Read More

Read More

Simon Murphy

Fund Manager

It is that time of year again where we issue a progress report on our suggestion that, starting from our first report in May 2020, ‘value’ (our proxy being Imperial Brands) might outperform ‘growth’ (our proxy being Rentokil Initial) over a 5-year period. We are now approaching the end of year four of our 5-year experiment and, as shown below, things are starting to look good for value! As a reminder, the key tenet of our philosophy has always been that starting valuations matter immensely to the future total return potential of investments.

To recap, Imperial had modestly outperformed Rentokil at the 3-year stage, delivering a total return of +44.4% compared to +36.9%, notwithstanding a muted environment for the global tobacco industry during this time and a significant, potentially extremely exciting, US pest control acquisition for Rentokil. So, what has happened to the two businesses over the last 12 months?

For Rentokil, the story has been all about the $6.7bn ‘landmark’ acquisition of Terminix back in October 2022. As the deal was completed late in the calendar year 2022 it significantly skewed the group results for the year to 31st December 2023. As such, for the year, group revenue grew +45% and adjusted operating profit +57%. The dividend grew +15%, and adjusted EPS grew more modestly at +9% due to the dilutive effects of issuing equity to part fund the Terminix transaction.

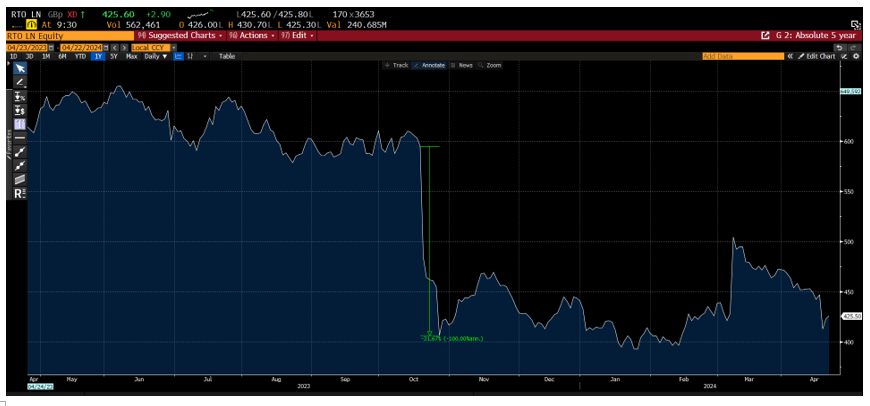

Whilst seemingly all on track, Rentokil ‘surprised’ the stock market with its third quarter trading statement in October where, due to a ‘softer consumer demand environment,’ the North American region only delivered organic growth of +2.2% in the quarter. Furthermore, the company commented that ‘the region’s full year performance is anticipated to be marginally below our previous expectations.’ Whilst that may not sound like a particularly big deal, coming so soon after such an enormous transaction it was not taken well, which sadly is often the case when stocks are richly valued leaving little room for error or disappointment. The consequent share price reaction was brutal, with the price falling -32% over just six trading days, with little recovery since, as can be seen on the chart below.

Once again, by contrast, Imperial have had a much more mundane time of things over the past 12 months. In the year to 30th September 2023, net revenue grew +2.8%, operating profit +5.2%, EPS +5.1% and the dividend +4.0%, whilst similar trends have been seen in the latest half year to 31st March 2024, according to the company’s recent pre-close trading update.

Crucially, strong cash generation has enabled the company to continue enhancing shareholder returns through an ongoing, and increased, £1.1 billion share buyback, alongside progressive dividend growth. As a result, Imperial will have returned c.£4.7bn cumulatively to shareholders in FY23 and FY24 (equivalent to c.30% of the current market capitalisation of the company), with further material returns very much in prospect for the future.

Imperial are now in the fourth year of a 5-year strategy and firmly into the period of ‘improving financial delivery’. The jury is still out on the ultimate scale of potential improvement, and the industry backdrop certainly remains uninspiring in terms of volume growth for the foreseeable future. Nevertheless, the company is making good progress in gaining market share in their top five priority markets and momentum continues to build in all categories of next generation products. Most importantly, the quantum of shareholder returns delivered recently has been extremely impressive, and the future return potential remains highly attractive.

Given the dramatic fall in Rentokil’s share price during the period it is not surprising to see Imperial significantly outperform, despite its own share price doing relatively little over the last 12 months. Furthermore, the impact on total returns from the respective companies over the whole period is dramatic, as can be seen in the chart below, with a cumulative total return for Imperial of +52.6% compared to Rentokil’s -7.2%, giving Imperial a lead of nearly 60% with one year to go!

As we stated in our opening paragraph, the key to our argument has always been that starting valuations matter immensely to the total return potential of investments and can often dominate the operating performance of the business.

At the outset four years ago, Rentokil was on a forward P/E ratio of 35x, and Imperial was on 6x. Today, in no small part due to the concerns over performance in North America following the large Terminix acquisition, Rentokil’s multiple has fallen significantly to c. 19x whilst Imperial’s multiple remains at c. 6x.

Thus, despite demonstrably superior financial performance over the whole period, Rentokil has so far significantly underperformed as an investment, making no money for investors for the last four years.

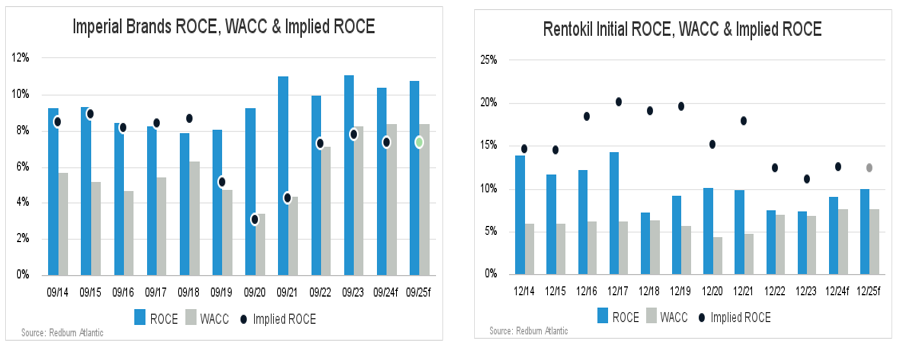

Whilst we are reticent to declare victory too early, given the scale of the outperformance to date we remain convinced that our experiment will ultimately prove successful – although 12 months is still a long time in stock market terms! Perhaps the share price reaction to Rentokil’s trading difficulties in North America was too harsh, and the company is certainly intent on reinvigorating organic growth in the region under their recently launched RIGHT WAY 2 plan. Notwithstanding that prospect however, we gain additional comfort in the return on capital employed charts below, from Redburn Atlantic, which are still suggestive of a market that continues (albeit less so) to overpay for the returns Rentokil generates, whilst simultaneously underpaying for those from Imperial Brands.

As previously, we will be sure to check in again next year for the final instalment.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund