Read More

Read More

Richard Scrope

Fund Manager

In this Olympic year, the race is one for power. Elections come thick and fast this year, with Taiwan and Bhutan’s already having come and gone, Russia’s due to happen in March, the US Presidential election in November, and the UK’s general election at a date of the Government’s choosing, as long as it is before the end of the year. The list of other elections is lengthy, but for investors, the US Presidential is likely to be the most important and with the least clear-cut outcome.

With Ron DeSantis withdrawing his nomination, it is almost certain that Donald Trump will win the Republican nomination, despite his divisive character traits, and probably in a record time, given his lead over the only remaining contender. This will probably work to the Republican’s advantage as the various hustings, which only serve to highlight the character flaws of the opponent ,will play a smaller part of the process or the coronation of the forthcoming nominee.

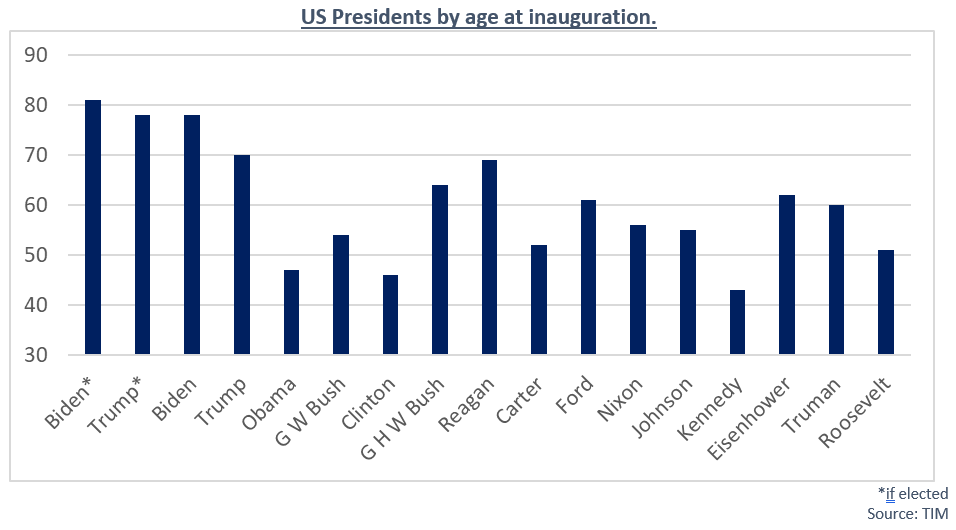

There is the unusual situation of the two sides running with a candidate seeking the second and final term in office (age the ages of 78 & 81 at the time of the election). Investors should have an idea of the priorities of both candidates, albeit with a swing factor of 2024 seeing the sitting President changing his policies to those which are deemed to capture the most votes, and once in office either candidate has almost free reign, bar Capitol Hill’s intervention, to roll back any promises made, safe in the knowledge that they will not be running again.

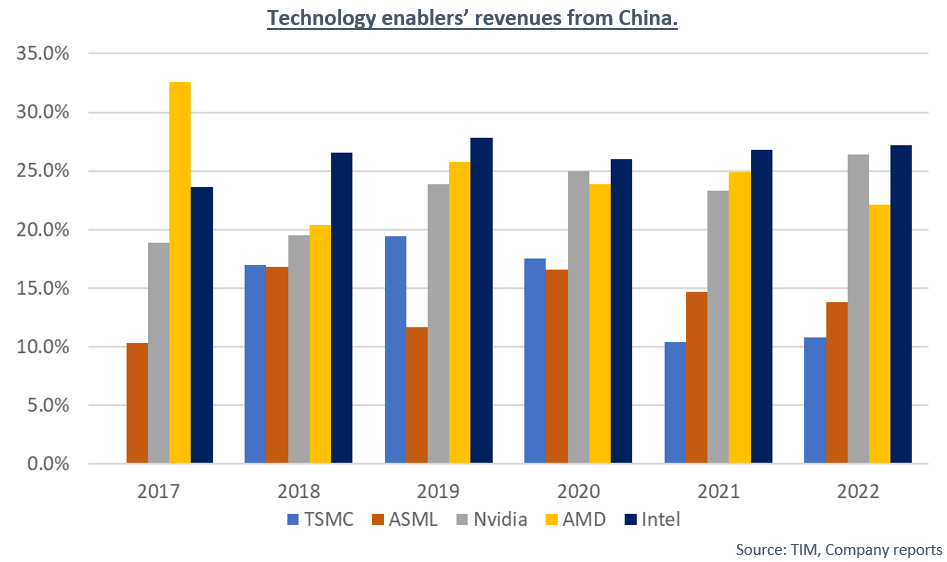

The rise in the prominence of AI and the rush of funds into all AI and microchip related companies in the past 18 months has led to the Biden administration continuing the Trump administration of clamping down on the ability of China to compete or gain access to the technical knowhow required in the AI world. One thing that seems likely, however, is that whoever wins in November, this anti-China rhetoric is likely to continue, and if Trump’s previous tenure is anything to go by, quite possibly increase.

Despite these restrictions, the technology sector, has become increasingly nimbler in circumnavigating the embargos imposed on their products, as embodied by Nvidia. The Company saw its previous China embargo compliant GPU fall foul of a change of standards and within months design a new GPU that passes the latest round of restrictions. Undoubtedly the standards agencies will find a reason to clamp down on the latest loophole as the campaign against the Chinese technology sector intensifies, but inevitably will always be one step behind the US and European technology companies that owe a large part of the revenues to sales to Chinese customers.

The unintended consequences of restricting access to the cutting-edge technology are that it pulls forward orders of the latest products before they too are banned, while at the same time seeing the Chinese back home-grown production, regardless of how it comes about the technological knowhow. Jensen Huang, the CEO of Nvidia, while visiting China, singled out Huawei, as a beneficiary of these controls and with the ability to make advanced GPUs and a potential rival to their dominance of the market.

As the chart above shows, since Donald Trump started his war against Chinese technology in 2018, initially with tariffs on imports, the percentage of revenues from China of many of the key component manufacturers has hardly moved. Undoubtedly this will not have gone unnoticed by both the Biden and Trump teams, and the regulators will probably be feeling the heat from both parties to hinder the flow of technology, especially as it becomes an easy vote winning topic in this election year.

Who finally mounts the top step of the podium may be undecided, but on some policy areas it will be a photo finish as to who comes out on top.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not