Read More

Read More

Simon Murphy

Fund Manager

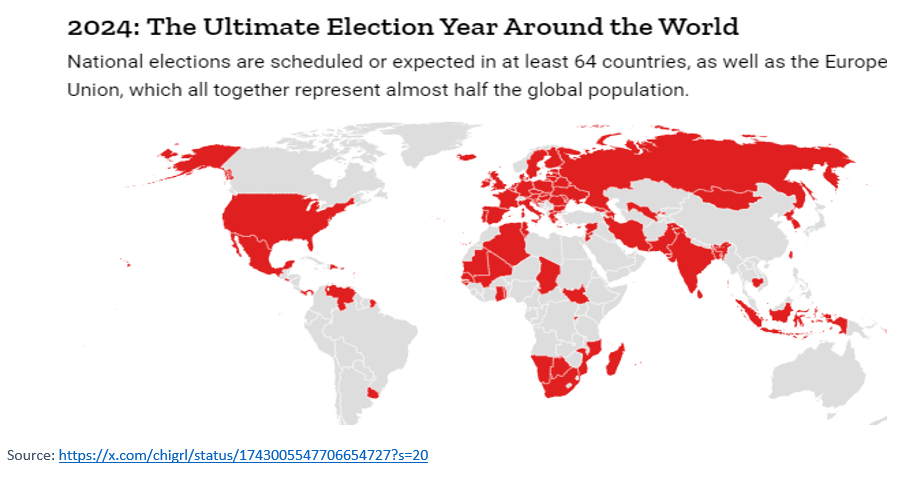

Among the plethora of reasons we have been given for avoiding investing in the UK in recent years, one we feel sure will reappear in 2024 is ‘political uncertainty’ given the proximity of a general election. Whilst this will undoubtedly assume great significance here in the UK, it is worth remembering that we will certainly not be alone. Indeed, as the chart below highlights, elections are scheduled in a substantial number of countries this year, covering nearly half the global population, including of course the United States in November.

As the title of this piece suggests, borrowing a phrase coined by Bill Clinton’s 1992 election strategist James Carville, elections are frequently determined by the state of the economy, and voters’ personal financial situations, at the time the election takes place. Whether that will prove the case for the UK’s next election we will find out in due course, although in our view there already seems to be a consensus that, after nearly 14 years of a Conservative government, the UK will vote for change this time regardless of prevailing economic conditions.

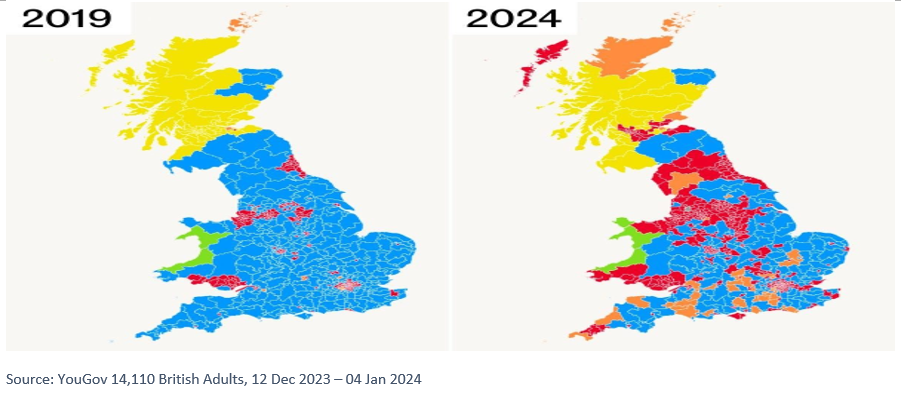

Indeed, that would certainly seem to be the case if the latest YouGov poll proves to be accurate, predicting a defeat for the Conservatives on a similar scale to 1997 and a subsequent Labour majority in the region of 120 seats. The picture below illustrates the size of the potential shift from the last election in 2019 to the forecast one for 2024 based on this poll.

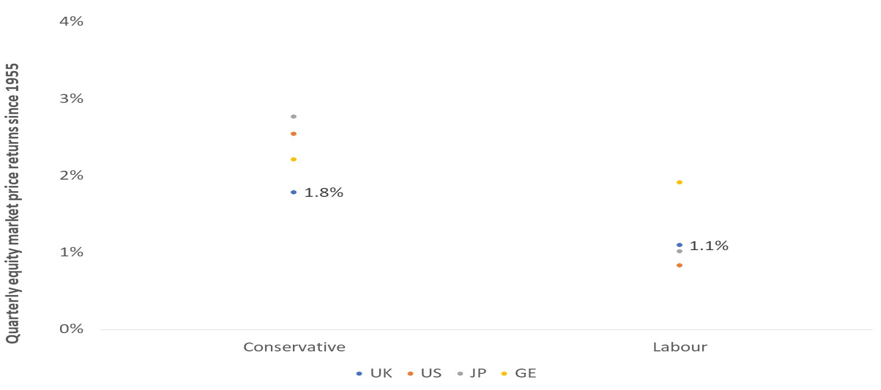

So, on the assumption that polls like this one and others prove accurate, should this be a cause for celebration or concern for UK investors? Statistically, the historical data does point to better equity market returns under Conservative rather than Labour governments, not just in the UK but more broadly. The chart below, from Panmure Gordon’s Chief Economist Simon French, shows the difference in quarterly stock market returns, since 1955, under the two different regimes in the UK, USA, Japan, and Germany.

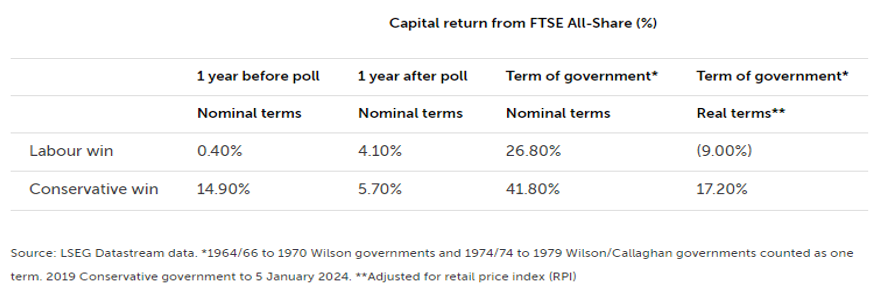

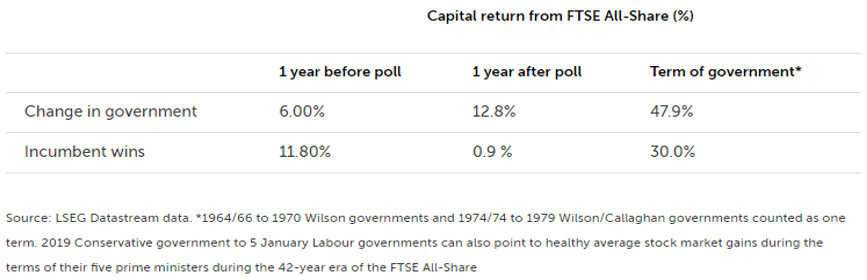

This data is supported by a recent piece from AJ Bell which looked at the sixteen general elections in the UK since the inception of the FTSE All-Share in 1962. As shown in the table below, nominal returns 1 year after an election have been modestly more positive following a Conservative win, however that increases dramatically over the full term of government, particularly in real, after inflation, terms.

So, whilst on the face of it a change in the UK government in 2024 might give investors cause for concern, the AJ Bell piece also highlighted further interesting statistics such as in the table below. This shows that returns 12 months after a UK election appear materially stronger following a change in government than if the incumbent wins, regardless of which party takes over office. Returns over the whole term of government appear significantly better likewise.

Whilst all these statistics are of passing interest, we believe it is the economic and market environments, both in the UK and globally, that have a far greater bearing on the performance of UK equities than the political party in power. This is particularly true given the global nature of most businesses listed on the UK stock market today and, in our opinion, the limited difference between the centre-left politics of Keir Starmer and the centre-right politics of Rishi Sunak.

So, whilst ‘political uncertainty’ will undoubtedly raise its head again this year, the reality is that whichever party wins the general election, it is unlikely to be of any greater significance than the outlook for global growth and corporate earnings in determining the path for UK equities in the years ahead. Not forgetting, of course, the outstanding value already on offer in vast swathes of the UK equity market today.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund