Read More

Read More

Richard Scrope

Fund Manager

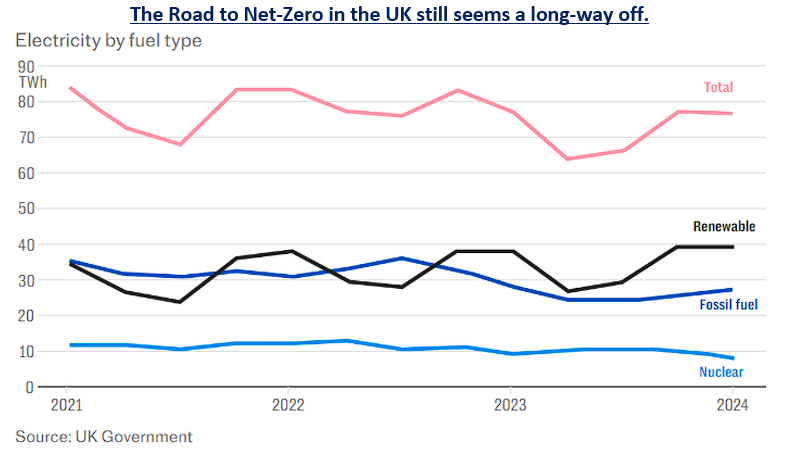

Ed Miliband, the former leader of the Labour Party, has been appointed the head of GB Energy and tasked with formulating how the UK will keep the lights on whilst meeting its net-zero commitments. So far it appears that nuclear power is low down his priority list favouring wind and solar, despite the need for power when the wind doesn’t blow and the sun doesn’t shine.

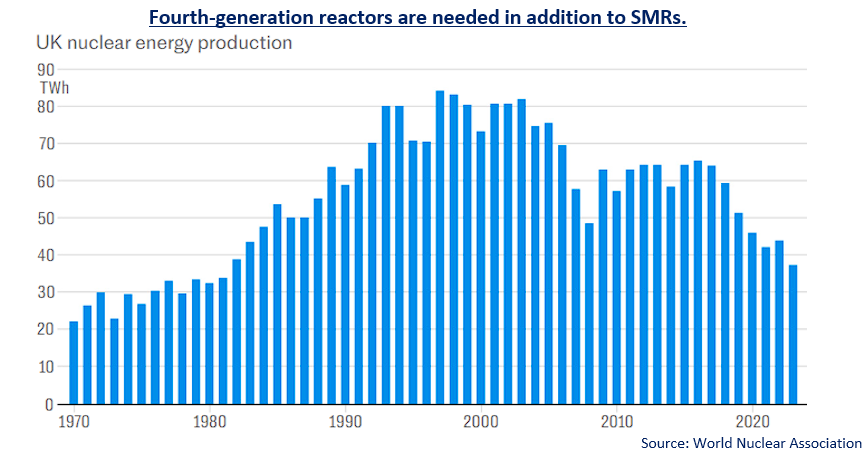

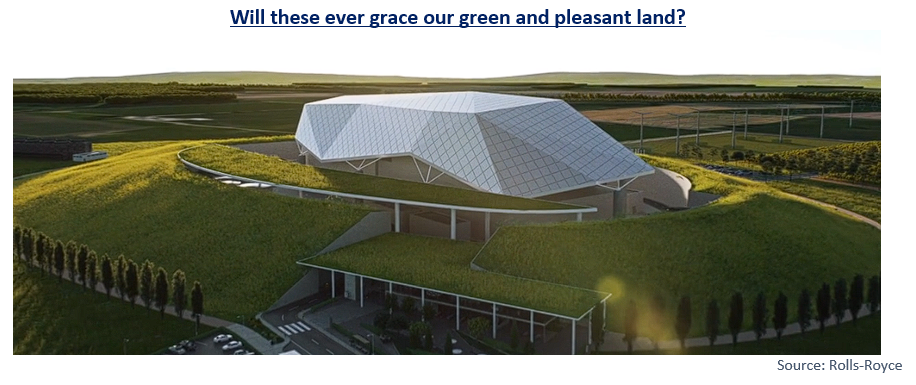

The candidates for providing the government with small modular nuclear reactors (SMRs) have been reduced to four with NuScale Power, Rolls-Royce’s former SMR partner, dropped from the list. This despite its designs being approved in the US and being the most likely to have a reactor producing the UK with regular power in the shortest timescale. Nuclear has long been beset with budgetary overspend and red tape hurdles, and now the government seems unlikely to have power from SMRs before 2035, at a time when the UK’s existing nuclear production is falling.

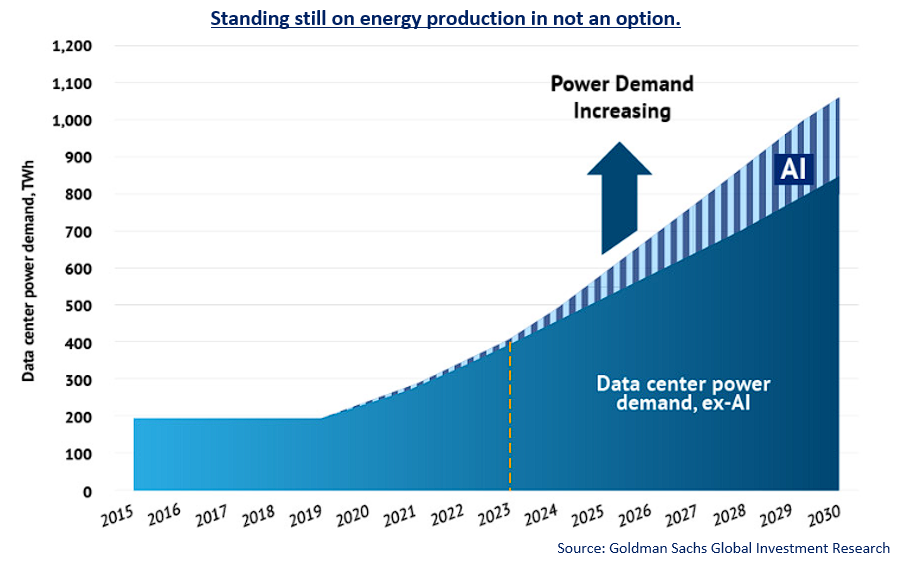

In a world where electricity consumption is only expected to increase, if coal and gas are to be phased out, nuclear almost certainly needs to play an increasing part of the mix, a fact that has not been missed by the big technology companies. With data centre power demands increasing exponentially in the era of AI, Google, Microsoft and Amazon are all calling on nuclear companies to secure stable, clean supplies.

Currently data centres consume a small percentage of total power consumption in most US states. However, in Virginia they account for 26% of the total, giving an insight to what the future may hold as the number of data centres continue to increase. McKinsey estimates that data centre demand will increase by 10% per year until 2030. The International Energy Agency estimates that demand from AI, data centres and crypto could double by 2026, to 21% of total energy demand, with the added demand equal to the total used, in the high-usage case in Germany, or Sweden at the conservate end.

Microsoft has signed a 20-year deal with Constellation Energy to purchase power from the infamous Three Mile Island Nuclear Plant, which is due to reopen in 2028. Amazon has agreed to buy power from Susquehanna for one of its datacentres in Pennsylvania and, this week, Google announced a deal with Kairos Power for multiple SMRs. We expect that these deals are only the tip of the iceberg as data demands continue to increase and data centres cannot afford to have an unstable power supply - only nuclear can provide this in a low-carbon world, despite what the anti-nuclear activists might argue.

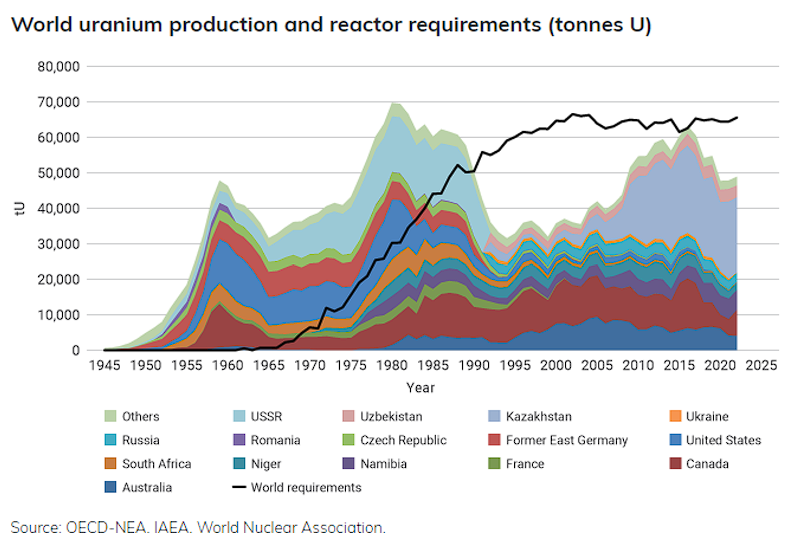

With uranium production being volatile and the majority coming from the developing world or those with interests different from the Western world, securing supply will be of national importance. According to the OECD and the World Nuclear Organisation, should every idled mine and planned project go into production, uranium production there will be a shortage of supply by 2030; delaying decisions to whether or not to build new plants risk the relevant party falling down the priority list for suppliers.

Germany phased out the last of its nuclear power plants in April 2023, and now ironically is a net importer of power from France, where 70% of power production comes from this source. Should Ed Miliband not fully embrace nuclear, the UK may need to only turn the lights on when the wind blows and thus drop down the list of where the energy-hungry technology companies want to invest.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not