Read More

Read More

Richard Scrope

Fund Manager

The performance of the magnificent seven over the past year needs no introduction, however, is it time to question the ongoing outperformance of these band of brothers? The rise in prominence of AI has helped both the profits of most of the mag-7 but at the same time increased the expectation of what they might be able to earn in the future should this trend continue. This field is but one example of where active management can add value to investors who are prepared to do more than hold a passive basket of companies that have exposure to a market or theme.

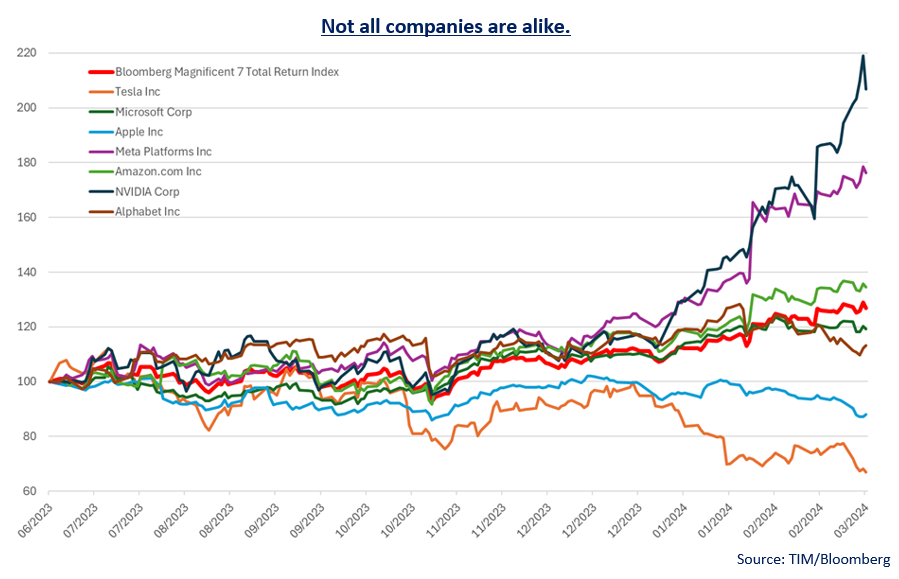

Over the past few months, however, although the Bloomberg Magnificent 7 index has continued to grow, what has been going on under the bonnet suggests that all is not well in the world of the Mag-7 and the relative performance of the underlying companies has been quite stark. Tesla’s recent performance has seen it drop out of the top 10 companies in the MSCI World Index in which all the others like as Eli Lilly and Broadcom have entered the top 10. Mishaps, like Alphabet’s recent relaunch of Gemini with its overly ‘woke’ version of history, exemplify the importance of not missing a step given the performance of these companies, and the need to remain relevant versus the competition.

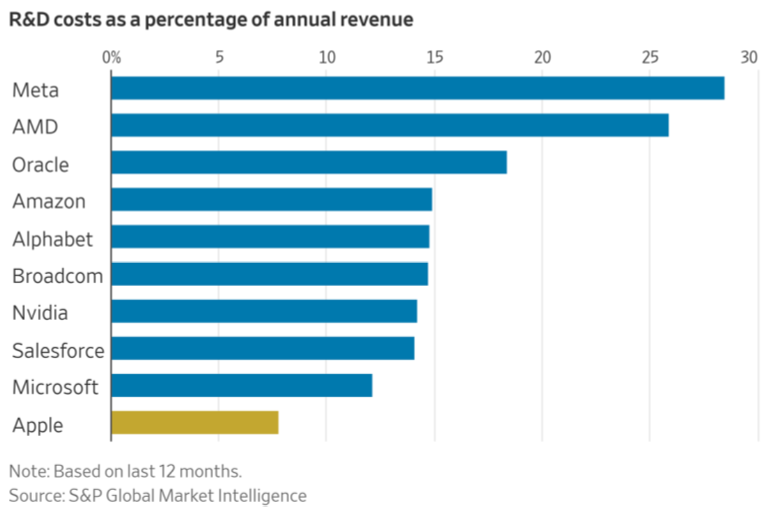

The barriers to entry in the technology space have increased substantially since the emergence of AI as a key feature, as the sums involved to keep up with the competition, let alone try and break into the oligopoly of the key players have increased exponentially. Scale and cash flows have therefore grown in importance and are likely to continue in the rapidly evolving landscape.

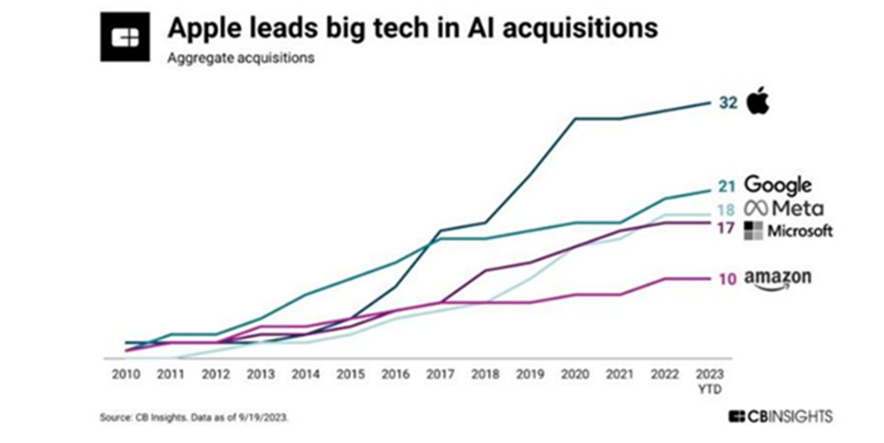

Apple has recently taken steps to openly embrace AI and, despite spending over $29bn on R&D in 2023, has also been quietly taking a slightly different approach to keeping itself current by going on an acquisition spree in the field. Whether they are envisaging the Vision Pro as their platform on which to accelerate their entrance into the market is yet to be seen, and the desire for developing its own inhouse AI platform has the market divided as to whether they are too late into the field and for now is not giving them the benefit of the doubt. As the second largest company in the world, one needs to make an active decision whether to own it or not.

One of our major concerns in the growing divergence in the magnificent seven is their weighting in numerous passive funds, as they not only appear in most the large ETFs but also in significant scale, and if investors are not careful in analysing the underlying holdings in their passive funds, they are at risk of doubling up on companies that may no longer be delivering outperformance. For example, even in a large index fund such as the SPDR S&P 500 ETF, over 97% of the constituents have a weighting of less than 1% and thus have little bearing on overall returns. The top 10 companies account for over 32% of the overall index, and all of them are also the top 10 companies in the MSCI world index, where the top 10 account for over 21.5% of the index and over 99.5% of the constituents have a weighting of less than 1%.

The importance of being able to identify and hold only those companies that can remain at the forefront of their field, whether in AI or any other field, is why now it is probably even more important not to take an active approach to investing. In a world where passives now account for 51% of all managed funds, the willingness to find a fund with a high active share may well deliver superior and differentiated returns to those who opt for the lazy option of just buying an index without regard to what they are owning and in what scale. The adage that “nobody ever got fired for owning IBM” seems apt for what could be the attitude towards holding a passive fund today, but as we have seen with IBM, this may well prove not to be the best approach to take.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not