Read More

Read More

Simon Murphy

Fund Manager

It was the American author Mark Twain who reportedly quipped, ‘the reports of my death are greatly exaggerated’. Leaping tenuously to the investing landscape of today, similar sentiment seems to us to be particularly apt in the context of the UK consumer and their spending prospects.

Without doubt consumption is extremely important, representing on average c.65% of UK GDP in any given year and totaling in the region of £1.3 - £1.4 trillion per annum. As such, the outlook for consumer spending has a significant bearing on the outlook for economic growth. It also has direct implications for the prospects of a great many businesses in the UK stock market, in areas such as retail, travel & leisure, house building and so on.

It will come as no surprise to anyone that, in recent months, the headlines relating to consumption have been extremely unfavourable. The situation was summed up recently in a report by the Resolution Foundation which made the news for predicting the UK faces the biggest income squeeze in nearly 50 years.

The drivers of this prediction are easy enough to understand and centre primarily on the mismatch between current elevated levels of inflation, which hit 6.2% in February – the highest rate for 30 years - and income growth which, whilst rising at a healthy annual rate of 4.8% in the three months to January, is not doing enough to prevent a real income squeeze.

What’s more, inflation levels are set to rise even further, potentially peaking at 8% + over the next few months, as soaring energy and food prices add further pressure. The situation as regards energy bills is particularly acute, with the energy price cap set to rise by 54% in April and will potentially, given elevated oil and gas prices, rise significantly again in the autumn.

As if these issues are not enough, UK consumers also face the prospect of ongoing increases in interest rates, as the Bank of England grapples with inflation, and a rise in taxes, as National Insurance rates are set to rise to help fund the NHS’s recovery from the pandemic. Taken together, it is no wonder the outlook appears so concerning, as demonstrated in the poll below, highlighting the third lowest level of economic optimism of the UK public over the last 44 years.

This sentiment has certainly not been lost on the UK stock market either. As you can see from the chart below, the domestically orientated UK Mid 250 (ex. Investment Trusts) Index has been falling fairly consistently since September 2021 and, at the recent low, was down c. 22% from the peak, with a great many consumer related shares having fallen significantly further still.

Whilst obviously cognisant of these pressures, we are currently far less bearish on the UK consumption outlook than many. For sure these are very real headwinds but, to our minds at least, there are some significant offsetting factors which are potentially being ignored amongst the extremely gloomy headlines.

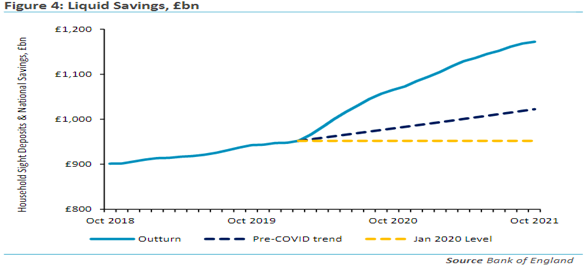

By far and away the biggest offset is the level of ‘excess savings’ that have been accumulated on household balance sheets as a consequence of the extraordinary government support mechanisms that were put in place over the last two years to help cope with the pandemic. The chart below, from Panmure Gordon, highlights growth of c.£220bn – around 10% of UK GDP – significantly higher than pre-Covid trends and a meaningful level of reserves to help offset these pressures.

Another very important offset is the underlying strength of the UK labour market currently. The unemployment rate sits at a relatively low 3.9%, whilst job vacancies in February rose to a new record of 1.32m (chart below). This suggests to us that wage increases are likely to remain healthy for some time and, as inflation eventually starts to fall, the real income balance will start to improve.

The strength of the UK housing market, and its impact on consumer psychology, should not be underestimated in our view either. According to the Halifax, average house prices are currently rising at their fastest rate in 15 years, increasing nearly 11% on a year ago. In a similar vein, we are convinced that a significant level of ‘pent up’ demand exists in consumers, following lengthy restrictions placed on ordinary activities during the pandemic. As one economist concluded recently, in highly scientific fashion, ‘people just want to do things again’!

Whilst no means foolproof, we also find talking to company management teams to be extremely helpful at times such as these. For example, we recently spoke with UK house builder Vistry Group, where their highly experienced CEO could not have been more robust in terms of the demand profile the business currently sees (subsequently corroborated by several other house builders also).

We are convinced that most people do not embark on the biggest purchase of their lives – a house – lightly, and we are certain that new buyers are all too aware of inflation, energy price increases, interest rate rises, the pandemic and uncertain geopolitics and yet, to quote the Vistry CEO, the business is ‘absolutely flying’ with record sales rates currently. This comes when the share price has already fallen over -30% from the recent highs and the prospective dividend yield is now higher than the p/e ratio.

Indeed, if you were to take the entire listed UK housebuilding sector together as though it were ‘one’ firm, it would have a market capitalization of c. £30.9bn, an estimated p/e ratio for 2022 of 7.4x, a dividend yield of 7.7% with several billion pounds of net cash on the balance sheet! *

We think these, and many other UK consumer exposed stocks, represent outstanding investment opportunities for the medium term, irrespective of the alarming near term headlines.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund