Read More

Read More

Simon Murphy

Fund Manager

We’ve discussed, at length and numerous times, the disdain that investors have shown towards the UK equity market over recent years and the many reasons for why that might have been the case. To us, the final nail in the coffin – the hitting rock bottom moment if you will – came with the ‘unprecedented’ scale of dividend cuts, cancellations and deferrals we witnessed during 2020.

As we know, the UK market has always had a strong focus on income generation, and dividends have historically formed an important component of total returns from UK equities, representing approx. 1/3rd of total returns over the last 20 years.

Faced with the sheer unknown once the Covid-19 pandemic struck, UK corporates reacted swiftly in terms of preserving cash flow by any means possible including the cutting of dividends. Whilst a totally

understandable response, the sudden removal of a key support to the UK equity investment case was a cruel blow for many.

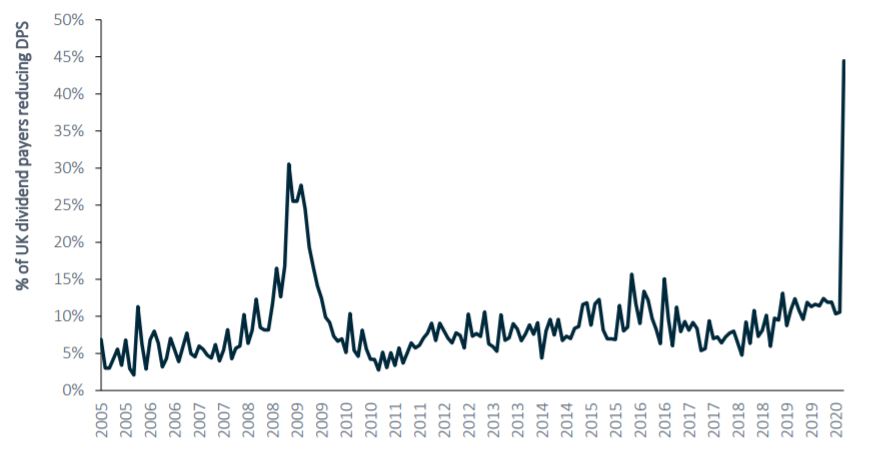

It is worth reiterating just how severe the response was, as the chart below from Panmure Gordon illustrates so clearly.

As it happens this chart is a little out of date. In the end, over the course of Q2-Q4 2020, 66% of UK dividend paying companies cancelled or cut their dividends according to the widely followed Link UK Dividend Monitor. By contrast, as you can see above, only c.30% of firms did likewise through the 2008/9 great financial crisis.

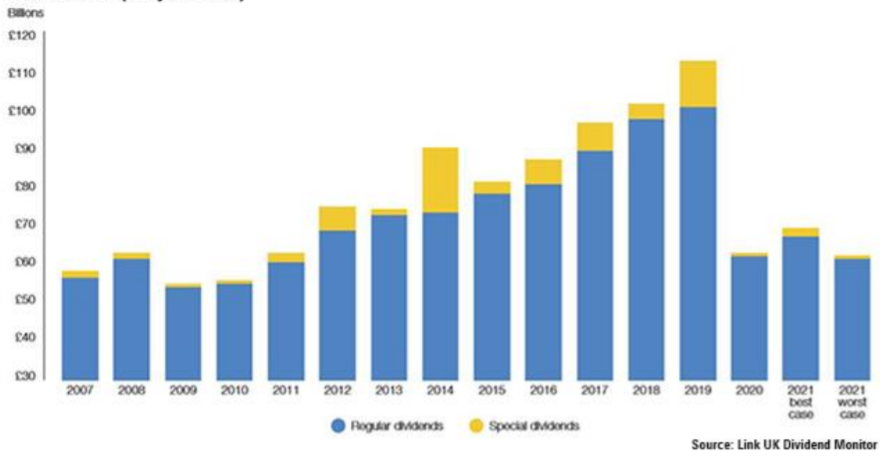

The net result was a massive -44% cut to total dividends paid by UK plc in 2020, from £110.6bn in 2019 to £61.9bn. The decline in underlying dividends (excluding special payments) was a slightly less severe

-38.1% to £61.1bn. As the next chart shows, 2020 dividend payments essentially returned to the level they first reached in 2011, thereby wiping out 8 years of income growth in the process.

So, whilst we may indeed have hit rock bottom in 2020 in terms of enthusiasm towards UK equities, we certainly don’t believe we have to stay there. In fact, we see plenty of reasons for optimism going

forwards. Despite the savage cut to dividends last year, the trailing yield on the UK equity market still stands at approximately 3.4% - not a bad starting point we would suggest, in a world generally still

suffering from a shortage of income.

What’s more, we are reasonably optimistic that UK dividends will now start to grow again. The Link chart above highlights their best- and worst-case scenarios for 2021 dividend growth as +10% and

-0.7% respectively. It will come as little surprise to readers that we sit firmly in the former camp as a central case.

Our more positive outlook is predicated on a reasonably swift reopening of the economy over the next few months and a fairly rapid return to the dividend paying list by many companies, as visibility on the

outlook improves. Already there are encouraging signs in that respect with companies such as Sainsbury’s, Ferguson, Persimmon and Bunzl among others that have already restarted payments that

had previously been suspended.

Admittedly a big unknown in the UK dividend outlook is the speed and scale at which the banking sector will be allowed to resume dividend payments over the next 12 months. It is also true that it will

take time for the broader market to make up for the significant chunk of (more or less permanent) dividend reductions in the oil & gas sector. Nevertheless, with a starting yield over 3% and growth

prospects in the 5-10% range, there are certainly worse places to be.

At Tyndall we have always been wary of overreliance on sourcing dividends from a small number of stocks in largely mature sectors of the market. Luckily, we can find plenty of exciting opportunities

elsewhere, with strong yields and good dividend growth potential. Perhaps that explains our unremitting enthusiasm for the UK equity market!

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund