Read More

Read More

Simon Murphy

Fund Manager

It is that time of year again where we issue a progress report on our suggestion that, starting from our first report in May 2020, ‘value’ (our proxy being Imperial Brands) might outperform ‘growth’ (our proxy being Rentokil Initial) over a 5-year period. We are now just over 3 years into our experiment.

As a reminder, Imperial had at the 2-year stage, outperformed Rentokil, delivering a total return of +22.8% compared to +15.0%, notwithstanding a muted environment for the global tobacco industry during this time and a significant, potentially extremely exciting, US pest control acquisition for Rentokil. So, what progress have the two businesses made over the last 12 months?

As in previous years, Rentokil has seemingly gone from strength to strength, with the ‘landmark’ acquisition of Terminix (approx. $6.7bn) completing in October 2022, part way through the financial year to 31st December 2022. For the year as a whole, revenue grew +19% and adjusted operating profit +23%, including the benefits of M&A. The dividend grew +18%, although statutory EPS fell -18% due to ‘one-off and adjusting items, and interest related to the Terminix transaction’.

Organic revenue growth was a healthy +6.6%, initial progress on the integration of Terminx was described as ‘excellent’, with expectations for cost synergies raised to ‘at least $200m’. The medium-term organic revenue growth target for the group was raised from 4.0-5.0% to ‘at least 5.0%’, with ambitions for group adjusted operating margin to be greater than 19%, from the current 15.4%, and free cash flow conversion of at least 90% by 2025. Net debt to EBITDA, whilst high, is expected to be less than 3x by the end of 2024.

Once again, by contrast, Imperial have had a much more mundane time of things over the past 12 months. In the year to 30th September 2022, net revenue grew +1.5%, operating profit +1.8%, EPS +4.9% and the dividend +1.5%. Similar, albeit even more muted, trends have been seen in the latest half year results to 31st March 2023. However, strong cash generation has meant a strengthened balance sheet and enabled the company to enhance shareholder returns through an ongoing £1 billion share buyback, alongside a progressive dividend.

Imperial are now in the third year of a 5-year strategy and, in theory, have been through 2 years of ‘foundation building’ and are now moving to a period of ‘improving financial delivery’. The jury is still out on the scale of potential improvement, and global tobacco market volumes, particularly in the USA, remain under significant pressure in the short term. Nevertheless, there are encouraging signs in terms of market share gains across their top five markets, alongside new product launches in next generation products such as vapour and heated tobacco.

Given the respective business and financial developments noted above, it would be perfectly reasonable to expect, once again, Rentokil’s share price to have materially outperformed Imperial’s over the last year. As it happens, courtesy of a powerful rally in the last 2 months as ‘growth’ stocks have returned to favour, Rentokil have indeed (just) outperformed, returning +19.1% total return compared to +17.6% for Imperial, over the period 4th May 2022 to 23rd May 2023.

However, despite this recent outperformance, Imperial is still ahead over the entire period (6th May 2020 to 23rd May 2023), as the chart below shows, with a cumulative total return of +44.4% compared to Rentokil’s +36.9%.

Whilst Imperial only has a relatively modest lead in terms of total returns, it comes against a backdrop where Rentokil has grown turnover, operating profit and EPS at compound rates of +11.5%, +16%, +14% per annum respectively over the last 3 years, compared to Imperial’s turnover, operating profit and EPS that are all marginally lower than they were 3 years ago!

The key to our argument remains, of course, that starting valuations matter immensely to the total return potential of investments and can often, as we are most likely seeing above, dominate the operating performance of the business. At the outset 3 years ago, Rentokil was on a forward P/E ratio of 35x, and Imperial was on 6x. Today those multiples are more like 28x and 6.5x respectively. Thus, despite demonstrably superior financial performance, Rentokil has so far underperformed as an investment, due to the extremely high starting valuation that is being derated over time.

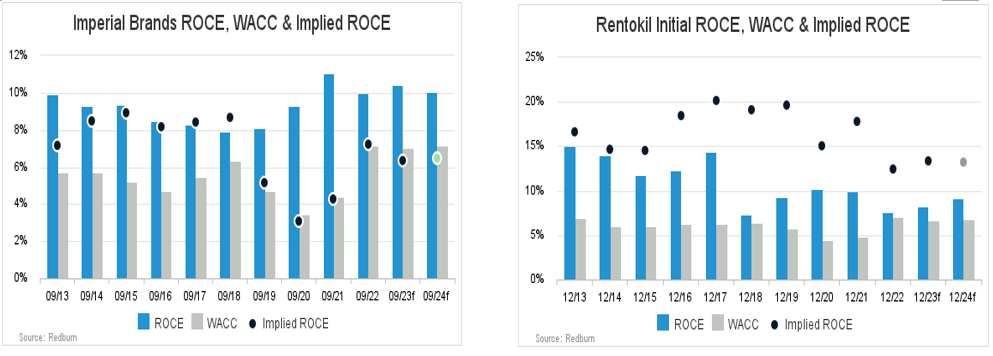

Given the small margin of outperformance so far, it is clearly still all to play for over the next 2 years. However, the dynamics shown to date convince us our assertion will play out, as do the implied return on capital employed charts below (from Redburn). These continue to suggest the market is significantly overpaying for the returns Rentokil generates whilst simultaneously underpaying for those from Imperial Brands.

As previously, we will be sure to check in again a year from now with a further progress report.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund