Read More

Read More

Simon Murphy

Fund Manager

If Harold Wilson was correct that “a week is a long time in politics” then 3 months must be starting to feel like a lifetime for the recently elected Labour government, and particularly the Chancellor of the Exchequer Rachel Reeves. Declaring, as she did at the end of July, that the new government had inherited a £22bn hole in the public finances and that “difficult decisions” would be inevitable at the next budget, she subsequently announced that it would be a full 3 months until that budget would be delivered on 30th October.

The speculation and uncertainty surrounding potential tax increases has been as intense as it was predictable and, as discussed below, has had very real negative consequences, at least in the short term. Notwithstanding the title of this note, we understand that it is hardly a viable option for the Chancellor to keep her mouth shut, however we sincerely hope this episode will provide valuable early tenure lessons on the importance and power of government messaging and communication.

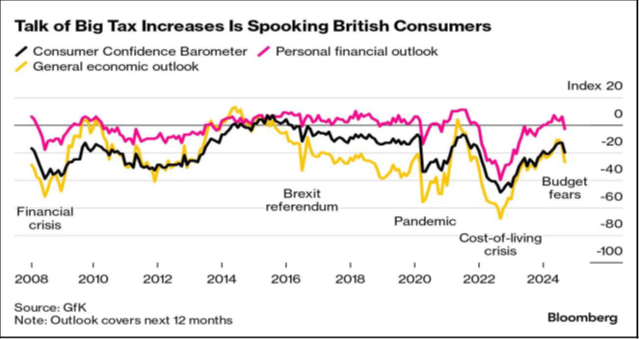

Consumer confidence remains at the heart of the economic growth outlook in the UK and, after a difficult few years, has been gradually recovering over the last year or so as highlighted in the chart below, of the widely followed GFK Consumer Confidence Barometer.

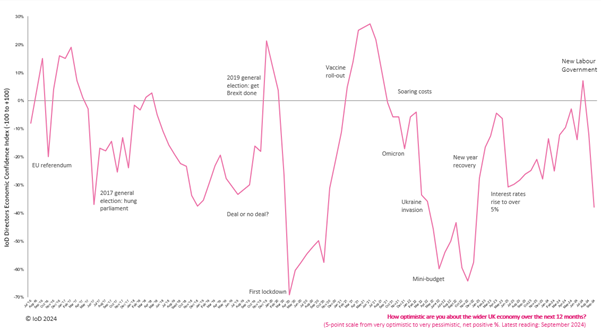

As can also be seen, there has been a renewed decline in confidence recently arising from uncertainty surrounding the forthcoming budget measures. Indeed, it is not just consumers who have become more cautious recently either, as illustrated in the chart below, which shows the Economic Confidence Index of the Institute of Directors – a measure of business leaders optimism in the prospects for the UK economy over the next 12 months.

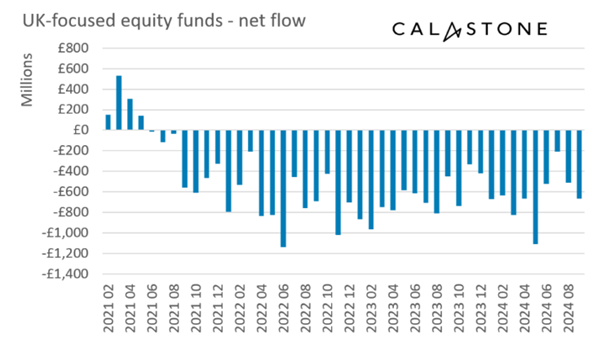

Finally, whilst perhaps stretching the direct causal relationship a little, it is disappointing to see outflows from UK-focused equity funds starting to accelerate again in the last couple of months, after a fleeting period of hope in June and July, as highlighted in the chart below from Calastone.

We completely understand why, given the uncertainty, concerns around the outlook have increased recently. However, at this stage we remain optimistic that it is likely a relatively short term issue and, as we look to the medium term, prospects for the UK economy remain positive.

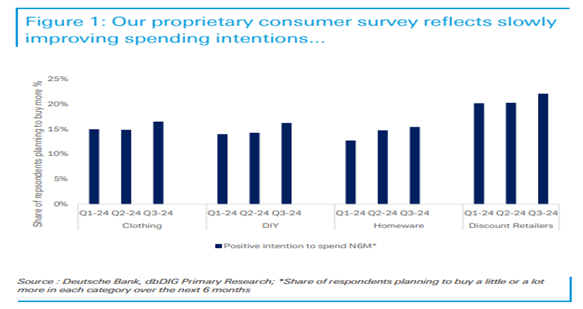

Focussing specifically on the outlook for the consumer, we note several reasons for optimism including inherently strong consumer balance sheets, positive real wage growth, a robust jobs market and a revival in housing market activity as interest rates have peaked and started to come down. These improvements are beginning to be reflected in spending intentions, albeit slowly, as can be seen in the consumer survey data shown below from Deutsche Bank.

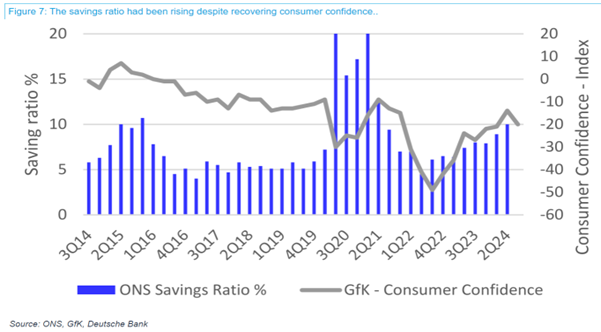

However, to us the key to unleashing a more powerful wave of consumer activity remains a sustained pick up in confidence. Most likely as a consequence of several consecutive years of disruption (pandemic, Ukraine war, energy crisis, cost of living crisis, inflation, interest rates etc), recent improvements in consumer finances have largely resulted in increased savings rates, rather than being spent, as the chart below shows clearly.

Which leads us squarely back to where we started. Not long ago, market participants were excited by the prospect of a few years of much needed political stability in the UK, following the turbulent end to 14 years of conservative government. Today, given the uncertainty surrounding potential budget proposals, that no longer feels as assured. However, it is still very early days for the new administration and there remains plenty of time for mistakes to be corrected. It is also true that Labour continue to emphasise the need/desire for enhanced levels of growth in the UK, and we are yet to see concrete proposals aimed at meeting that objective, although presumably we will hear more on that subject at the end of the month.

So, for now we remain positive on the outlook for the UK economy and UK consumers specifically. In our view, the building blocks for a better period of activity are almost all in place. The missing block is a sustained improvement in confidence, and that remains eminently achievable from our starting position today, ever more so if the new government can avoid serious additional foot in mouth moments.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund