Read More

Read More

Simon Murphy

Fund Manager

As the end of another fascinating year in markets approaches, it is customary for the great and the good of the investing community to offer weighty tomes on the prospects for 2024. An unbelievable amount of research and endeavour goes into these exercises, and those that care to proffer views do so in the genuine belief (hope) that they can add meaningful value to their clients. Unfortunately, as the J.K. Galbraith quote above alludes to, they typically do not.

For the reasons we set out below, we will not be joining our peers on the forecasting merry-go-round for 2024 (or any other arbitrary period) in this or any other article we write. Instead, later in this piece, we thought it might be useful to jot down a few high-level things that we think we know, and which we find extremely helpful in framing how we construct our portfolio and the key areas of the market we focus on. We cannot stress the word ‘think’ highly enough though.

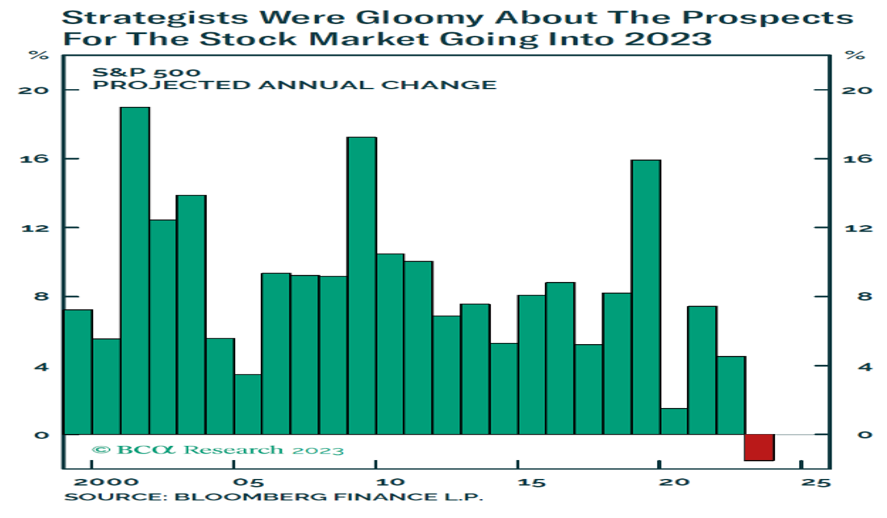

So why are we so against forecasting? Well, the chart below, from BCA Research, shows the collective forecasting efforts of the extremely intelligent, highly paid, and widely followed, ‘expert’ strategists on Wall Street. As you can see, for the first time this century, they predicted a negative year for the S&P 500 in 2023. Although the year is not quite over yet, as at the close last Friday, the S&P 500 has delivered a total return of +21.8% year-to-date. Lest we be tempted to ignore 2023 as a one off, the chart also shows the collective forecast for 2022 was a positive return of c.+5% when in fact the S&P 500 delivered a negative total return of -18.1%!

In the business of investing, where we spend our entire time dealing with uncertainty and imperfect information, we can fully understand the desire to either predict the future accurately ourselves or to find an ‘expert’ who can. Indeed, these strategists and other forecasters do not (usually) intend to get it so wrong, but the simple fact is that it is next to impossible to accurately assess the range of likely outcomes for extremely complex and dynamic systems such as asset markets – and certainly not over a short, arbitrary, time frame like 12 calendar months!

Indeed, it is not just market forecasters that get it consistently wrong either, the economic forecasters are typically just as bad. One of the worst culprits in recent times, in our view, has been our very own Bank of England. Not only did they, along with others to be fair, dismiss the largest and most persistent bout of inflationary pressure in over 40 years as just ‘transitory,’ but they have been equally woeful on the growth outlook. In the November 2022 Monetary Policy Report, the Bank made extremely gloomy headlines for forecasting the UK economy to deliver eight consecutive quarters of negative GDP growth, with the 2023 calendar year estimated at -1.9%.

To put it into context, the UK saw only six consecutive quarters of negative growth during the global financial crisis of 2008/9 and yet, at the end of last year, the Bank decided we were in line for eight! We always felt that this was a particularly unlikely scenario, given the starting conditions of negligible unemployment, strong wage growth, a healthy banking system and relatively healthy corporate and consumer balance sheets. Then again, who are we to argue with the intellectual might of the Bank, with its army of PhD economists and highly sophisticated econometric models? Roll forward 12 months and we have not, yet, had any negative quarters and the Bank’s latest forecast is for 2023 GDP to grow +0.6% not fall -1.9%!

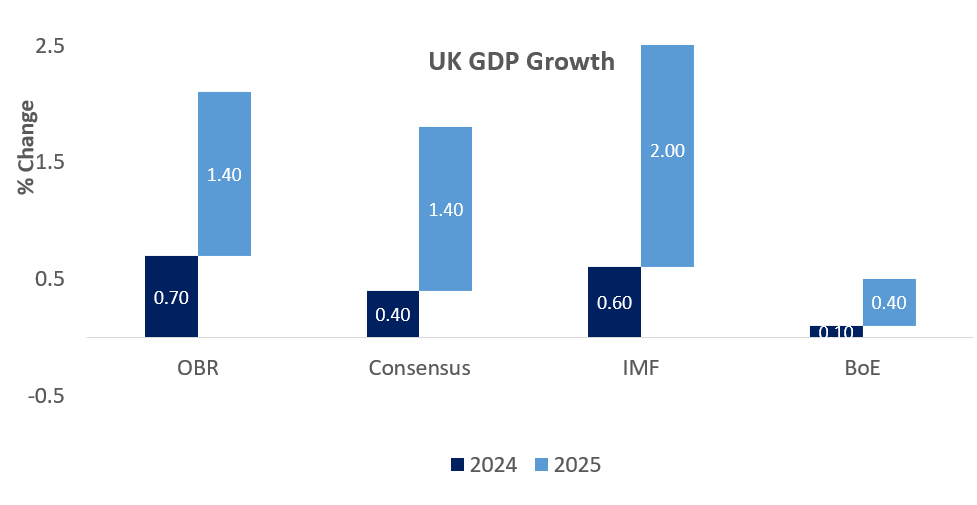

Not known for self-reflection, they continue to have extremely pessimistic forecasts for 2024 and 2025 compared to others, as the chart below, from the November 2023 Economic and Fiscal Outlook of the Office for Budget Responsibility (OBR), highlights. Who knows, maybe their forecasts will prove more accurate going forwards than recently. Maybe.

So, instead of a forecast, here are some things we think we know:

- We think the world has suffered several ‘shocks’ in relatively quick succession in recent years, including a pandemic, military conflicts, energy crises, inflationary episodes and more.

- We think the negative psychological impact of a sustained period of ‘shocks’ on investors has been substantial and ongoing, driving a general lack of risk appetite and a willingness to ‘fear the worst’ (with exceptions such as the enthusiasm for all things Artificial Intelligence).

- We think this environment of negativity has been amplified in the context of UK assets that were already reeling from the negative perception of the Brexit vote to leave the EU.

- We think the broad negative outlook is falling disproportionately on more traditional or ‘value’ orientated areas of markets.

- We think the broad negative outlook is falling disproportionately on mid-sized and smaller companies than on large companies, both in the UK and globally.

- We think the persistent negativity, allied to the actions of key market participants, has created a situation where UK equities look significantly undervalued relative to global peers.

- We think this undervaluation is particularly pronounced in the value areas of the market and the mid and small sized companies.

- We think this situation presents an opportunity for several years of outsized returns from some, if not all, parts of the UK equity market.

Damn! Against our better judgement we have gone and produced a forecast – outsized returns from parts, if not all, of the UK equity market over several years. Although, as far as forecasts go, our guess is that most readers will be pretty unimpressed. After all, there are no complicated scientific models or fancy charts to back it up, and it categorically does not have a time frame attached to it – so what use is that to us, we can almost hear the collective groan.

Which brings us squarely back to what this piece is all about. In the face of a highly uncertain future, the illusion of precision, typically coming as it does with a body of ‘evidence’ and articulated by a host of ‘experts,’ may feel much more comforting than a vague, time frame lacking, notion but it is exactly as described – an illusion - and no more likely to be accurate accordingly.

When it comes to running our fund, we focus on the points above that we think we know. The result is a portfolio today that is highly cyclical, focused on mid-sized companies, offers exceptional value to our eyes, and should be capable of delivering exceptional returns to our clients in the future. Indeed, we are as excited about the prospects for our fund today as we have ever been in our career. As to when that value crystallization might occur, we do not believe we or anyone else can forecast, and so we do not even try. We genuinely believe it will, and we hope it will be sooner rather than later, but, when it comes to timing, we do at least know, that we don’t know.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund