Read More

Read More

Felix Wintle

Fund Manager

The question on many investors’ minds is whether to buy Tech stocks now that they have corrected so significantly. There are several factors to consider. The first is time horizon. We all know that Tech stocks will bounce at some point and that bounces in bear markets can be big and, so for those with a shorter-term time horizon, a relief rally may be worth trying to play for, but the timing is very hard to get right. For those with a longer-term horizon, those looking to buy and hold, the valuation of stocks may look appealing but is that reason enough to buy back into these stocks?

The answer to that, in my view, is no. In bear markets valuations contract and, as we’ve seen, the market can go through long periods of price discovery, where market participants just can’t find ‘the right level’ for stocks to bottom and move forward on a consistent basis. An example of this price discovery is PayPal, a former stock market darling and ‘quality company’ which has fallen a staggering 75% since July and at no point has the cheapening valuation been a catalyst to buy the stock.

The problem here is that bulls tend to anchor on the investment case that once propelled the stock when it was rising and assume that the investment case is unimpaired and that it will ultimately be the reason the stock recovers. One of the key tenets of the stock market however, is that it is a discounting mechanism, so the very fact that a stock’s price is breaking down often means that the bull case is fully priced in and the market is signalling that the future is less good than the past. What’s the difference between a normal correction, which should be bought, and a new downtrend, which should be sold? That’s usually down to the extent of the correction on an individual and group basis. If the whole sector is selling off hard, that should be taken as a warning sign rather than an opportunity.

In terms of the valuation contraction, what’s different this time is that we do not have the Federal Reserve at our backs. Since the Fed started to play the QE game in Q4 2008 there has been an implicit Fed put option; when times get tough the Fed would stimulate its way out of trouble with QE or rate cuts. This time round however, the Fed has moved from QE to QT and is hiking rates as well. This means that the most likely course is further contraction in multiples rather than a return to former valuation levels.

Another factor to consider is the length of time that the sector has been leadership and the extent to which the sector is owned. In terms of leadership, many of the mega cap Tech names have been leadership for over a decade and this has historically proven to be the cycle. In fact, many cycles have been significantly shorter than this. It cannot be denied that these great companies have been dominant for a very long period and have also been well found by the market. They are extremely well owned, across the active and passive investment universes.

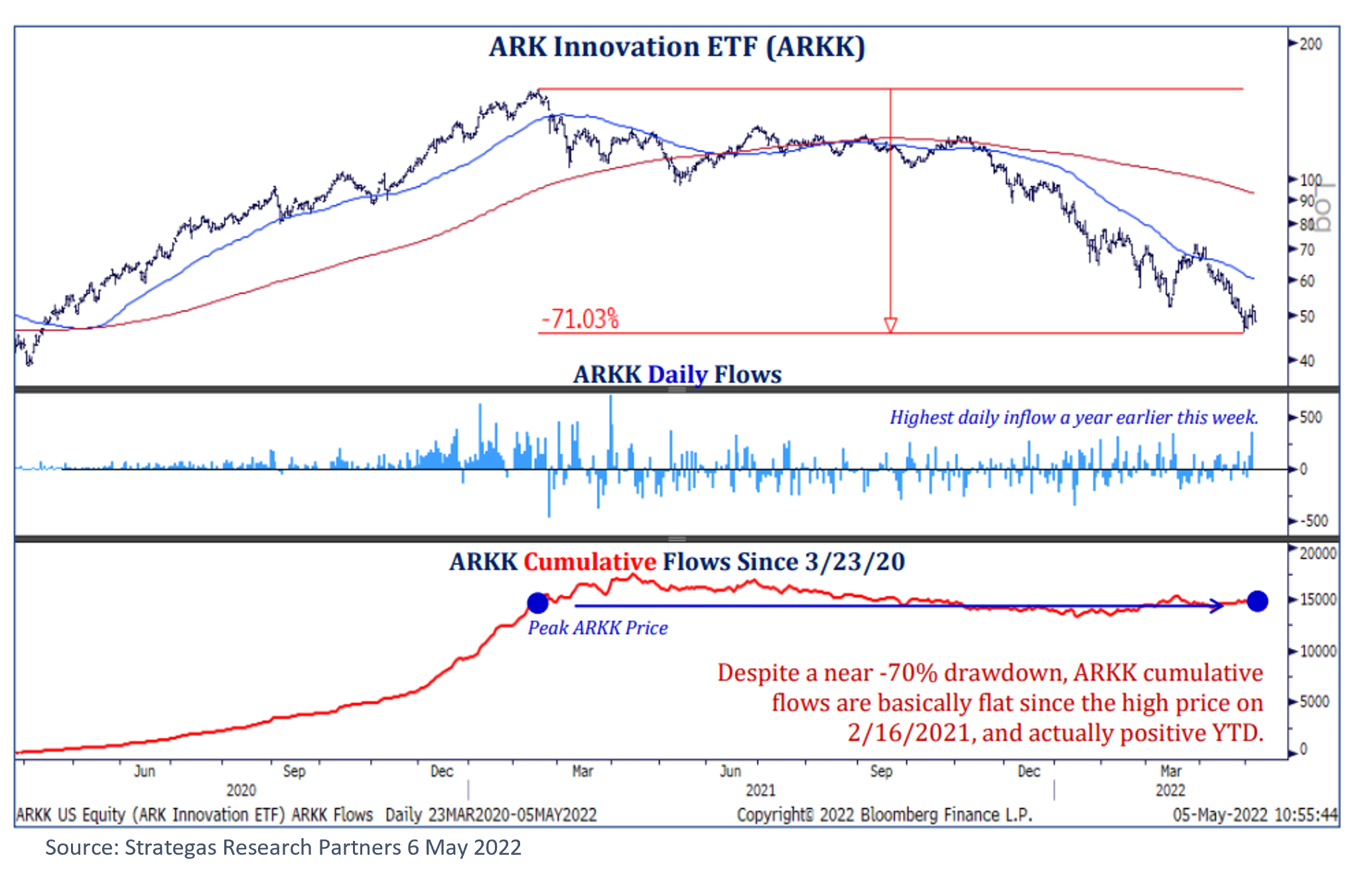

And despite the big sell off, Nasdaq is down 29% from the peak in November, there has been no capitulative flush of investment outflows, as can be seen from the Ark flows, which have held steady throughout.

In order to see a real low, you’d expect to see big outflows from retail investors and this has not happened.

Looking back to the peak of the last great Tech cycle in 2000, it took the Nasdaq about 16 years to regain leadership and surpass the previous peak in 2000.

Similarly in 2000, Tech was very popular and widely owned with a huge number of new Tech funds being launched into the peak. While this hasn’t been the case this time round, although there are some very high-profile funds out there like Ark Innovation, the red flags are there but in a slightly different guise: a plethora of ETFs, cross correlation of holdings, Tesla and Crypto are the villains of the piece this time around.

While there will be bounces in Tech, my view is that these should be faded and are unlikely to last. History tells us that, given the intense selling in the Tech sector, that the boom times are over for the sector for now and that as we emerge from this bear market it will be new sectors that will lead, and those Tech bulls will be left behind as the new cycle begins.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not