Read More

Read More

Felix Wintle

Fund Manager

Sector rotations are quite common at the turn of the year and 2023 has been no exception. So far this year, the winners of 2022 have been notable underperformers and the losers of 2022 have been big outperformers. The question for investors is whether these moves are the start of a new bull market or whether they are merely bounces in an ongoing bear market.

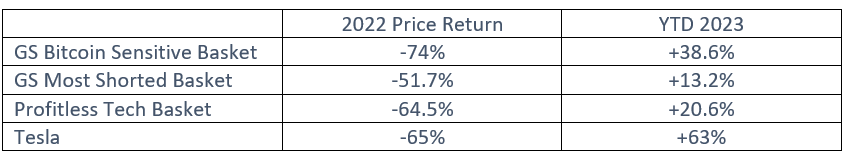

There is no easy answer to this of course, only hindsight can tell us for certain, but there have been component parts of this rally that, in my view, look like speculative fervour. Below is a table that shows some of the most speculative corners of the US market which have bounced significantly in the first 7 weeks of 2023, after having a torrid time in 2022.

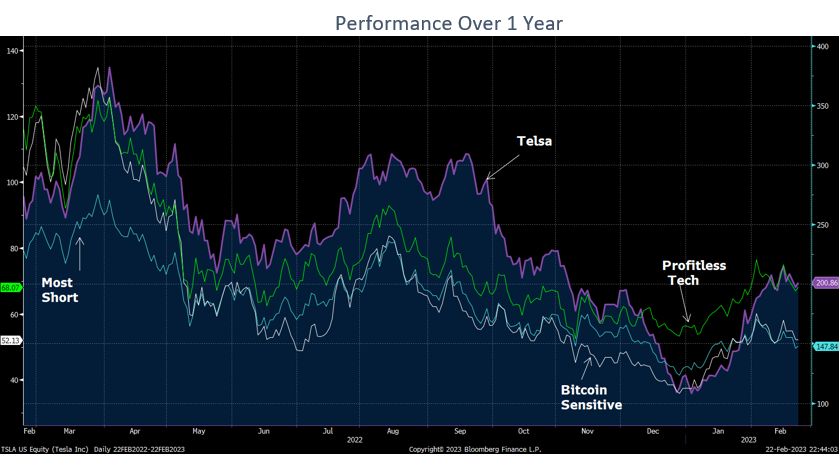

The chart below shows the performance over 1 year which highlights how correlated these equities are, indicating the probability that investors are chasing stocks with certain factors rather than owning them for their underlying fundamental attributes.

It is important to remember that the year-to-date performance has to be taken in the context of the longer-term picture. Take, for example, the Bitcoin Sensitive Basket which fell some 74% in 2022. In order to get back to break even, it has to go up 285%. This puts its year-to-date performance of +38.6% into some perspective, ie: if you’d held last year too, you’re still nowhere near to getting your money back.

There has been similar speculative action in individual names. I quote Tesla only because it has been the poster child for speculation in the mega cap space and as the chart overleaf attests, many of the shareholders would also seem to be those who are investing in Bitcoin, Most Shorted Stocks and Profitless Tech. I do not believe that this is a sustainable bull phase in Tesla or in the speculative corners of the market which leads to the question why have they gone up so much? Tesla has doubled since its 6 January low for example. Sometimes the answer is simply because they went down so much to start with, and bear markets often give the biggest rallies when least expected.

Bear markets are periods when the market transfers leadership from one group to another and this is another reason why I do not believe the move in high beta Tech and Bitcoin is sustainable. I am looking for leadership in other sectors, particularly Industrials which is benefitting from the ongoing infrastructure rebuild and the re-shoring of manufacturing. This is likely to be one of the key investment themes for the next several years.

WARNING: All information about the VT Tyndall North American Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not