Read More

Read More

Felix Wintle

Fund Manager

One of the recurring themes in markets are the narratives that people spin to try to further their agendas. In bear markets that narrative is often intended to distract investors from what’s really going on. But talk is cheap; what people do is much more important than what they say, and this is never more true when stocks prices are falling as they have been all year.

One of the interesting behaviours has been the prevalence among big cap tech companies to engage in stock splits. Tesla, Google, Apple, Amazon, Shopify are among those who have split their stock and the question has to be why and, more specifically, why now? Many of these stocks have had sky high stock prices for a long time and they will tell you that they split to allow smaller investors to be able to buy their stock. Interesting, however, that they split only after the big move in the stock has already happened and their stock prices are in defined downtrends. Are they trying to get investors to support their falling prices?

What’s been happening in the C suite is always noteworthy. Jeff Bezos stood down as CEO of Amazon in July 2021, Sheryl Sandberg quit as CFO of Meta in June 2022. Others that have remained in situ have been big sellers of stock; Satya Nadella, the CEO of Microsoft, sold approximately $15m worth of Microsoft stock on 1 September. Amy Hood, the CFO, clearly thought this was a good idea and followed her boss by selling $19.5m of stock the very next day. Luca Maestri, the CFO of Apple, sold approximately $17m of stock in August. Kate Adams, the General Council, has sold around $30m of stock in the last two months. Insiders are allowed to sell of course, and there can be many reasons that insiders wish to sell, my point is only to say that insider sales of this magnitude are seldom bullish signs.

In other sectors, former cult stocks like Beyond Meat have also seen fortunes wane. The stock has been under considerable pressure (-75% year to date) and suffered the loss of its Chief Supply Chain officer who has left the business to ‘pursue another opportunity’; not a great sign for a company once touted as the saviour of the planet as it relates to meat alternatives. Embarrassingly, the COO, was recently arrested for biting another man’s nose in a fracas at a football game, somewhat ironic for a company that sells vegan meat. He has been charged with assault and battery. One could argue that this has little to do with the prospects of the company, but it’s the behaviour that is interesting. Would either of these things have happened if Beyond Meat was in the ascendency?

We wrote in June about the hiring freeze that has been ongoing in Tech, and this has become more of a trend of firing and cost reduction. Just this week, Amazon has announced that it’s freezing hiring at the corporate level. If Amazon is pulling back on hiring, we should all take note, particularly given their reputation for investing during downcycles. Meta, which has fallen 56% since its name change, tore up its lease on 225 Park Avenue and paid full termination fees on the property that it signed up to in 2016, leaving 4 years left on the lease. Big Tech has been the major lessor of office space at the margin, and for them to renege on this deal is yet another sign of where we are in the cycle.

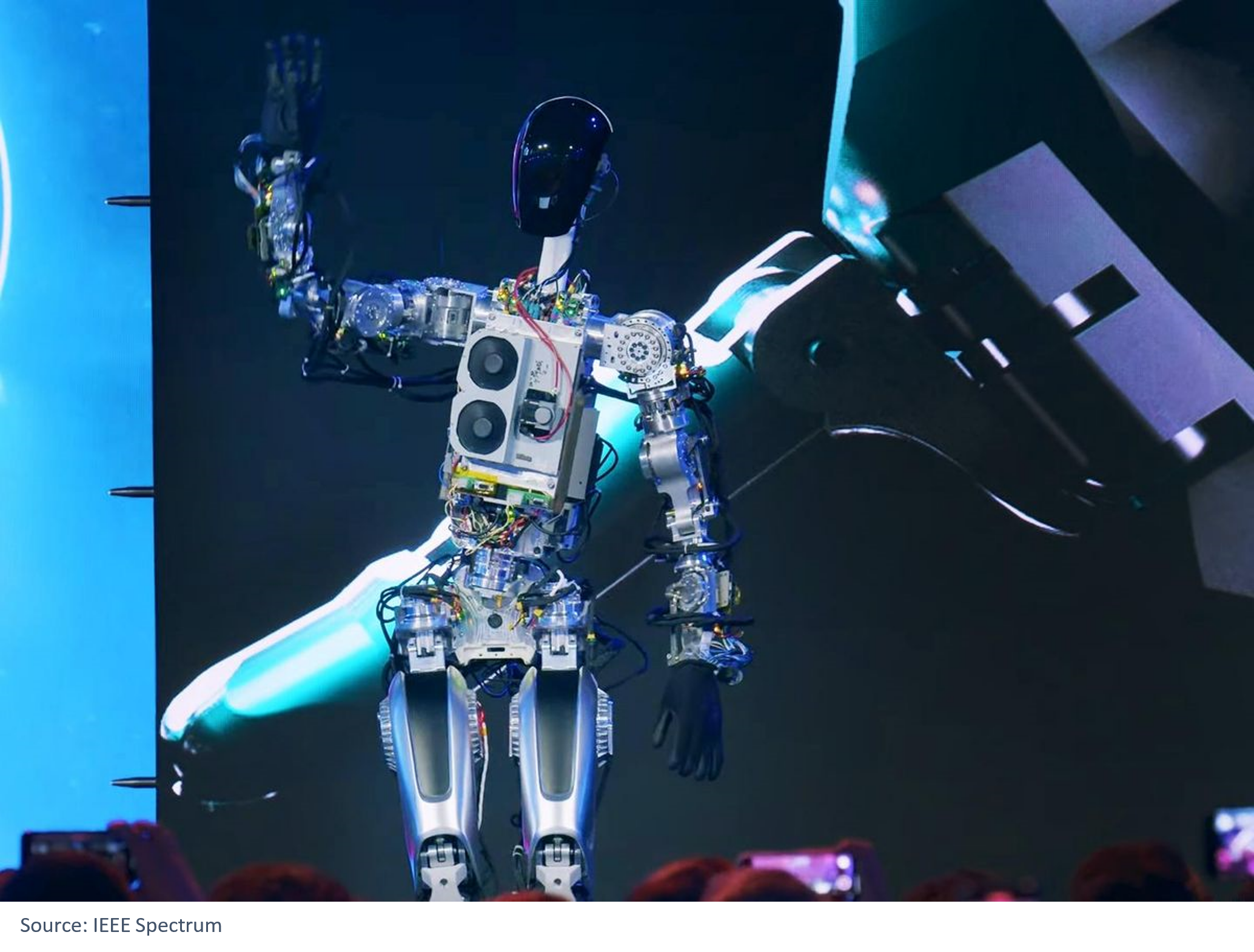

Let’s leave the last mention to the poster boy of the tech bubble, Elon Musk. Whilst he has been excitedly talking up his Optimus humanoid robot, he has recently laid off 10,000 people and bought Twitter for $44bn. Just to be clear, that’s not Tesla buying Twitter, that’s Elon Musk buying Twitter. Never before has a CEO personally acquired another S&P 500 company for such a price tag. What better way to distract attention away from the core business and what else says peak Tech better?

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not