Read More

Read More

Richard Scrope

Fund Manager

With cinemas closed for the foreseeable future, film producers are starting to release their latest blockbusters directly to their streaming platforms, and this shift in strategy is likely to remain the case

once cinema’s reopen. Worldwide, the ability to access with the click of a button, whatever you want to watch, continues to drive the growth in subscriber numbers for the streaming companies despite increasing monthly fees.

The last few years have seen a proliferation of streaming services as traditional cable companies realise that their customers are increasingly preferring to consume content on demand. In 2019, 74% of US households paid for at least one SVOD (subscription video on-demand) service, and 64% pay for more than one. Cable still captures a significant share of US consumer wallets with 75% of households

subscribing, however a decade earlier the percentage was 87%. We expect, especially given the lockdowns, that when the 2020 numbers are released we will have passed the point where SVOD households overtake cable ones.

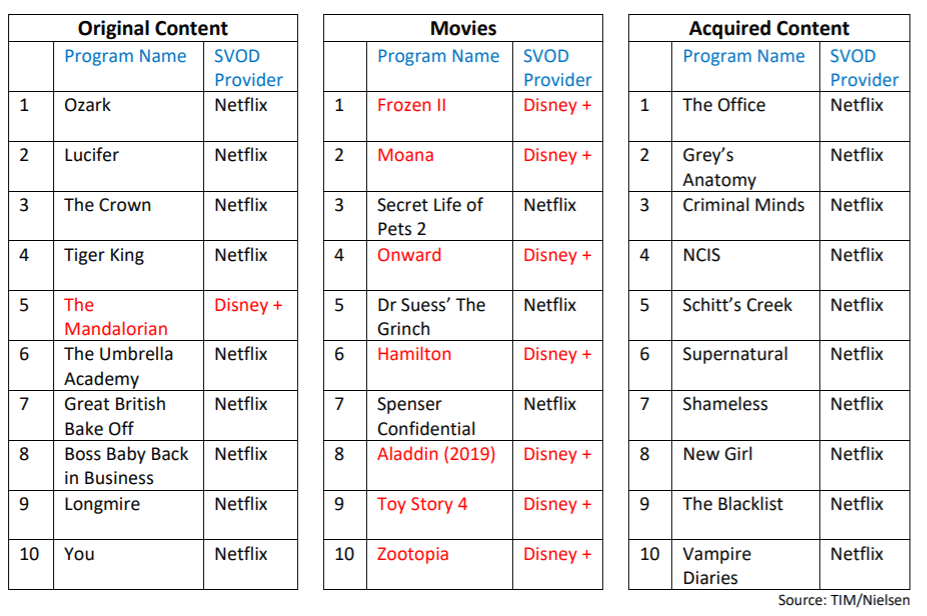

The question remains as to how many SVOD services are households prepared to pay for given the expansion of offerings. The key to capturing your share of wallet is content. The table below shows how Netflix and Disney + dominate the industry and continue to outgrow their peers:

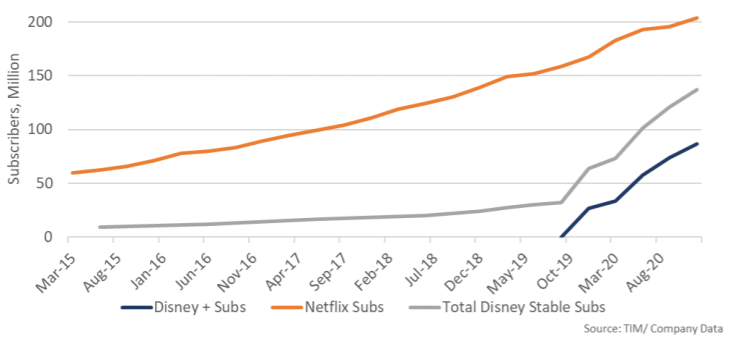

Capital markets have been kind to the SVOD companies, allowing them to tap the debt markets to fund new content. Netflix reached a milestone last week, announcing for the first time that they have the cash flow to be self-funding in 2021 despite continuing to invest heavily in more original content. Disney does not expect Disney + to turn profitable until 2024, despite surpassing their original four year subscriber target in their first year of operation. They now target 300-340m subscribers for its stable of streaming services by 2024. The inroad that Disney has made into the streaming market was praised even by Netflix, whose IR said last week: “Not to take anything away at all from what Disney’s done because it’s been amazing, and I’m a happy customer myself.”

Despite the success of Netflix the company believes that they only capture about 10% of viewing time in the US, but with Amazon giving their SVOD content free with Prime membership, and Apple giving

a year of free Apple TV with a purchase of a piece of Apple hardware, competition for share of wallet is fierce. Debate remains whether the other players in the space can entice consumers to their

platforms and to do so, many that own popular content, such as Peacock (Comcast), are bringing their original content back in house and terminating the licensing agreements with Netflix.

In a world where content is king, we believe that Netflix and Disney (held in the Fund) are likely to remain the default SVOD services for most households. As the first mover, Netflix has become the entrenched SVOD provider with a growing catalogue of its own content and a vast library of third party films. Disney not only has appeal to households with children, but also has a growing adult following, with Disney, Marvel, Pixar, National Geographic and Lucas Films under its umbrella, as well as the ability to bundle in ESPN and Hulu. As for the multitude of other providers (Crackle, Britbox, HBO Max, Peacock, Paramont +, Acorn, Sling, Fubo to name but a few) we fear many will struggle to get the critical mass to make their offerings profitable and thus over time may well see licensing their content a more cash generative route to follow, however, writing off sunk costs might be a difficult step for management to accept.

Much is likely to change in this space over the years to come but we believe that the same dynamics operate here as identified by Nike’s CEO in March, namely that “in times like these the strong brands

become even stronger”.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not