Read More

Read More

Richard Scrope

Fund Manager

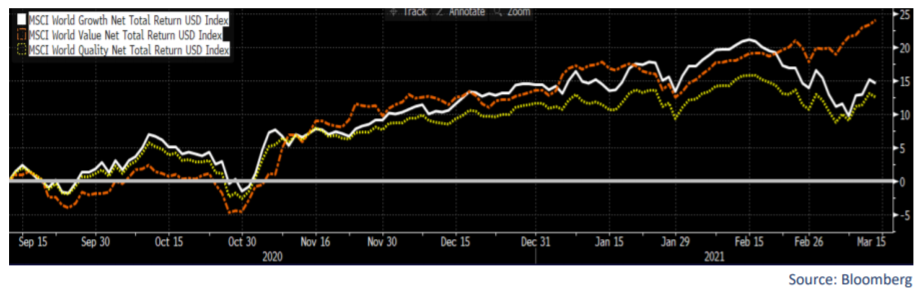

While the debate continues between ‘Growth’ versus ‘Value’ as the correct investment strategy today given that the market is looking forward to a post lockdown world, we believe that a third option has become overlooked. ‘Growth’ and ‘Quality’ have been increasingly used as synonymous terms by investors that have benefited from the momentum trade and drove significant market returns over the ten years since the financial crisis; while some ‘Quality’ companies do display growth characteristics, they can also be distinctly different in nature. Both have seen their valuations rise to lofty levels, but the question is whether both classes can justify their current levels.

Conversely ‘Quality’ companies can be found in more cyclical sectors, often disregarded, or ignored by quality growth investors. In the VT Tyndall Global Select Fund we have never eschewed sectors owing to market or investor sentiment, as we believe that ‘Quality’ companies are not solely to be found in the technology or consumer sectors, but in fact many examples can be found in the material, industrial, banking and even energy sectors. The by-product of this belief is the Fund is diversified across the market sectors and not concentrated in a pocket of the investment universe, which we see a risk that could emerge from following a purely ‘Quality Growth’ strategy. Nonetheless, we are bottom-up investors we focus on the company fundamentals and therefore geographic and sectorial breakdown are simply outputs of the opportunities that we find.

The recent re-allocation of funds from ‘Growth’ to ‘Value’ strategies has resulted in Quality companies ending up as collateral damage, as lazy investors, and machine trading mechanisms, have grouped them under the ‘Growth’ banner. Although it is difficult to predict when this wholesale switch to so-called ‘Value’ stocks will conclude, we believe that it is leading to excellent opportunities in ‘Quality’ companies for fundamental long-term investors.

While we recognise that having the end of the pandemic in sight a change in leadership is afoot and as governmental support has kept many loss-making companies afloat, which now have very easy year-on-year comparisons, the market may react positively to signs of growth returning in so-called ‘Value’ stocks. We also see that there are short-term return opportunities lie in those ‘Quality’ companies that fall into the more cyclical ‘Value’ camp, and over a longer time period the whole category will drive superior returns to investors. Aware of the dynamics that would drive markets once inflation expectations started to rise and growth returned post the pandemic induced correction, positions in companies such as Zebra Technologies, United Rentals and increases to its existing banking positions were amongst the opportunities that the Fund identified last year.

Trying to be ‘smart’ and time markets or reposition portfolios on short-term fundamentals is a risky strategy and can easily result in capital destruction. We do, however, believe that investors should be awake to shifts in underlying dynamics, but also need to cut out the market noise that leads to heuristic tendencies. Thus, we espouse a strategy of identifying ‘Quality’ companies that sit either in established industries with defensible market positions or those that embrace structural trends within the market.

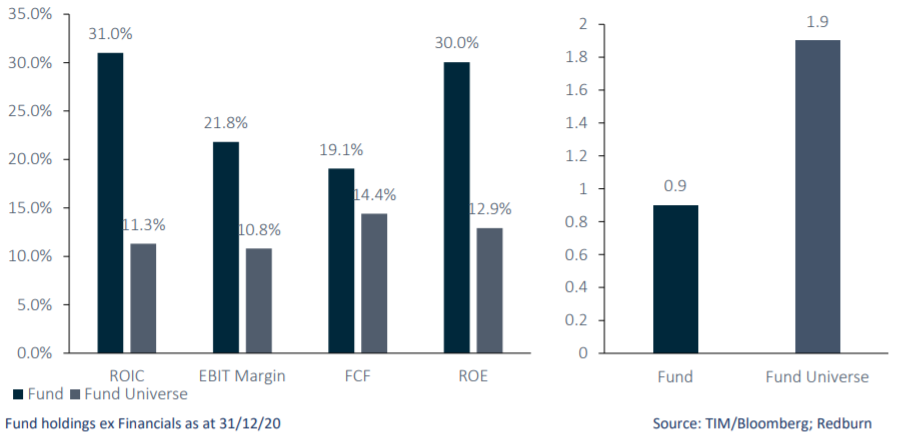

The VT Tyndall Global Select Fund is a pure play ‘Quality’ fund that eschews decaying industries or loss-making themes. It is invested across the market spectrum, from more cyclical sectors such as equipment rentals to banks and online travel, as well as companies that benefit from the digital revolution such as digital payments and video streaming, and other long-term mega trends or niche markets. To mention but a few, these range from cookers for professional kitchens to medical diagnostics, make-up to consumer athletic leisure, and animal health to inventory management. All are global leaders in their own fields and as the chart above shows, have returns well in excess of the market average, which is beneficial for the companies and their investors alike.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not