Read More

Read More

Simon Murphy

Fund Manager

Another one bites the dust. This time it is the turn of the British premium chocolate chain, Hotel Chocolat, to fall prey to a takeover from an overseas corporate buyer, at an eye watering premium of 170% to the current share price. It’s probably worth repeating that again – a premium of 170% to the current share price. Granted a total outlay of £534 million is likely pocket change for a food giant such as Mars, but even so, 170%!

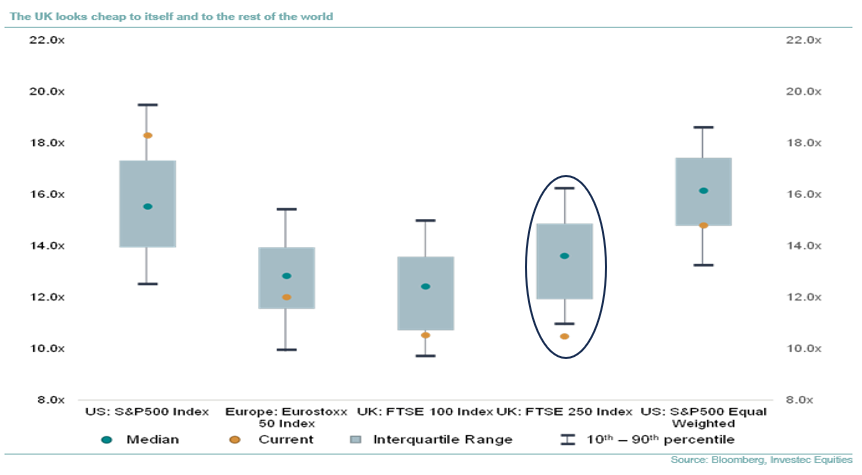

Once again, we can only marvel at the value currently on offer in UK equities, particularly in the mid and small cap areas of the market. As a reminder, the chart below puts current valuations (yellow dots) into context both relative to their own history and other geographic regions – we’ve circled the FTSE 250 index for reference.

We appreciate this supposed outstanding value has been on offer for some time now and does not, in isolation, seem enough to prevent an almost relentless wave of selling of UK assets. It has been well documented that UK institutional investors, particularly pension funds, have all but abandoned investment in UK equities, with holdings in UK private sector pension funds falling from over 50% of portfolios 20 years ago to just 4% today.

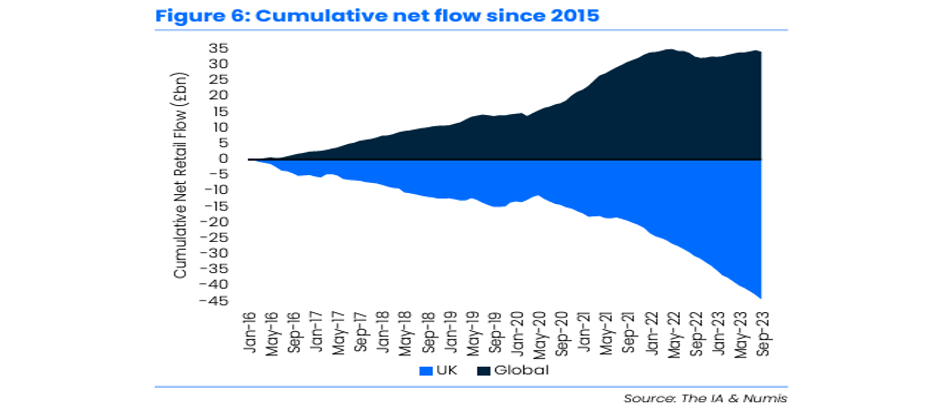

Meanwhile, international investors have consistently shunned UK assets since the Brexit vote in 2016, with the latest global fund manager surveys indicating close to record underweight positions. To top things off, September 2023 was the 26th month in a row of net retail investor outflows from UK focused open-ended equity funds, and cumulative outflows now stand at approximately - £45bn since 2015, as highlighted in the chart below.

It may be tempting to conclude that this trend will persist indefinitely – market participants do excel at extrapolating the recent past after all. If so then, barring a few examples of value realisation through M&A activity, the UK market will likely continue disappointing investors as a perennial ‘value trap’. However, we believe there are genuine grounds for optimism ahead, not least because, as with any seemingly intractable problem, understanding of the issue is the first step in the eventual resolution process.

In that regard there have been numerous positive developments of late, starting with the Chancellor’s so-called ‘Edinburgh Reforms’ late last year and the more recent ‘Mansion House Reforms’ for UK capital markets in July. The latter proposals aim to, amongst other things, increase funding for high-growth companies, strengthen the attractiveness of the UK as a listing destination and ensure we have the most growth-friendly regulation possible without compromising stability.

Following on from these initial consultations, several proposals are now being discussed in wider circles. The recently established Capital Markets Industry Taskforce, comprised of leading organisations from across the financial markets ecosystem, wrote to the Chancellor this month urging coordinated policy actions aimed at increasing the allocation of UK domestic capital to high quality UK companies, as is still very much the case in most other large economies globally.

Prominent city economist Simon French, of Panmure Gordon, estimates that the cost of financing a UK-listed company is currently 23% higher than for an equivalent company looking to raise equity overseas. He suggests three proposals aimed at reintroducing the ‘natural buyer’ of UK shares including putting a floor under the amount of UK equity ownership held by public sector pension schemes, reintroducing some form of ‘British’ ISA, and developing a ‘national wealth fund’.

To be clear, these and numerous other ideas are still at a formative stage, and it will take time for any specific proposals to be implemented – indeed there has been a degree of disappointment that there were limited new developments in the autumn statement this week. However, we are at least starting the journey and, in our view, any sensible measures eventually introduced will be extremely welcome and likely very positive for UK equities.

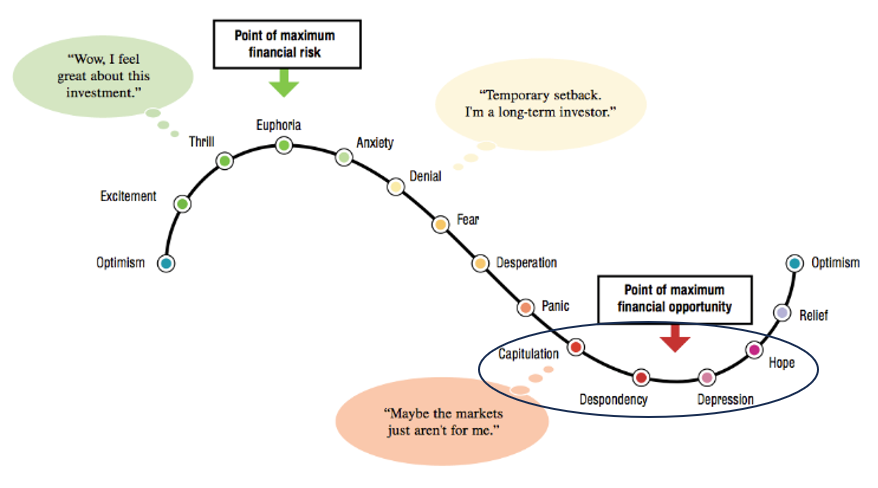

The chart below shows a standard ‘cycle of emotion’ as it relates to investing. Readers will have their own opinions, but in our view most investor attitudes towards UK equities today sit somewhere in the ‘Capitulation, Despondency, Depression’ range with an odd bit of ‘Hope’ thrown in. It should come as no real surprise, but it is worth remembering that this is the emotional range that typically provides the greatest financial upside in due course!

At times like these, we are reminded of the famous quote from Charlie Munger, Warren Buffett’s long-term investment partner:

“Extreme patience combined with extreme decisiveness. You may call that our investment process. Yes, it’s that simple.”

Whilst we may be taking it somewhat out of context, we understand it has been a hugely frustrating period for UK focused investors and ‘extreme patience’ is being sorely tested. However, in our view the value currently on offer is so outstanding that ‘extreme decisiveness’ is essential now. There will be no bell ringing to signal the time has come – and at these valuations you really don’t need one.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund