Read More

Read More

Felix Wintle

Fund Manager

To look at the S&P 500 over the last 6 weeks, the casual observer would conclude that not much had happened and markets had continued higher in a measured way. Although the index level has ticked gently higher, under the surface it’s been quite the maelstrom of rotation. First, Tech meaningfully sold off, with the Nasdaq falling some 12% from its high, and many of the high-flying tech and green energy stocks falling sharply. The best indicator for these exposures is the Ark Innovation ETF, which fell 31% from its recent high on the 16th February. The more speculative SPACs also sold off and there was a general risk off theme to high valuation tech and growth names. Then, for most of the month of March, the cyclical sectors had their time to correct, with Energy, Materials, Industrials and Consumer Discretionary all under-performing, as did the Russell 2000, which has been one of the best places to be year to date, correcting about 10% from its recent high.

There are many reasons to believe, however, that this is the correction that gives the market a springboard for the next leg higher. As we anniversary the Covid crash of Q2 2020, we will be cycling through the easiest comparisons for generations, and in some cases, the easiest comparisons ever seen. The oil price is the perfect example; having traded at around $60 in the first quarter of last year, it plummeted to the never-seen-before level of -$40 per barrel by late April. It is inputs like this that are going to contribute to accelerating levels of inflation in the next few months.

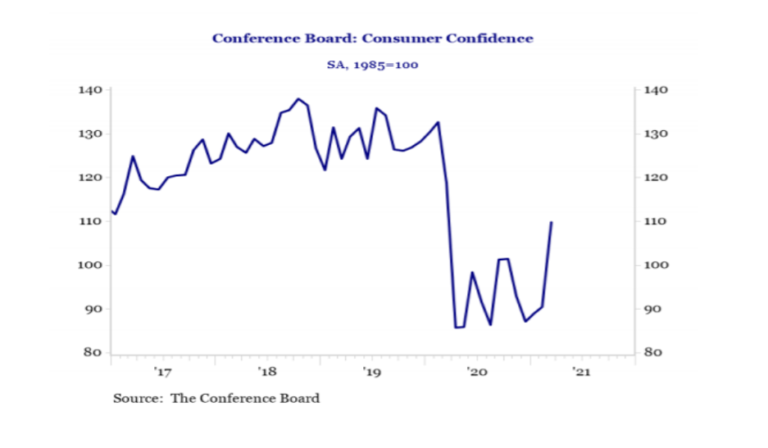

Growth is likely to be very strong as well in the next few months with the potential for double digit GDP growth in the second quarter. This is not all due to low base effects, however. The economy is already in recovery mode and is springing back to life as the reopening gathers pace. Retail sales have already bounced back as has consumer confidence, which recorded a reading of 109 in March which was a big leap up from 94 in February. ...

Added on to low base effects and a recovering economy are the stimulus cheques which are being sent to consumers, and then on top of this there is a further $2.5tr of announced stimulus and infrastructure spending coming as part of the American Jobs Act. The Federal Reserve has also prioritised job creation over inflation with a promise to let the economy ‘run hot’ with no rate rises until 2023.

The post-recession recovery, plus stimulus, plus an accommodative Federal Reserve means that now is the time for US equities to continue their march higher.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not