Read More

Read More

Felix Wintle

Fund Manager

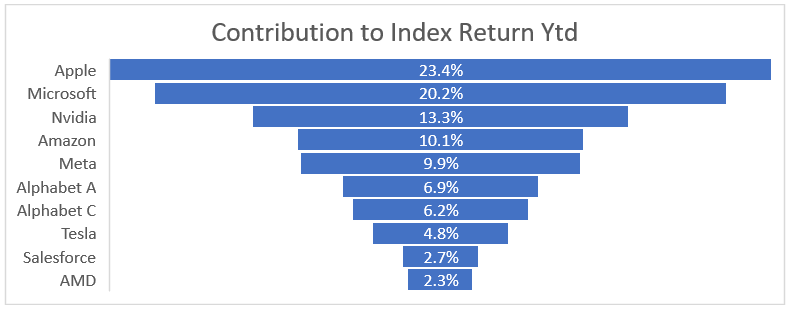

We live in a post QE era, where the Federal Reserve is aggressively raising rates and Quantitative Easing has been replaced by Quantitative Tightening, right? That has certainly been the narrative and while the interest rate cycle has without doubt reversed, the QE to QT switch has been much more nuanced and less clear, particularly since the banking crisis in March. There has actually been quite a lot of stimulus added back since then and this has contributed to the lopsided market we have today, where the mega caps account for 89% of the S&P 500’s gain so far year to date*.

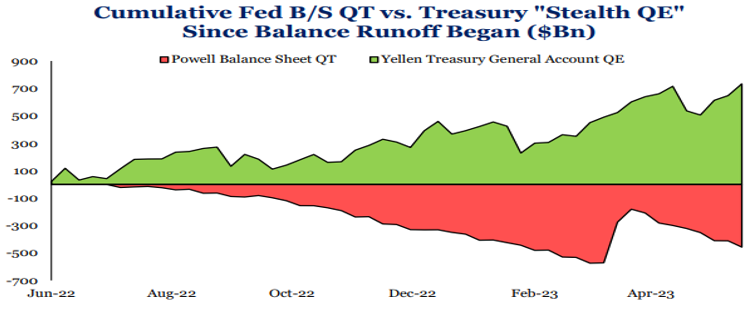

When Silicon Valley Bank and Signature Bank failed practically overnight in March, the Fed sprang into action and announced the Bank Term Funding Program which in two weeks undid 63% of the QT the Fed had achieved over the previous 12 months. In recent months there has been further QE made possible by the machinations of the debt ceiling debate. One of the issues caused by the debt ceiling stalemate is that the Treasury has not been able to issue any new debt. This has meant that, to pay its bills, the Treasury has had to draw on its cash reserves held with the Fed, where it would normally issue more debt, thus making spending neutral from a liquidity point of view. But with no debt being issued, this has in effect meant that the Treasury has been pumping cash into the system. This has more than compensated for Jay Powell’s attempts at QT as can be seen in the graph below.

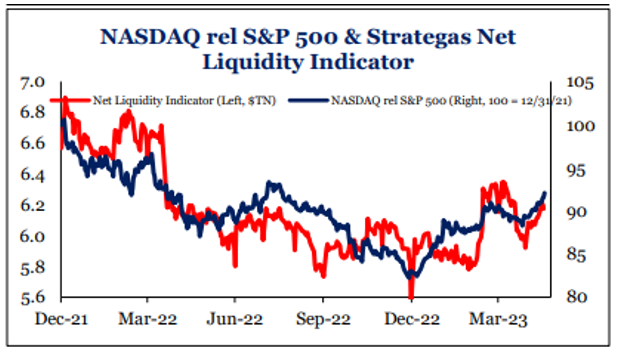

This also means that when the debt ceiling is raised, as it inevitably will, the reverse will happen, and that liquidity will leave the system. As can be seen below, excess liquidity is correlated quite closely to the Nasdaq outperforming S&P 500.

This may reset the table in terms of how investors view the market and instead of pouring more capital into the liquidity proxies at the top of the market, might look instead for new stocks and new leadership groups, where new product cycles and real growth can be found

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not