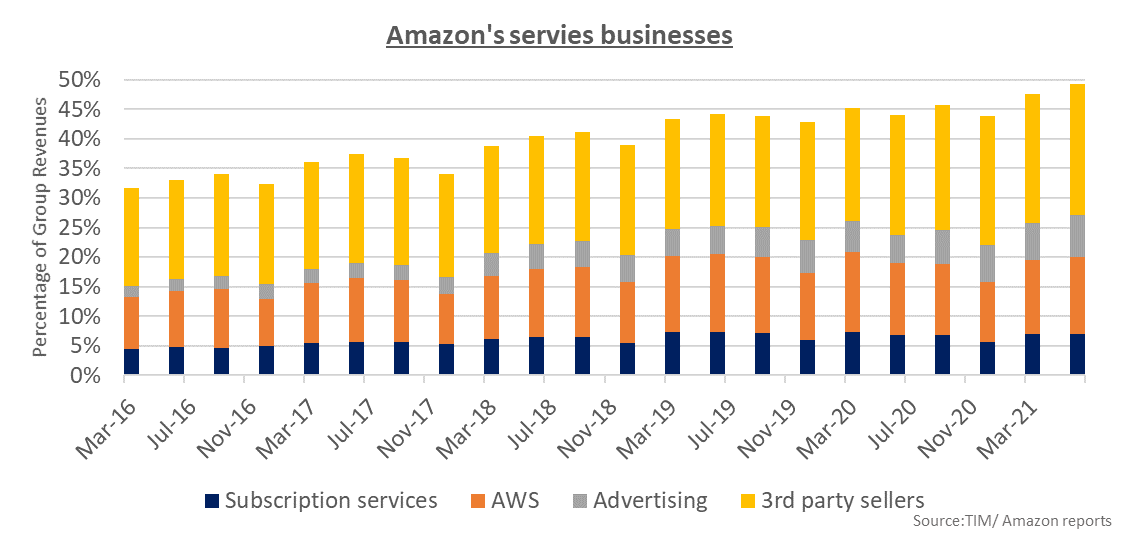

While AWS remains the jewel in Amazon’s crown, we believe that there are a couple of other developments that are happening in the overall business that the recent profit warning has led to the market to overlook. While the operating margins in the US e-commerce business are below the group average, they have been improving quarter on quarter, but more importantly the international e-commerce division inflected, posting positive returns for the first time in 2021, which has an outsized effect on the group. Furthermore, the higher margin subscription, advertising and 3rd party sales are outgrowing the core e-commerce business, so when combined with AWS, over 49% of Amazon’s sales are recurring in nature and should lead to gross margin leverage.

Therefore, we believe that the recent panic selling in Amazon was unjustified, and that there are reasons beyond the gold medal winning web service business in all the top three vendors that offer opportunities for the long-term investor.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not