Read More

Read More

Richard Scrope

Fund Manager

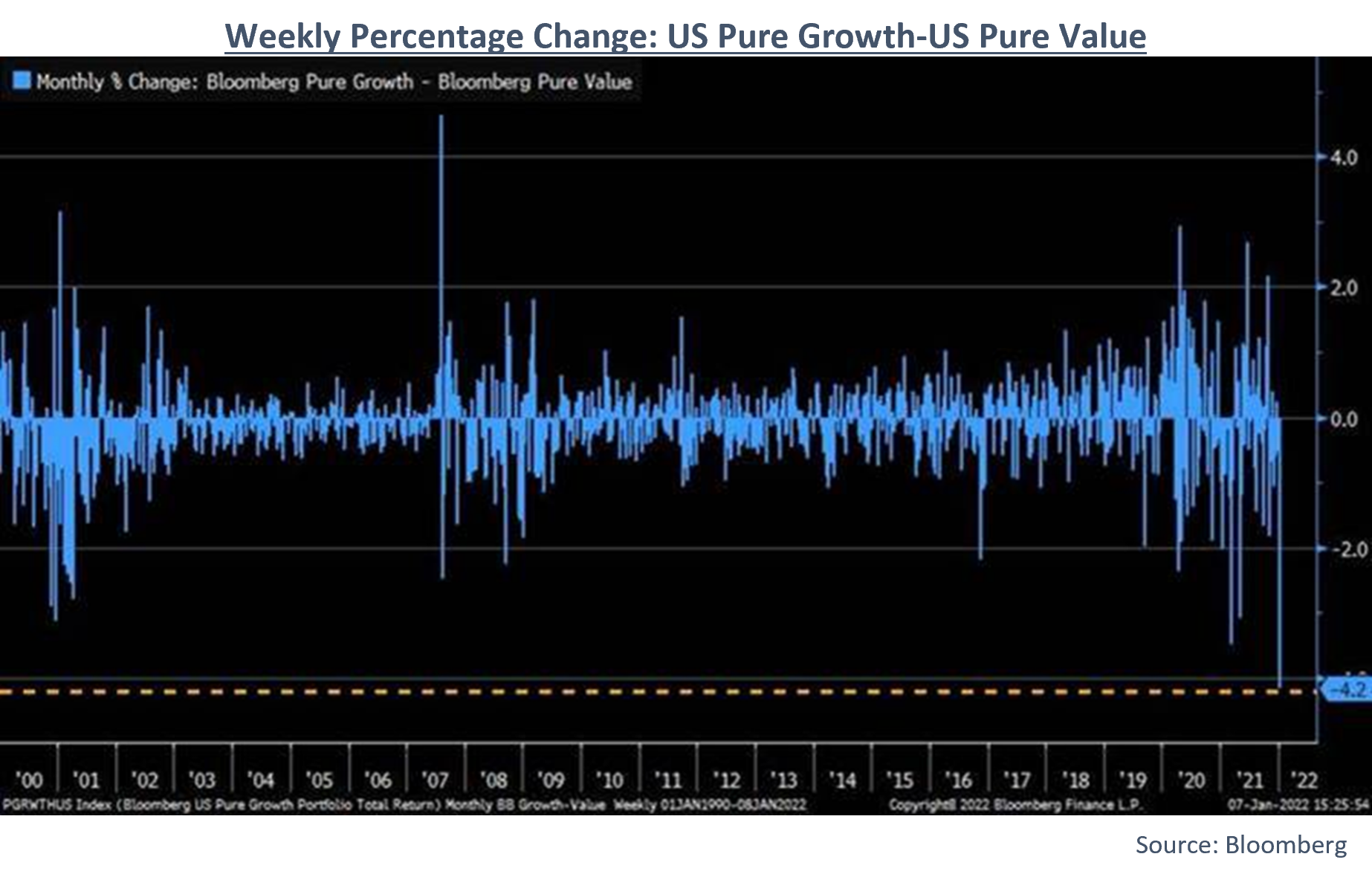

The turn of the year saw a rotation into ‘value’, funded by ‘growth’, of a magnitude not seen at any time this century, accelerating the shift in investor weightings seen in December. Those stocks which outperformed in 2021 have, almost all, seen their market value fall significantly over the past two weeks, with the technology and medical technology sectors feeling the brunt of the change. Conversely, the energy sector was buoyed by the oil price, which has risen from $65 per barrel at the start of December, to $85 today.

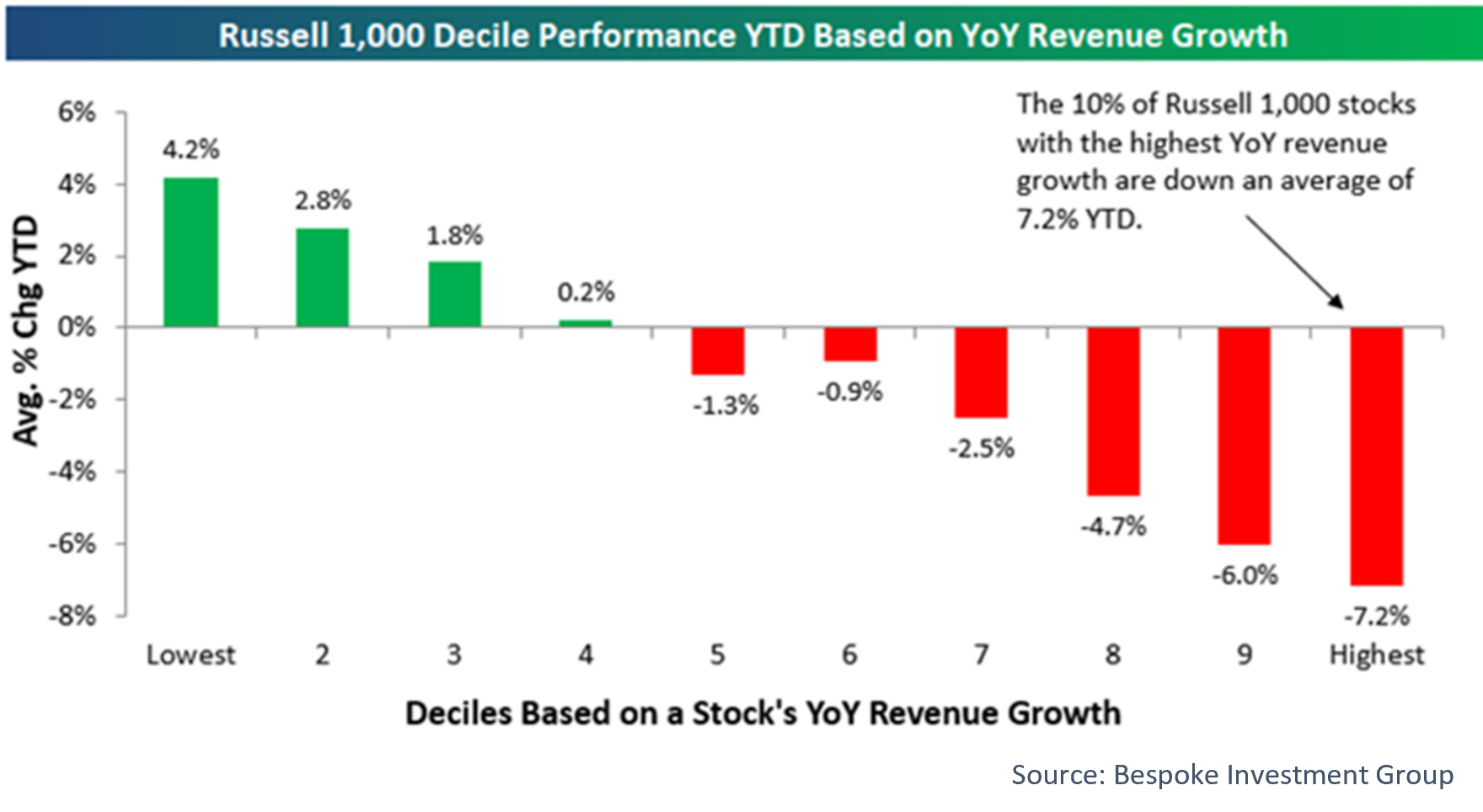

The shift, however, has not been confined to a sectorial basis, as the chart below shows, companies that have been able to grow their revenues over the past 12 months have been the worst performing stocks so far this year, while those which have not managed to increase revenues have been the best equities to hold; in fact, there has been almost a perfect correlation between growth in 2021 and performance year-to-date.

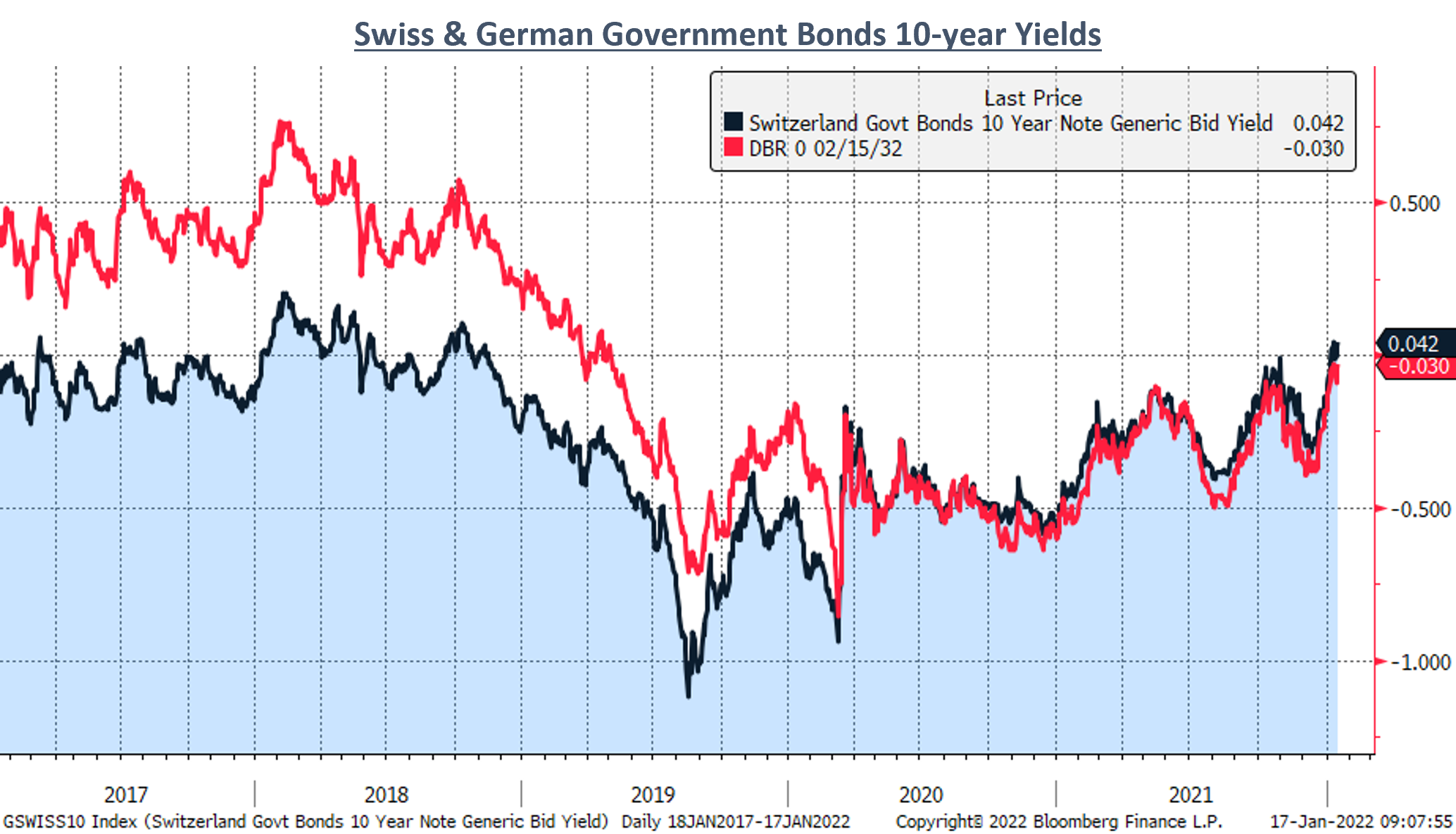

These moves, therefore, pose the questions as to what is causing the shift in sentiment and is it likely to be maintained on a longer-term basis? The answers to significant moves in equity markets can often be found in the bond markets and here we have seen 10-year yields increase globally. Swiss 10-year yields are no longer negative, and the respective German yields are also almost in positive territory for the first time since 2018.

As significant as these levels may be, the move in the US 10-year after the Federal Reserve adopted a more hawkish stance to fight inflation, by signalling that it would end asset purchases and raise interest rates sooner than expected, is more closely followed and has greater impact on investor sentiment. Although in recent weeks have seen rising yields, history would suggest that the end of the fourth quantitative easing (QE) programme should be followed by falling 10-year yields. As the chart below shows, each of the previous QE programmes have seen a significant drop in the 10-year yield, and the well documented taper-tantrum in 2013 also led to a drop in rates.

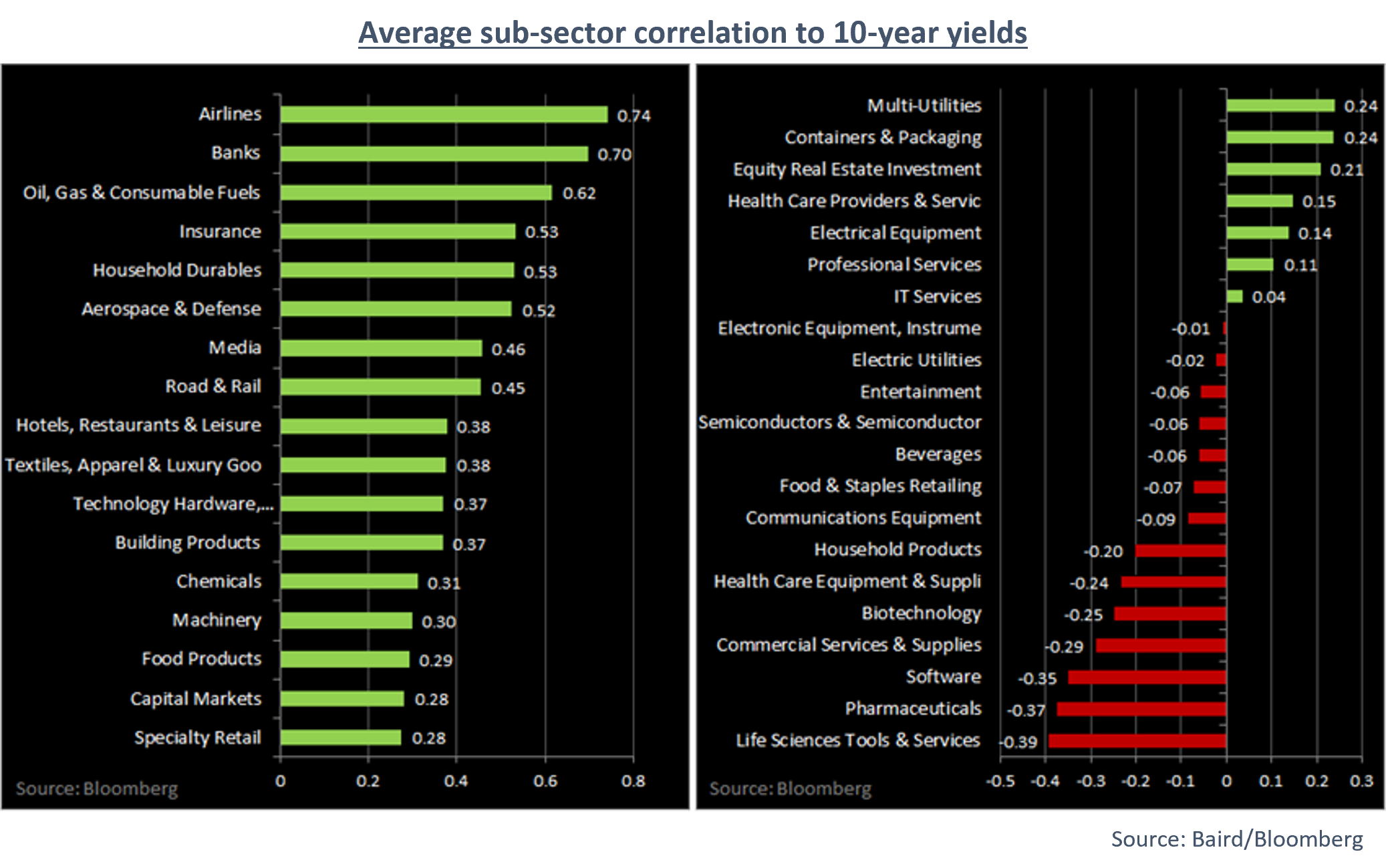

The recent increase in yields fits with the performance on a sectorial basis that we have seen so far this year, suggesting that investors are sticking to the historical playbook of where to position themselves while experiencing an increase in yields.

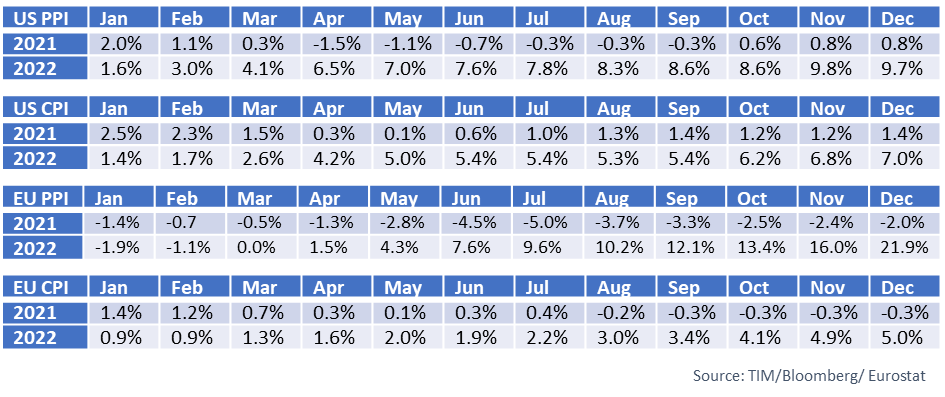

Therefore, we need to question what is different this time, or should we expect the 10-year yield to fall in the coming months as QE comes to an end, and thus will the shift to low/no growth companies prove to be short lived. The obvious difference is the rate of inflation being experienced both in Europe and the US. The tables below show the rates of CPI and PPI that the EU and the US have had as a previous year comparison and will have to lap this year. The optical effect of lapping a period of very low or deflation results in an inflated rate of inflation should the respective input components increase in the intervening period, and thus the following year the comparisons are significantly harder to match and therefore the reported numbers should start to come down.

While the headline rate is likely to reduce as the larger numbers are lapped there is no denying that both companies and consumers are feeling the pinch of increasing prices. Many of the costs are being passed through to the end consumer, protecting the profits of companies, but conversely workers are currently in a position to demand higher wages for their services, and this is also being realised, especially in the lower paid part of the workforce, albeit many of the increases are not positive in real terms.

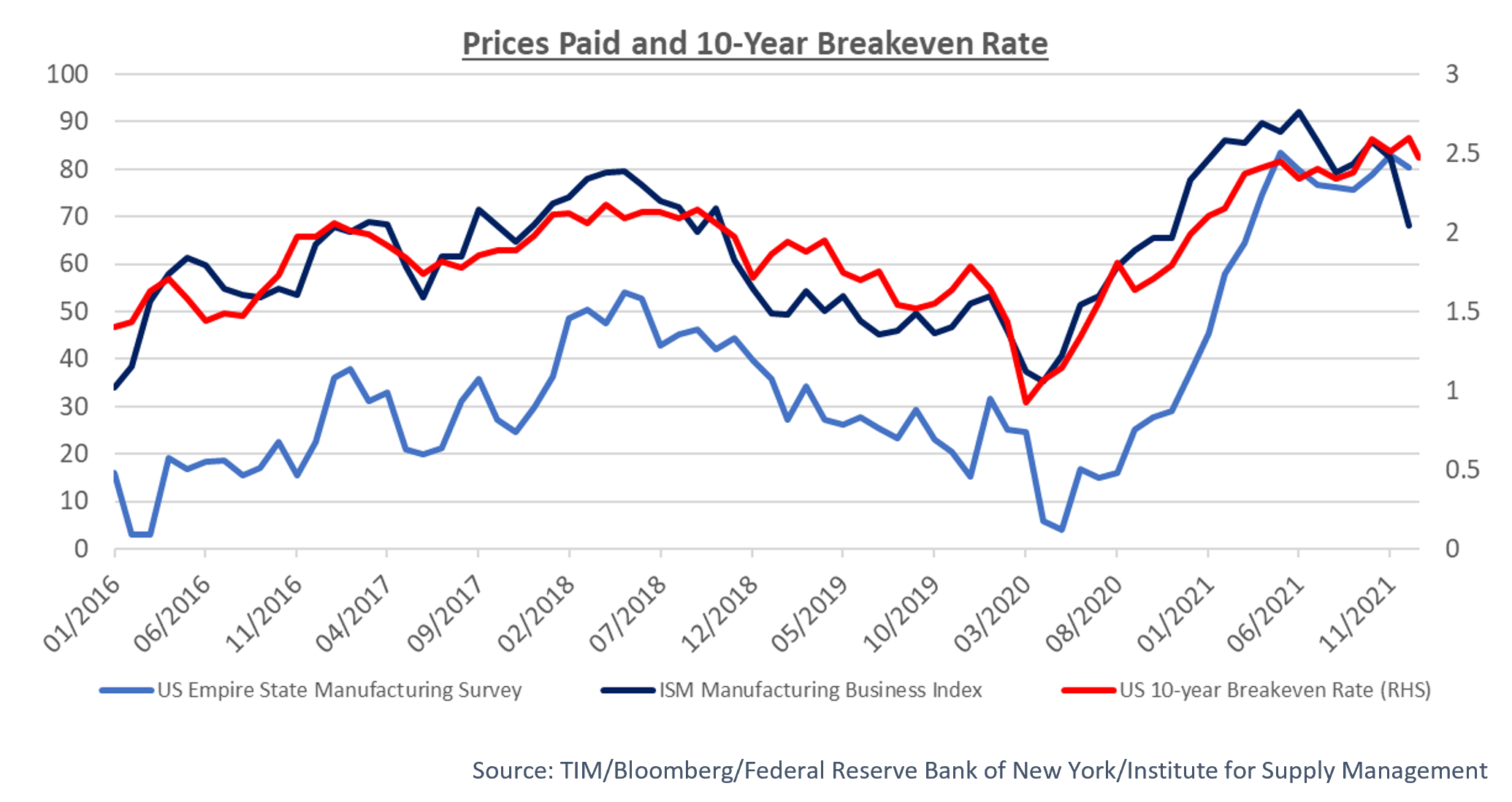

Most inflation numbers are backward looking and thus we expect there will still be some uncomfortable numbers reported over the coming weeks. We are, however, somewhat tentatively, starting to see the first signs in more real-time data of some of the inflationary forces of 2021 begin to wane. Although many shortages still exist in many components such as semiconductor chips, shipping rates and many commodity prices are off their all-time highs, backlogs in ports are also not as bad as they were in 2021, and the world is starting to learn to live with COVID. As the chart below shows, the two most widely followed surveys of prices paid, from a total of 500 manufacturing executives, show the rate of change starting to improve.

With such a wide range of possible outcomes, we continue to argue that a balanced portfolio with a mix of traditional quality companies with a history of growing throughout the business cycle, with more cyclical quality ‘value’ companies, and those companies are adapting to and driving technological change is the right course of action. We also highlight that often it is in times of uncertainty, and shifting investor sentiment that opportunities to invest in companies on your watchlist can arise. While sudden and significant style shifts can be painful for long-term investors, we do not believe in chasing short-term performance by making wholesale changes to portfolio composition is a recipe for long-term success, and that finding companies with outstanding fundamentals will prove to be the more profitable strategy.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not