Read More

Read More

Simon Murphy

Fund Manager

It probably won’t have escaped the attention of many readers that commodity prices have been on a roll of late, with the likes of oil, copper and iron ore rising between 15 – 25% or so year to date. Indeed, on Monday last week the Bloomberg Commodity Index, which tracks 23 raw materials, rose to its highest level since March 2013 having gained 67% since March of last year.

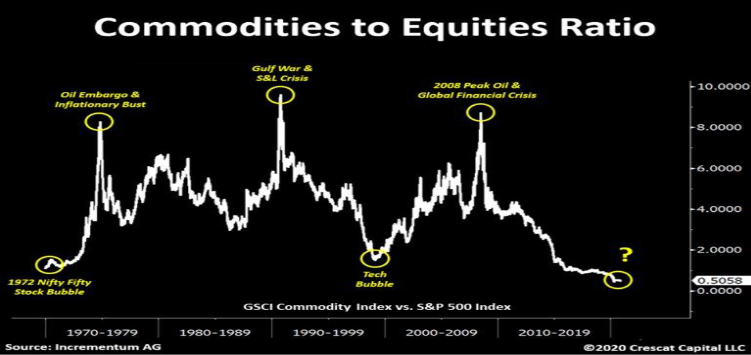

Yet despite this relatively strong recovery, in a medium to long term context, prices have only just started to recover lost ground, as can be seen in the chart below.

This resurgence in pricing has driven a number of industry commentators, led by Goldman Sachs and JP Morgan no less, to declare that a new commodity super cycle is now upon us. The issue is an important one for a whole host of reasons, but is particularly pertinent to the UK equity market given its significant exposure to commodity related stocks and sectors.

The case for a new super cycle appears to rest on a combination of 3 particular factors; a regime shift away from monetary policy dominance towards fiscal policy, a global economic recovery with an emphasis on a ‘green’ industrial revolution, and a general tightness of supply caused by lack of investment in recent years. Throw in the notion that commodities appear cheap relative to other assets (chart below) and the foundations appear set.

The shift in emphasis towards fiscal policy as the primary means of helping economies recover from the Covid-19 induced recession provides 2 potential sources of commodity demand – a ‘real’ source relating to the commodity intensive nature of proposed big infrastructure projects, and an ‘investment’ source as the spectre of higher inflation drives investors towards supposed inflation ‘hedges’, including real assets such as commodities. As the debate around resurgent (or not) inflation continues, those with a very, very long memory will recall that in the inflationary environment of the 1970’s, commodities were the only asset class to deliver a positive real return.

Clearly, a potentially strong, synchronised, global economic recovery will naturally buoy demand for commodities, with additional structural demand in specific commodities (eg. copper) from the now unstoppable trend towards decarbonisation and the so called green industrial revolution.

Finally, it remains the case in this, one of the most cyclical of sectors, that large additions to supply require major capital investment commitments and typically take a number of years to bring to fruition. As such, the persistently low prices we have seen in recent years deter these capital commitments and set the stage for a period of very tight supply, potentially leading to strong pricing

conditions for a number of years before, inevitably, those higher prices encourage the necessary capital investment to boost supply again.

Whether all of the above is sufficient to generate a super cycle in commodities will only be determined in the fullness of time. For now, we are minded to believe that there is sufficient momentum, driven

by the factors above, for rising prices to persist for a reasonable period.

In the VT Tyndall Real Income Fund, we are well represented in the resource space with meaningful holdings in Rio Tinto, BHP Group, Antofagasta and BP. Not only are these companies benefiting from the backdrop outlined above but, excitingly for us, they are also rewarding shareholders through high levels of dividend payments.

With their latest reported figures, both Rio Tinto and BHP Group announced bumper returns to shareholders, totaling some $14.1bn between them. Rio Tinto’s full year 2020 total dividend represented a 72% pay-out ratio and a +26% increase on 2019’s total. BHP’s interim 2021 dividend was an even bigger 85% pay-out ratio and a whopping +55% increase on 2020’s interim. In a world generally struggling for income, that’s just what the yield starved doctor ordered.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund