Read More

Read More

Felix Wintle

Fund Manager

One of the most important macro considerations in equity markets today is the fact that there is currently a synchronised reacceleration in economic growth in the three most important markets in the world namely America, Europe and China.

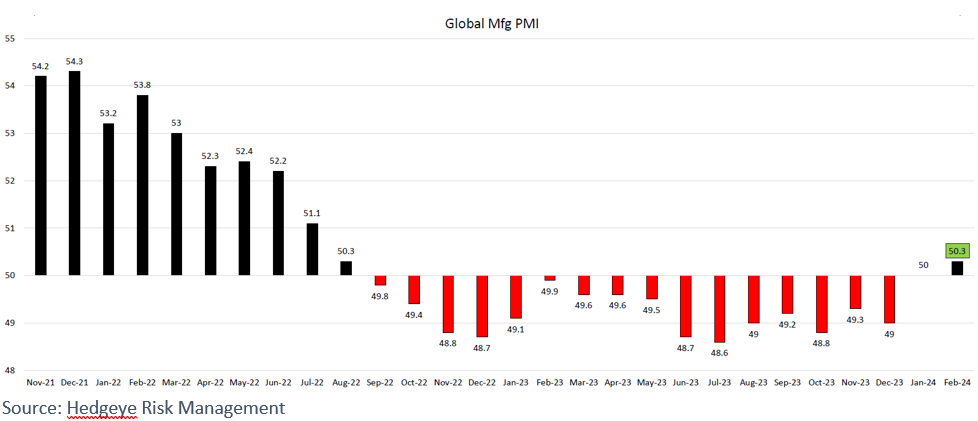

All three regions are emerging from a prolonged period of decelerating growth and so we find ourselves at the beginning of a new cycle in economic expansion. This can be seen in the chart below, which shows that after 16 months of negative readings in the global manufacturing PMI, last month we finally got above 50 again, showing expansion. This series has shown decelerating activity that goes back to November 2021, one of the longest on record.

This emerging new cycle benefits the more cyclical sectors of the market such as Industrials, Materials and Energy as they are more leveraged to the industrial economy. It’s interesting to note that Energy and Industrials are number 1 (+12.6%) and number 3 (+6.8%) in the year-to-date performance rankings of the S&P 500 sector ETFs, proving out that it’s not all about Tech (+4.8%) so far in 2024.

These sectors also tend to perform well in inflationary periods. The Materials sector houses many of the commodity related equities and this has been a hot area so far this year, with copper up 11.4% and the CRB Commodities Index +12.5%. We own Freeport McMoran in the tactical part of the fund as we see copper continuing to benefit from the upturn in the industrial economy as well as being an inflation beneficiary.

The Industrials sector is another key beneficiary of the upturn in manufacturing and industrial activity. Bolstered by three Federal spending programs, an extra $1.5trillion of spending is hitting the US economy over the next decade, but much of it happening in the next few years.

This is coming just as the ISM new orders index traverses the zero line once again and is now above 50%.

As can be seen, there has been a long period of negative (sub 50) readings which denote contraction and like the Global Manufacturing PMI chart overleaf, has now just poked its head into expansion territory. We believe this is likely the start of a continued upward trend, given the spending plans already in place.

The fund has a 26% weighting to these cyclical parts of the economy, and they act as a good diversifier away from Tech and Consumer. They are performing well in their own right and are exposed to long term investment themes which are unique to the US such as the Inflation Reduction Act, the Infrastructure Bill and the reshoring of the semiconductor industry.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not