Read More

Read More

Richard Scrope

Fund Manager

In chartist terminology a ‘death-cross’ occurs when the 50-day moving average falls through the 200-day moving average and often portends to a continued fall in the data set that it is tracking; this has occurred on the US Dollar index that averages exchange rates between the US Dollar and a basket of major world currencies.

Although there have many death crosses in the past decade, none have occurred after such a pronounced rise in the Dollar index, which rose to its highest point in 20 years. With the index already over 10% below its peak, the questions for both investors and companies alike are, what is the magnitude of the correction likely to be, and how to shape their hedging strategy going forward.

In times of uncertainty the Greenback, along with the Swiss Franc have been seen as safe havens, and 2022 was no exception, as investors grappled with the implications of the war in Ukraine, the policy decisions of global central bankers, inflation, and the decision of the UK Conservative party members to allow Liz Truss and Kwasi Kwarteng to play fast and loose with the UK economy. Without the intervention of the Bank of England, and the removal of the administration, Sterling looked as though it was going to reach parity with the Dollar and across the channel the Euro dropped below parity for the first time since 2002.

While the value of the Dollar has a large impact on multinational company profits, as many input costs such as raw materials are priced in Dollars, and sales may be in local currencies in a multitude of different countries. Therefore, company hedging strategies are important and become increasingly difficult when currencies move in such a dramatic fashion. US exporters also face headwinds from a stronger Dollar as their goods becoming less competitive and either they have to suffer margin compression by selling at a lower price point or face their goods being more expensive than those produced in the recipient countries.

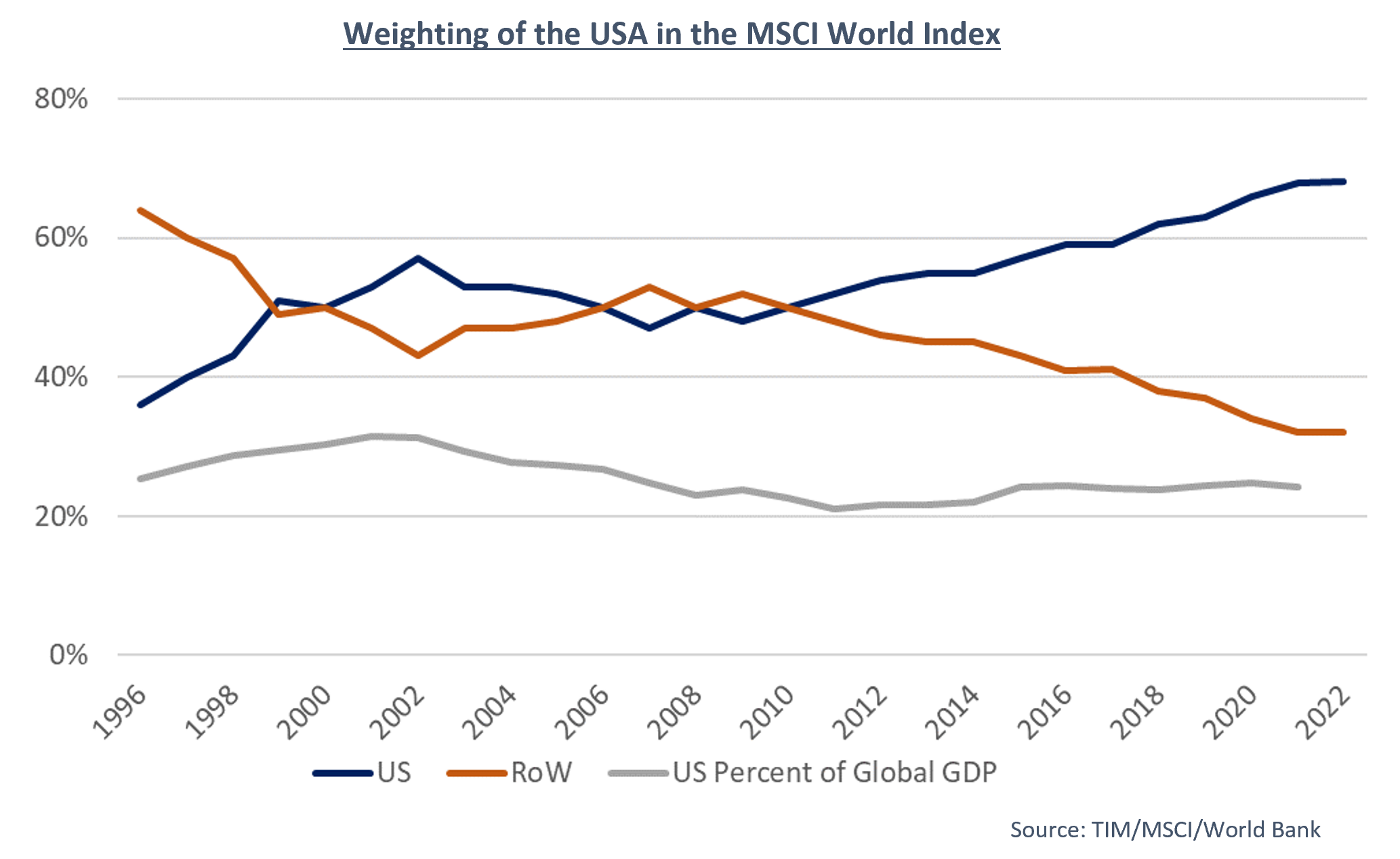

With the outsized weighting of the US in the MSCI World Index, which has increased significantly over the past 30 years, despite the percentage of GDP decreasing, the returns for non-Dollar denominated investors in global equities have become increasingly skewed by the performance of the Dollar, especially those in index tracking funds. For US domiciled investors the strengthening Dollar has led to diminishing returns on their overseas investments, so any pullback can have a positive effect.

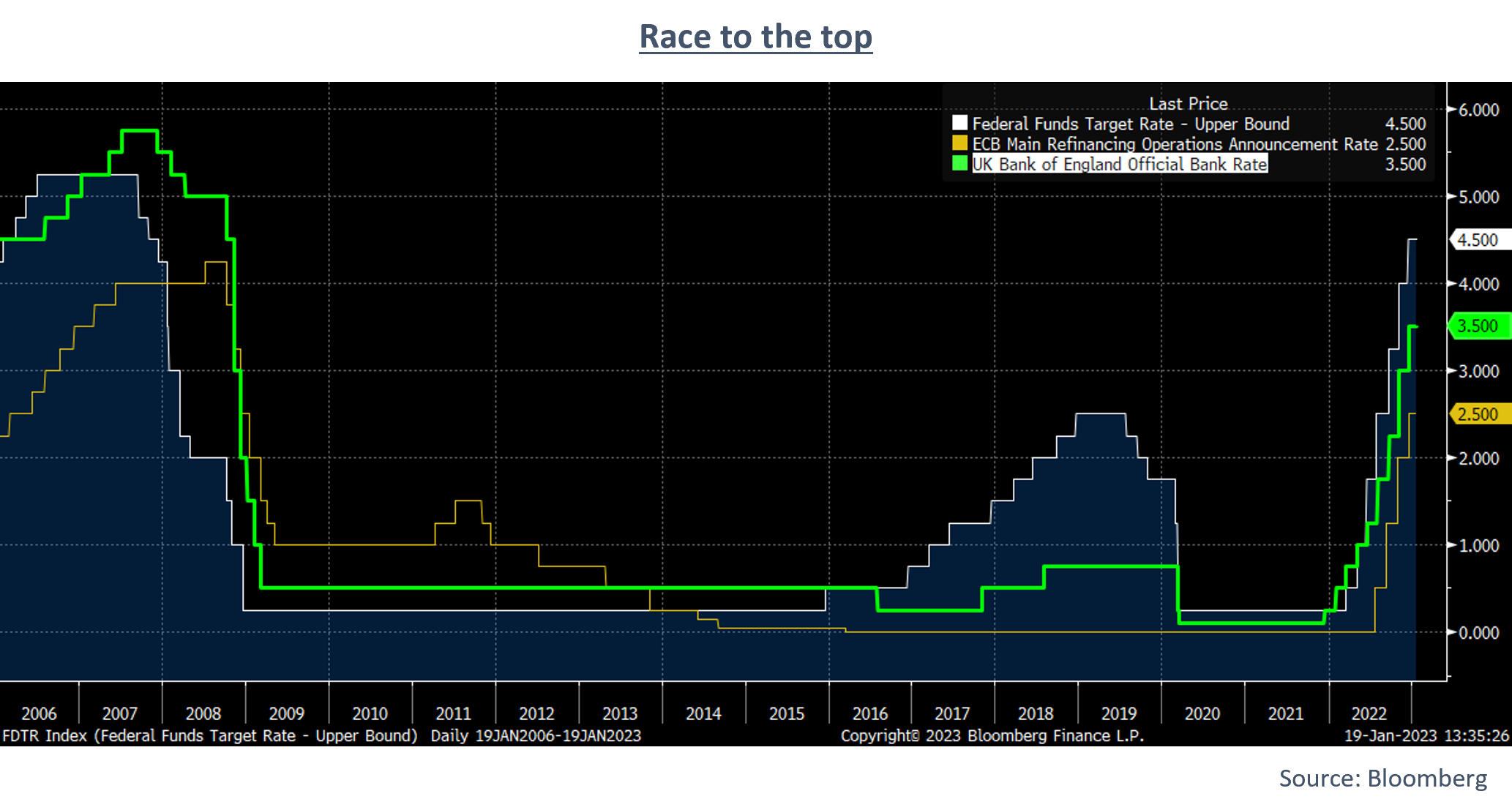

The monetary policies of central bankers may cap the decline of the Dollar index as the Federal Reserve has increased interest rates more aggressively and faster than their corresponding central bankers. This has resulted in a carry trade occurring with investors buying the high yielding Dollar and selling a lower yielding other currency, thus increasing the demand for Dollars. Despite the rate of interest rate increases starting to temper and is expected to peak around 5%, it is likely that the US deposit rate will remain higher than those of other developed countries and regions, and thus, although less profitable as the differential declines, the carry trade should provide a backstop to a dramatic Dollar decline.

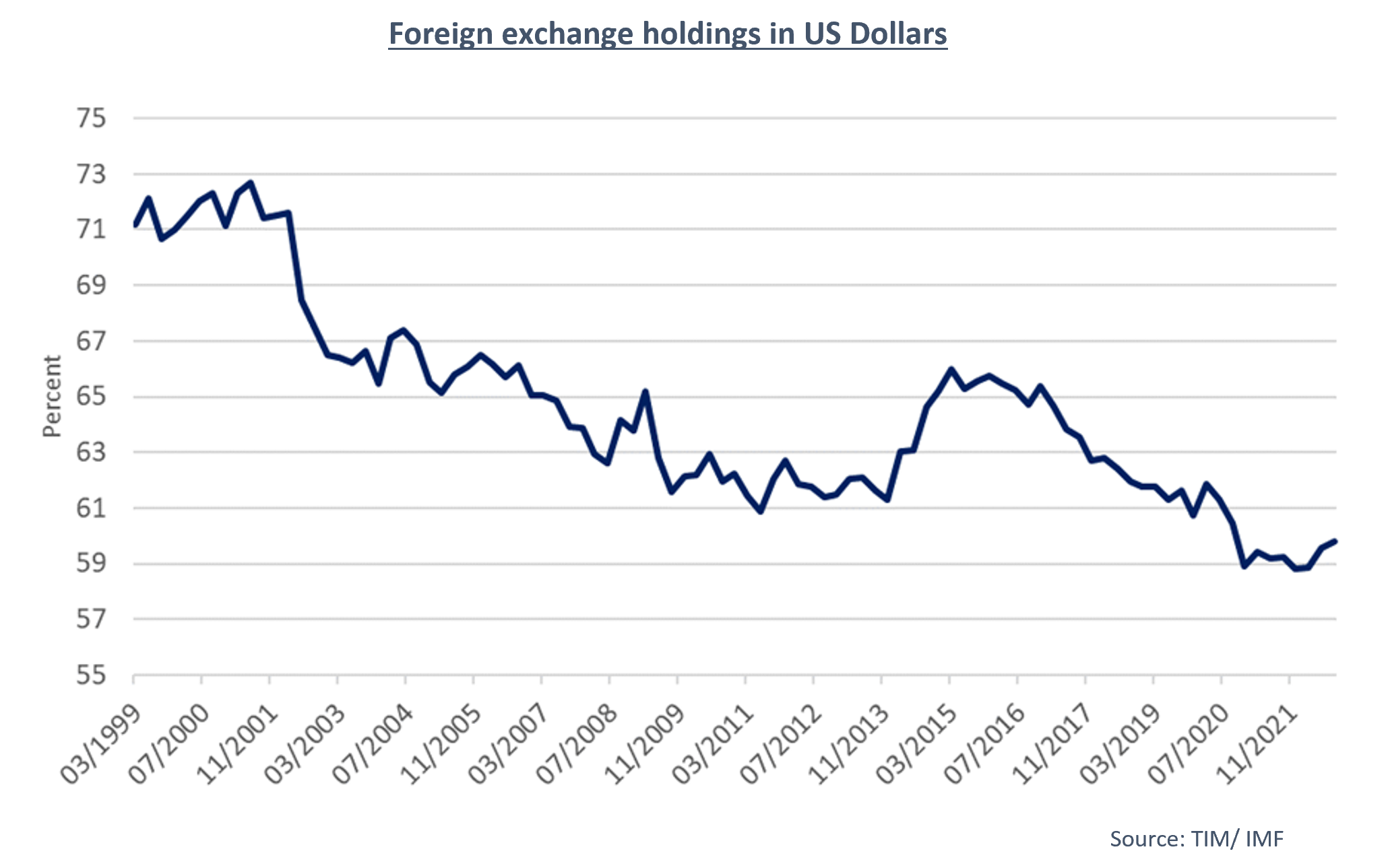

Emerging market corporates and bankers have long been hostage to a rising Dollar as they need Dollars to pay for imports and their external debts. Most countries manage to issue debt in their own currencies; however, corporates have less ability to do so, and thus often resort to issuing US Dollar, Sterling, or Euro denominated debt, however the volume of Dollar debt far outweighs the other currencies and thus companies tend to be exposed to the strengthening of the Dollar. The dominance of the Dollar has long been a source of concern, and although $6.6 trillion Dollars are traded against other currencies each day, the percentage of foreign exchange transactions that are conducted in Dollars has been falling throughout this century as companies and central banks look to diversify their assets and liabilities.

One way for central bankers to reduce Dollar their dependency is by buying gold bullion, which historically has been inversely related to the value of the Dollar and a hedge against inflation; this diversification helps banks to protect their reserves in times of market volatility. Recently central bank demand for gold has reached record levels, with 399 tonnes, worth around $20 billion being purchases in the third quarter of 2022.

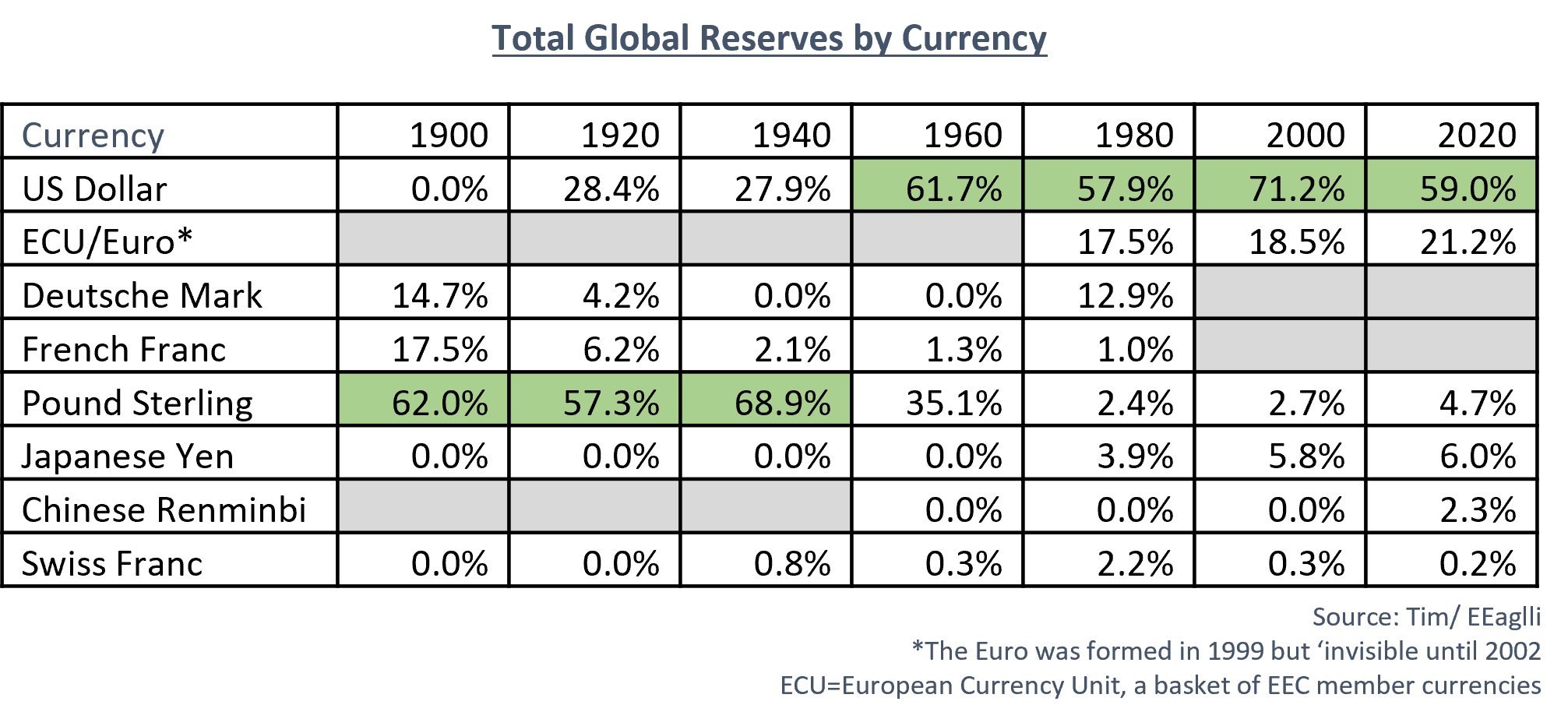

Currency fluctuations have long been part of the multitude of factors investors have to grapple with, and 2022 was somewhat of an anomaly given the scale and one-way nature of the increase in the value of the Dollar, yet understandable given the macro and geopolitical uncertainties that took place. Many of these uncertainties exist, which should provide some support for the Greenback, which remains the world’s dominant currency, however, currencies, like most asset classes do have a tendency to mean revert over time. Over the course of history many currencies have come and gone as the major form of exchange, and though the Dollar is off its peak, 65 countries still peg their currency to it, and we do not expect, bitcoin, or any other currency to take over its mantle anytime soon.

Time will tell whether gold, the Euro, Sterling, the Renminbi, the Yen or any other currency will increase in value against their peers this year, however, the Fund does not hedge their currency exposures, cannot directly hold gold and leaves any hedging strategies to the underlying companies that it holds.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not