Read More

Read More

Simon Murphy

Fund Manager

Whilst the popular misquote above is usually attributed to the American author Mark Twain, regular readers will recognise our affinity with it as it relates to the health, or otherwise, of both the UK economy and the UK stock market, such has been the deluge of relentless negativity in recent years.

Rather than repeat the well-rehearsed arguments for the defence, this week’s piece simply offers up a range of charts and graphs that should, we hope, give the perennial UK bears at least some pause for thought.

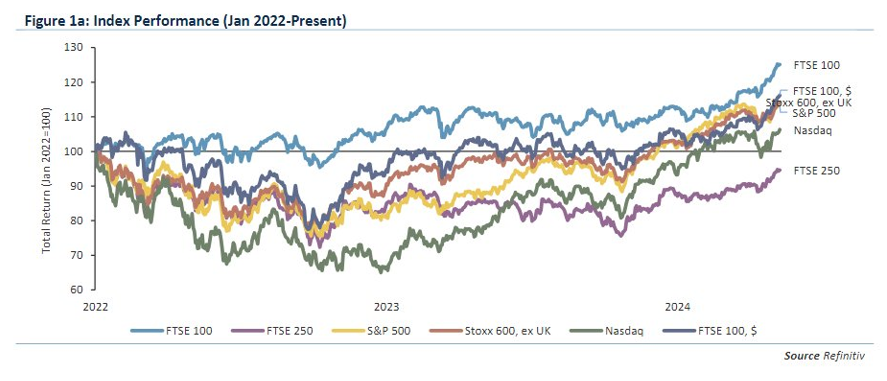

First up a potential ‘narrative killer’ from Panmure Gordon showing the outperformance by the FTSE 100 of the S&P 500, the Europe Stoxx 600 (ex UK) and the Nasdaq over more than two years now. Who says UK stocks never outperform? Granted, the more domestically orientated FTSE 250 has lagged considerably, but that is also true of mid and small sized companies in most other geographies as well – and denotes future opportunity in our view.

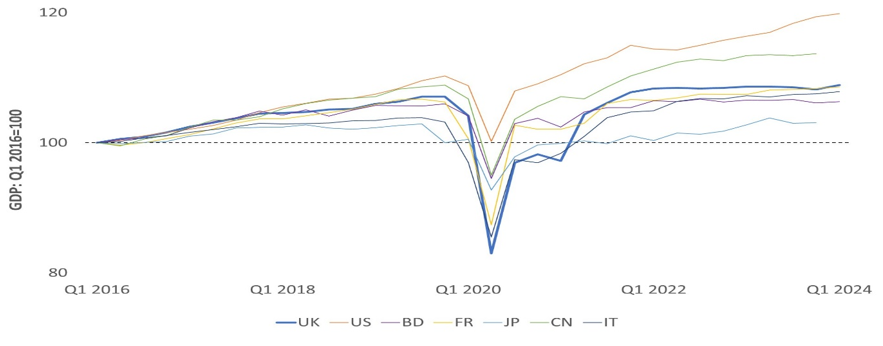

Next another potential ‘narrative killer’ again from Panmure Gordon, showing that, far from being an unmitigated disaster, cumulative UK GDP growth, since just before the Brexit vote in 2016, now ranks third across the G7 countries.

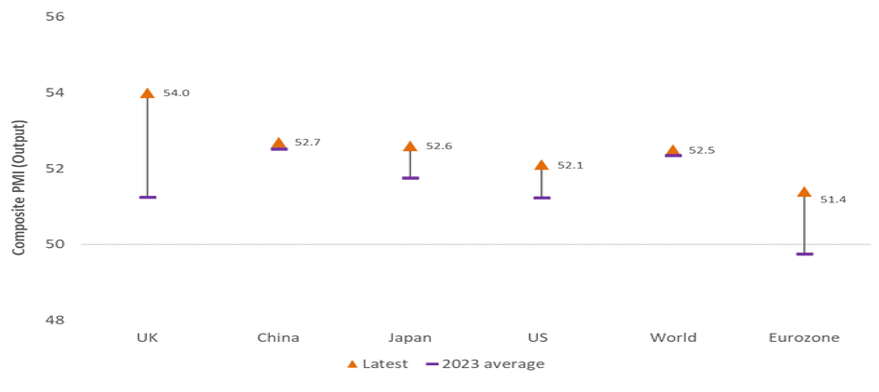

Continuing the economic theme, the UK currently leads the way in terms of closely followed surveys of economic activity as the chart below, of Composite Purchasing Managers Indices from around the world, highlights clearly – not just the absolute level but the biggest improvement since 2023 as well.

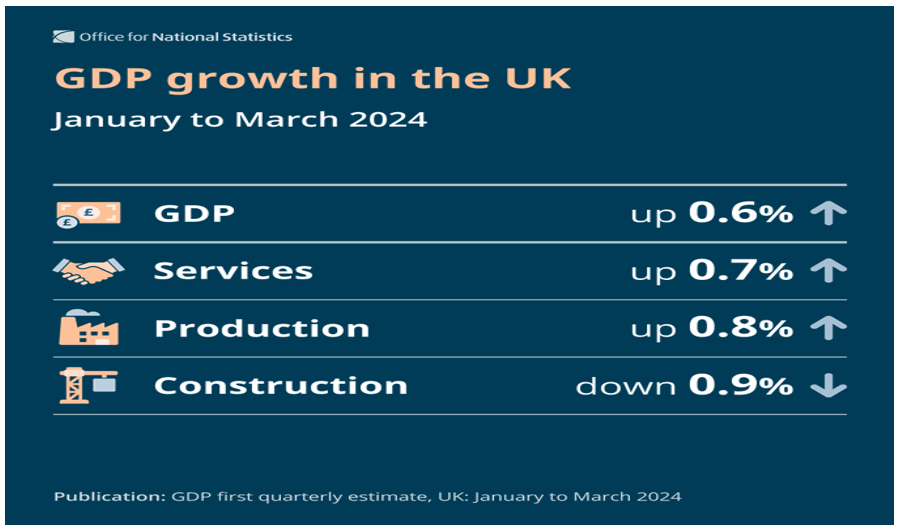

So, it is perhaps not entirely surprising to see a big positive development in the latest UK GDP data for the first quarter 2024. As can be seen below, despite weakness in construction (it was a very wet quarter), overall GDP growth came in at +0.6%, significantly ahead of almost every forecaster including our favourite, the Bank of England, who were expecting a mighty +0.1%........

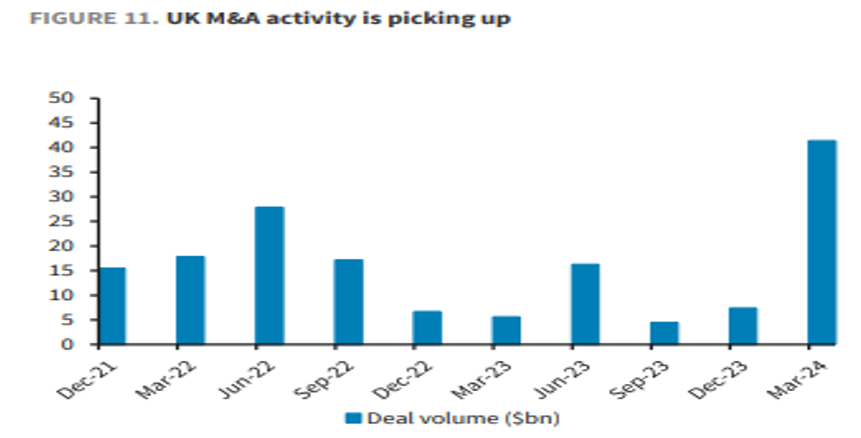

Meanwhile, it seems that the enormous value currently on offer in the UK equity market is starting to be recognised by some, at least if the most recent pick up in M&A activity is anything to go by, as can be seen in the chart below from Barclays Capital. What is also interesting to note is the size of the premiums typically being offered in these deals, with several in the region of +60% or more.

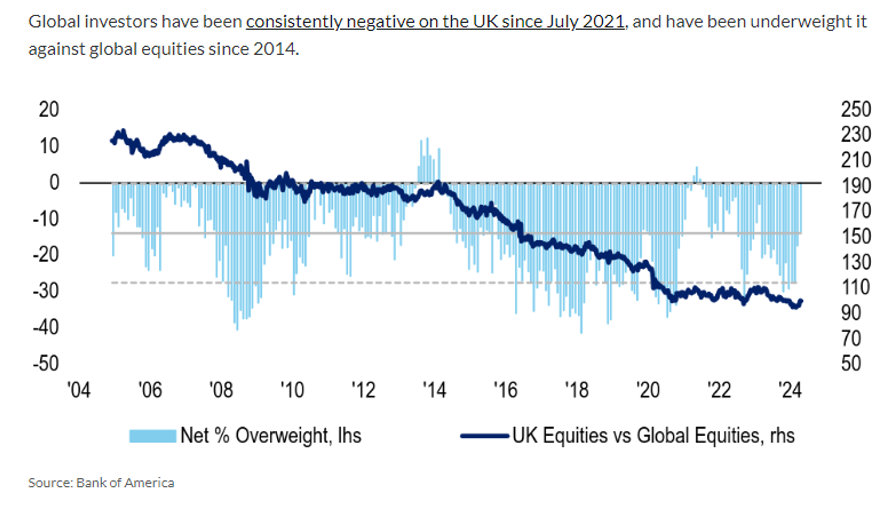

Whisper it quietly, but maybe global institutional investors are reassessing the prospects for the UK market also, if the latest survey from Bank of America is to be believed. Small improvements so far (they are less underweight now), as the chart below highlights, but let us not get too carried away – the UK has moved from being the most underweight to the third most underweight! Still plenty of scope for further improvement, we would suggest.

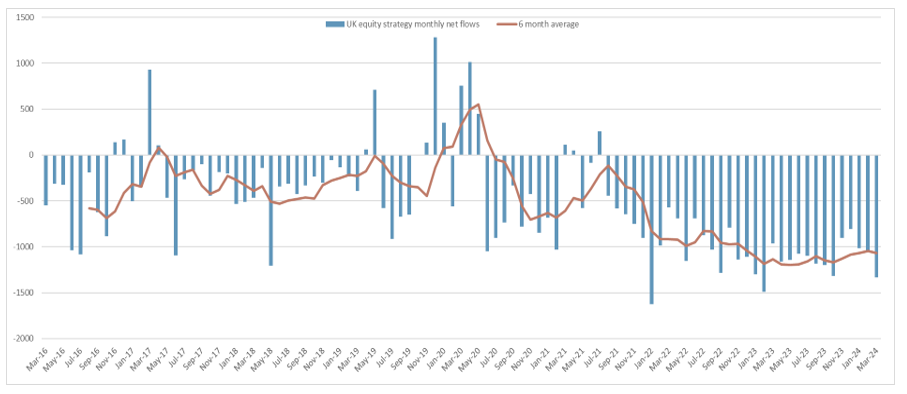

Sadly, such tentative signs of improvement are yet to be seen in retail investor flows, as the chart below from the Investment Association, of monthly UK fund flows, shows all too clearly.

Whilst it is tempting to observe that retail investors are usually the ‘last to know’ it would nonetheless be extremely welcome to see some easing of these relentless outflows sooner rather than later and that, by itself, would likely lend additional support to the UK equity market story.

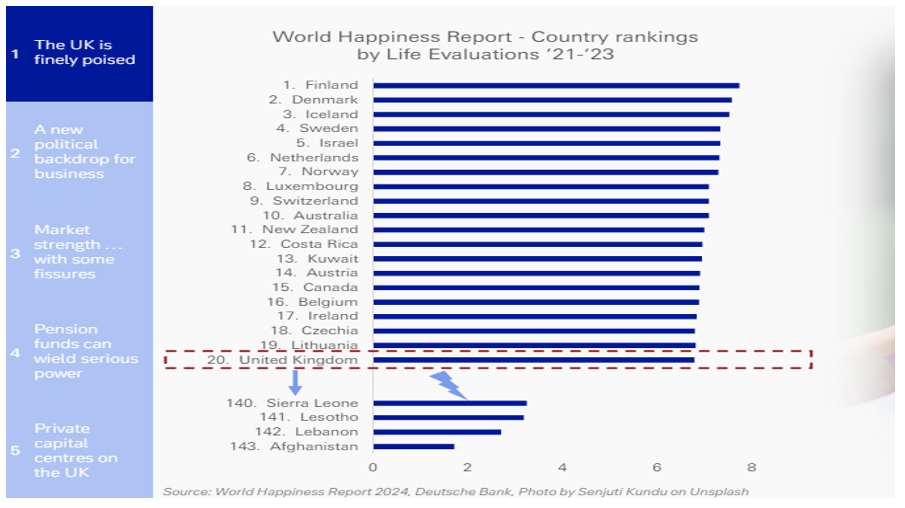

Finally, the chart below may be of little direct investing merit, but we found it extremely encouraging nevertheless. Perhaps us Brits are not as gloomy as many believe, particularly those that spend any time reading, watching, or listening to our mainstream media might think!

At the risk of repetition, to us the case is quite simple. The UK economy is certainly not firing on all cylinders, but it is not a ‘basket case’ either. The UK stock market is certainly not without its problems, but it is not a ‘backwater’ either.

It never ceases to amaze us how frequently facts and narratives do not align in the investing world. That creates risks when narratives are too rosy compared to the facts and, conversely, opportunity when narratives are too negative. We believe the latter is firmly the case in the UK today and we are enormously excited about the opportunity in front of us in the years ahead.

Please do not ask us for the ‘catalyst’ though.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund