Read More

Read More

Richard Scrope

Fund Manager

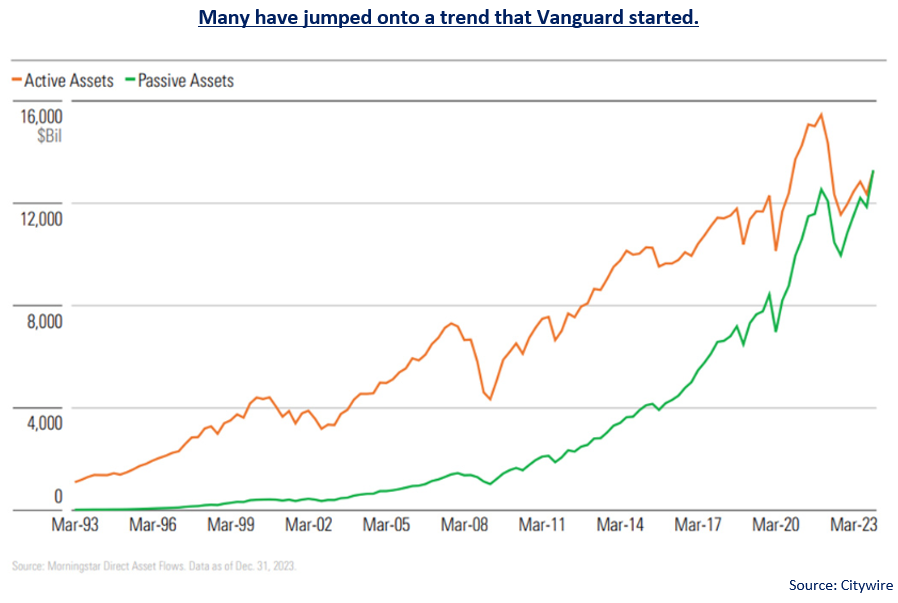

More money resides in passive funds than active funds today which not only saddens those of us who practise the art of active management, but also creates risks to investors that they may not be aware of i.e. the need to look below the bonnet to see what exactly they are investing in.

We have written in previous newsletters about the cross-correlation in the top 10 holdings between many widely followed exchange traded passive funds. This issue remains true today, with nine of the top 10 holdings in the SPDR S&P 500 ETF Trust being the same as the iShares MSCI World ETF. Berkshire Hathaway is the exception and comes in at number 11 in the iShares ETF.

Knowledge of what an index ETF can and cannot invest in is also important. For example, if an investor wanted exposure to Europe’s largest company, Novo Nordisk, it would not be worthwhile in investing in the SPDR Euro Stoxx ETF or any other ETF that aims to track the Euro Stoxx 50 index. The reason being that, despite it representing Europe’s blue-chip super-sector leaders in the region, Denmark is not included in the index while it is in the Stoxx Europe 600 index.

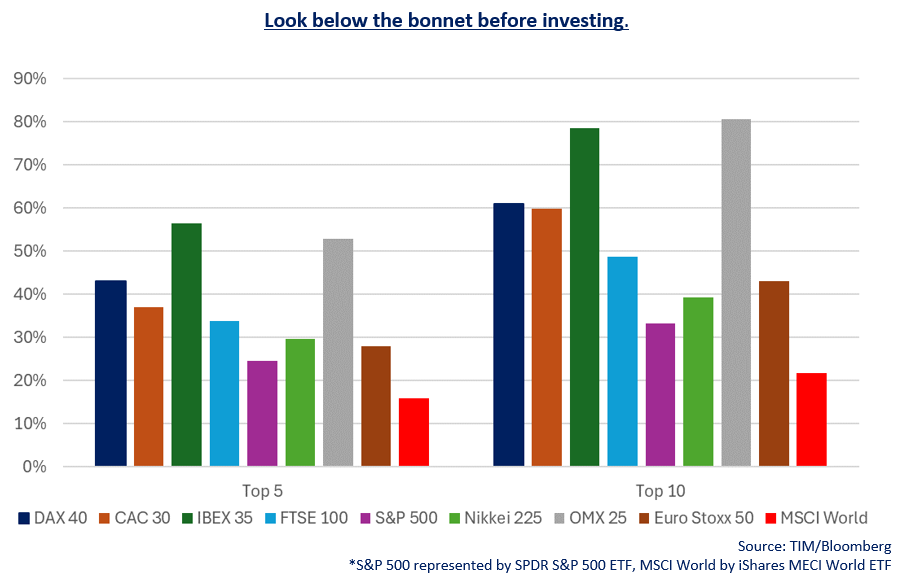

The other reason that investors need to look under the bonnet of ETF funds is the concentration of returns that are due to very few of the holdings. Many of the major country indices have maximum position sizes, but not all. Those that do are not uniform in what the rules surrounding them are. For example, Germany’s DAX Index and France’s CAC Index both put a limit in at 15%, while Spain’s IBEX index allows any single company to account for 20% of the index before reorganising the index. In the US we saw the S&P 500 Index having to implement a rare additional rebalancing last year as it not only has a 15% maximum position size but also a rule that requires rebalancing if the five largest companies account for more than 40% of the total index.

Some countries main indices have no limits at all, so investors need to pay attention to where their returns are coming from.

We do not say that concentration is necessarily a bad thing, or that the companies with large weightings are bad companies, as most have earned their position through organic growth and superior returns. However, active managers have the luxury of selecting only those companies with the best future growth potential and can therefore diversify the weightings of their holding accordingly.

The VT Tyndall Global Select Fund self imposes a maximum position size of 5% to avoid its returns being beholden to a small number of companies, focusing on risk-adjusted returns instead.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not