Read More

Read More

Richard Scrope

Fund Manager

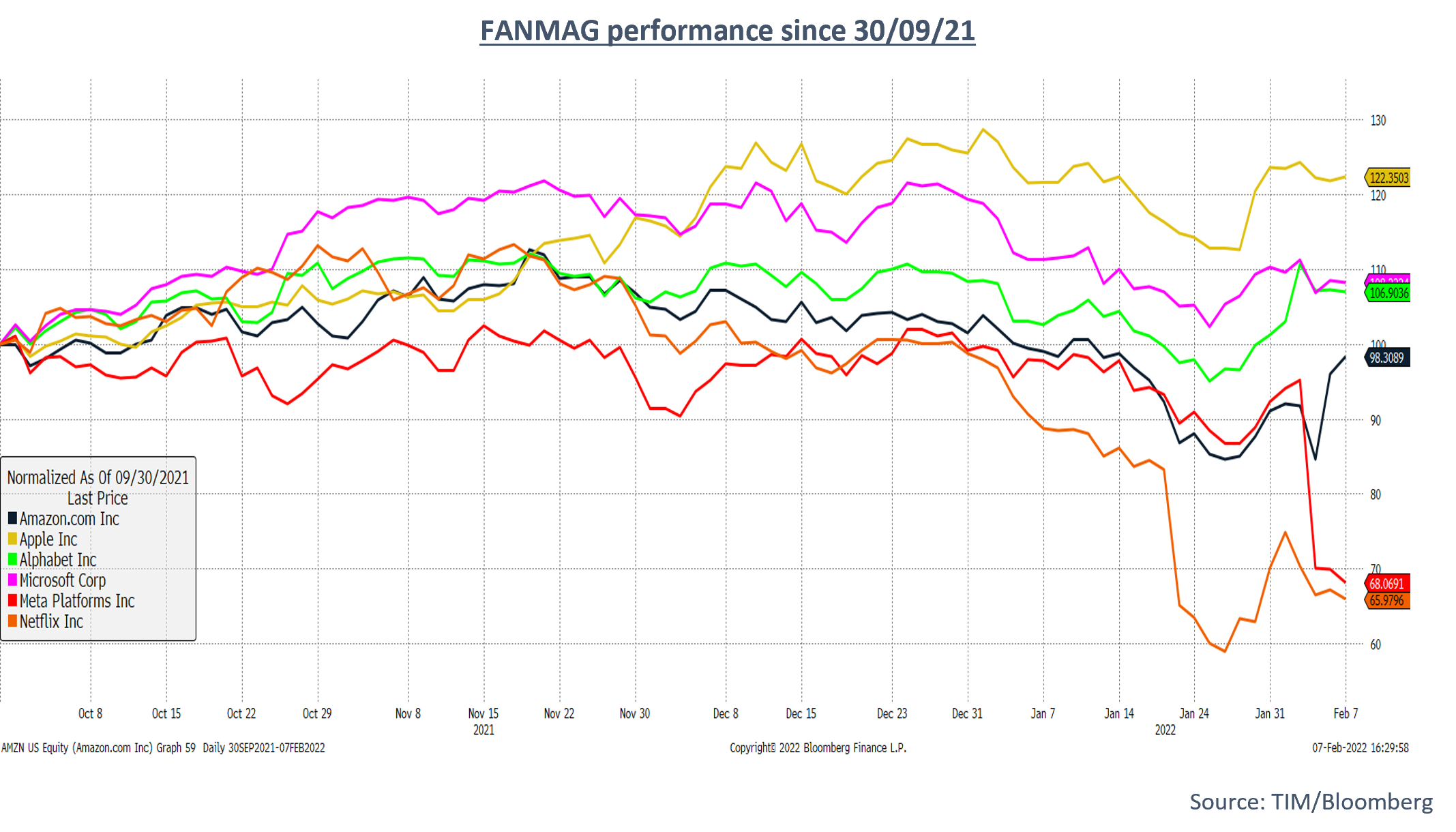

In Harry Nilsson’s famous ballad, the line ‘I can’t live, if living is without you’ is followed by ‘I can’t give, I can’t give any more’ and recently this has proved to be only too true for some of the poster children of the pandemic. Many commentators have written off the collective FANMAG group following their performance and contribution to US returns over the past decade, and with an equal-weighted return of -13.3% so far this year, it can be argued that they have a point. Selling winners, regardless of their underlying fundamentals, is often the lazy investor’s way of participating in a sector shift and the dramatic style rotation seen so far this year was no exception to this phenomenon; the disposal of the bathwater saw many babies head towards the plughole.

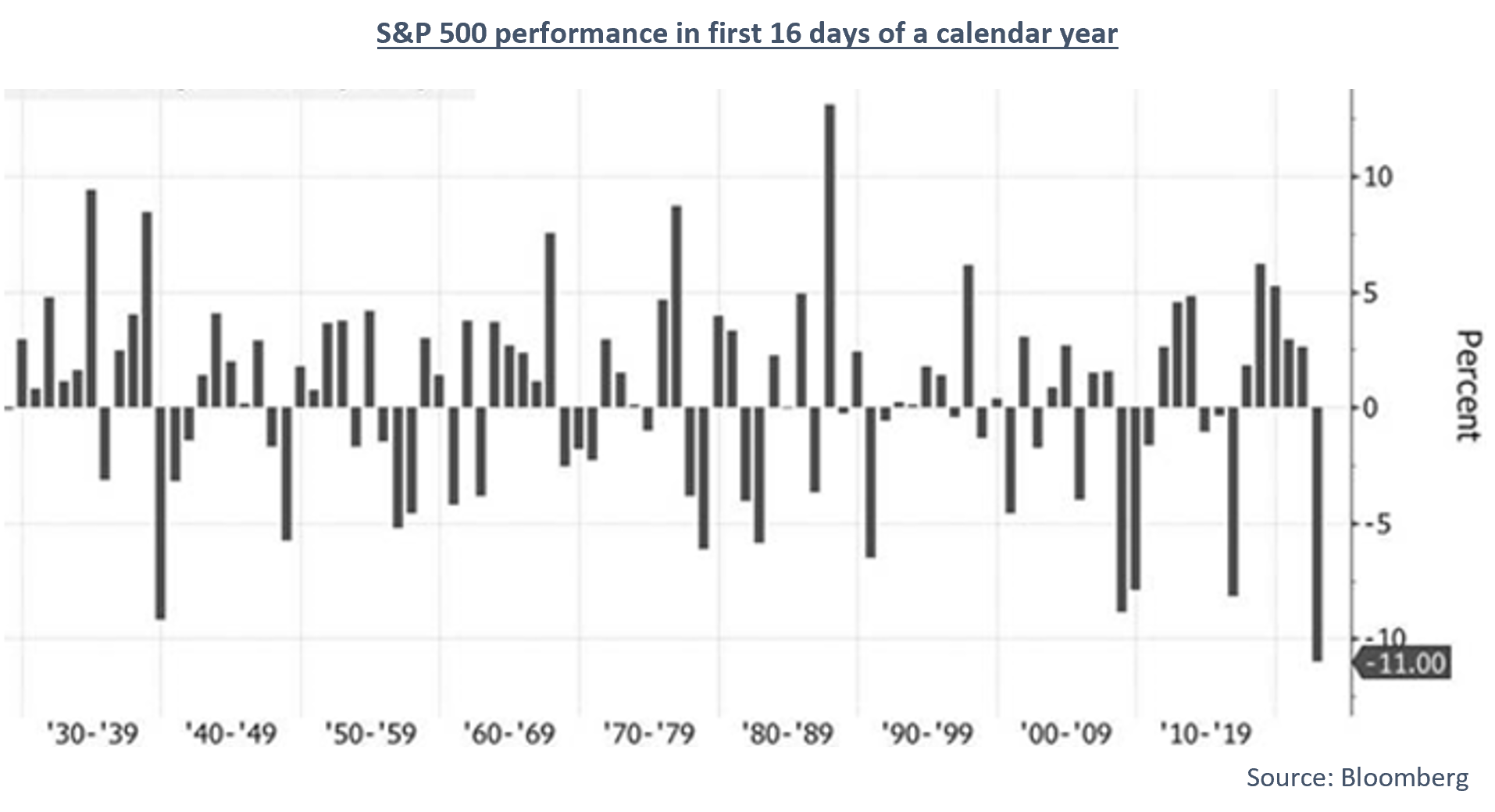

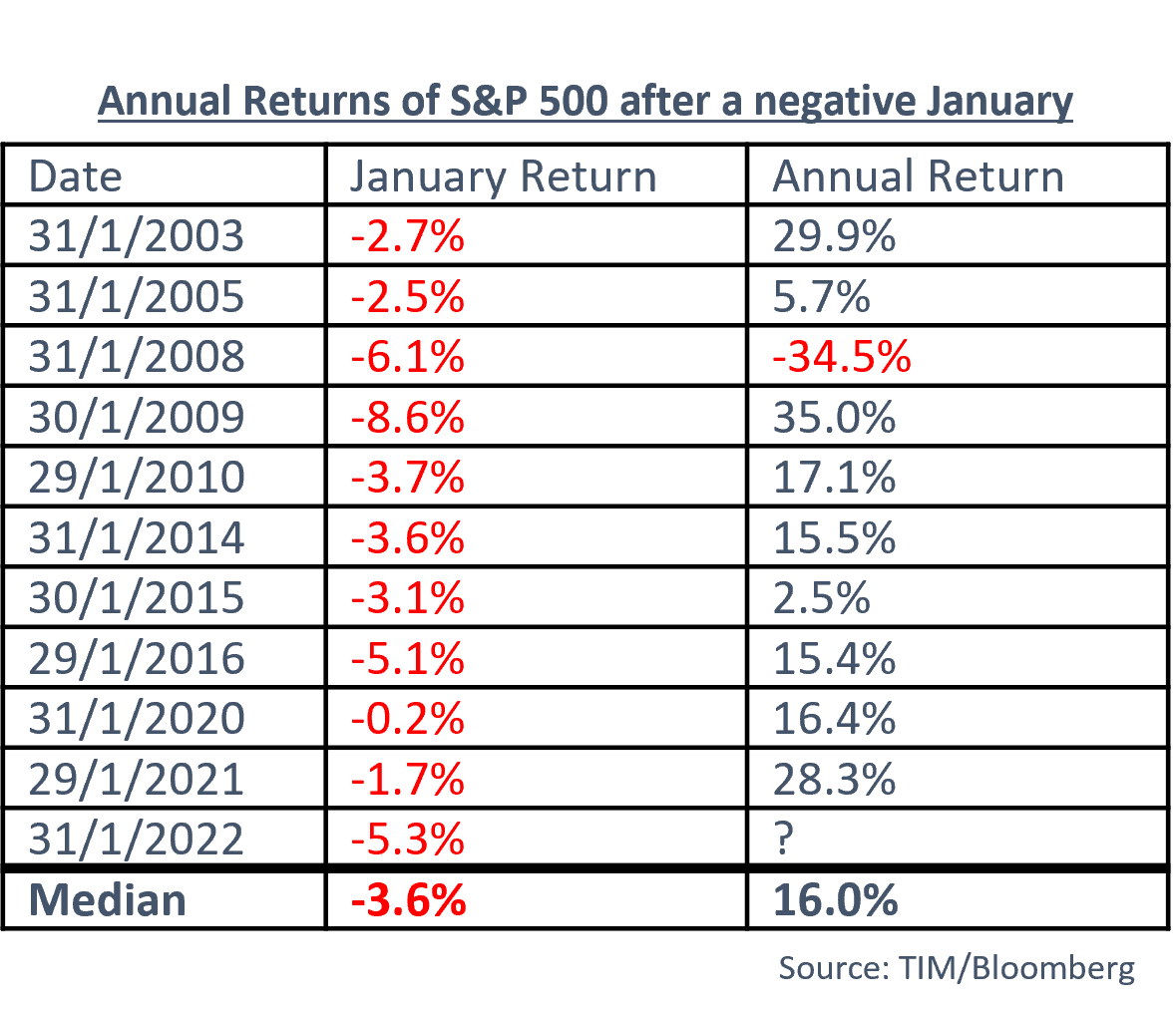

January is often a volatile month as strategists, economists and shorter-term investors attempt to predict the likely outcomes in the coming month and year, however, it has rarely been a good barometer of the outcome during the whole year and a negative January can often be a healthy shakeout rather than an indication of equity returns in the months ahead.

As is often the case in times of market corrections, the initial move is to fire first and ask questions later. The wholesale onslaught of the technology sector failed to distinguish between those companies that have become mission-critical, supported by cash flows and revenue generation, and those that are not. When companies are faced with decisions as how to deploy their capital, while facing numerous margin pressures, it pays to analyse where management teams might decide that they can’t give any more and those that they can’t live without.

The nature of what is deemed by companies and individuals to be mission-critical has become evident in the most recent round of company reports. Although many mission-critical stocks remain below water for the year-to-date, investors are awaking and realising that these companies do not fade away overnight and can continue to produce all-time high revenues and margins in a post pandemic world, despite the headwinds they face, leading to some outsize moves in share prices. On the flip side, many well-held stocks are less resilient, and Mr Market has little empathy for highly valued companies that fail to surpass expectations or show signs of being competed away.

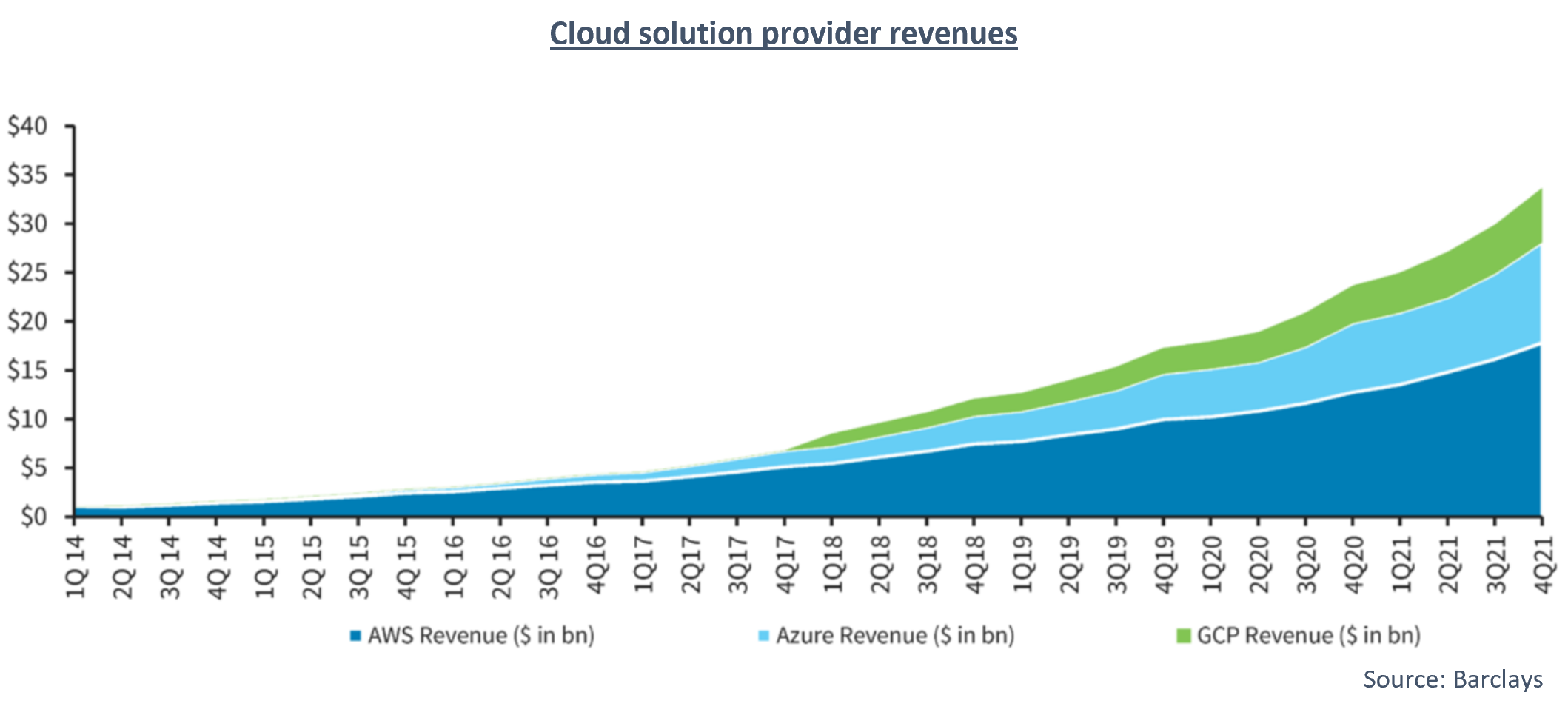

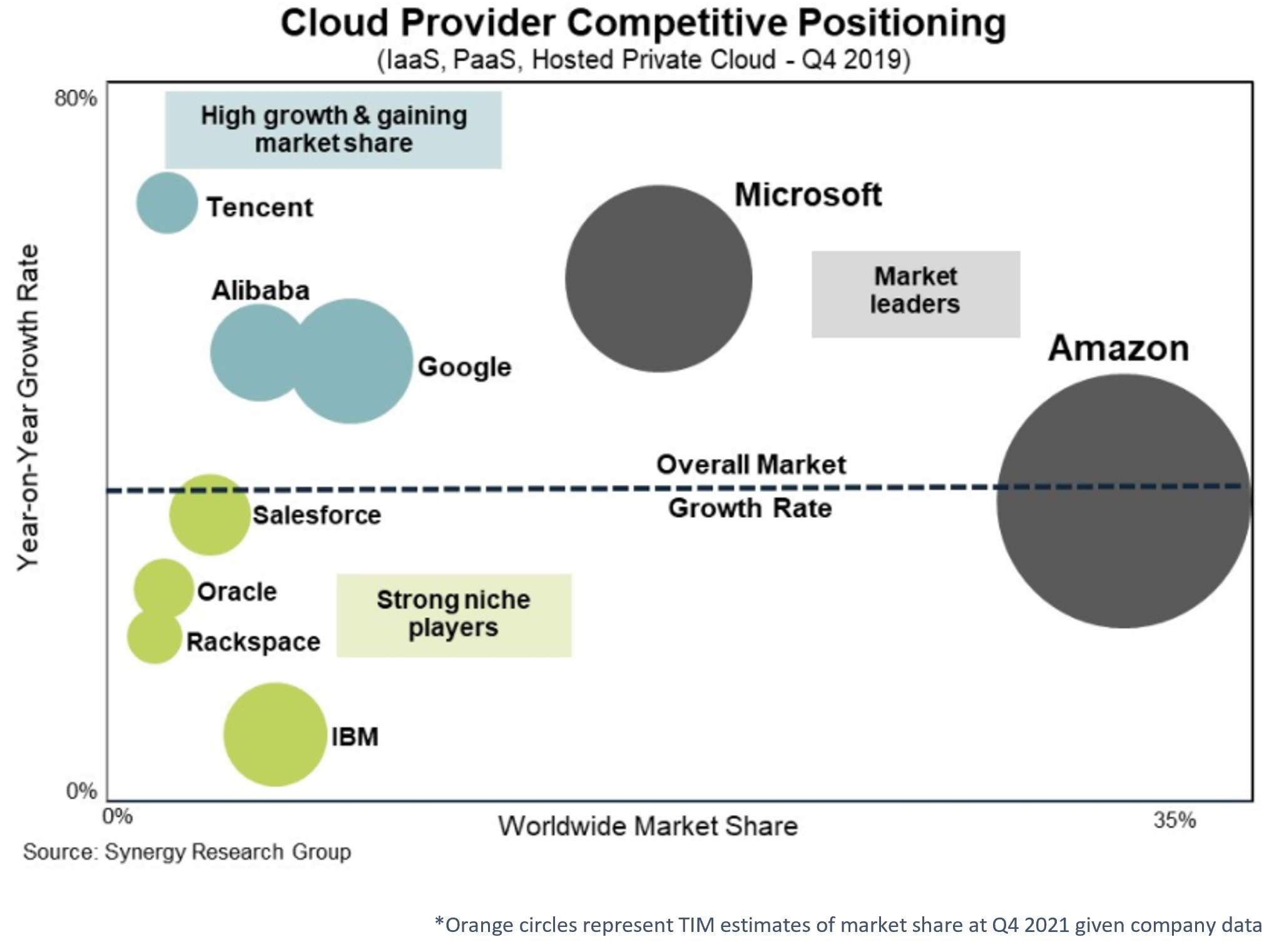

One of the key areas of progress has been the shift to cloud or hybrid databases. Although many companies claim to have cutting-edge solutions, scale matters and our discussions with management confirms our belief that in most pitches only Alphabet (Google cloud platform), Microsoft (Azure), and Amazon (AWS) feature.

Once a company makes the decision to shift to storing and using its data on the cloud, it is difficult to roll-back, providing a reliable recurring revenue stream for the providers, who aim to upsell additional services such as artificial intelligence analytics or security applications.

The three largest providers accounting now for around 60% of the overall market, and with size comes economies of scale and profitability. The days of GCP competing on price to gain market share appear to be in the past and margins are once again increasing for all three players. The overall cloud market continues to grow and is still in its infancy; Fortune estimates that the $78.3 billion US market will increase to $791.5 billion by 2028 and that the $72 billion international market will grow at an even

faster rate.

Cloud is only one of the areas where companies can venture to be seen as mission critical, as Apple demonstrates with its ecosystem intertwined with the everyday lives of billions of people, or as Alphabet and Amazon are to advertising with their large addressable audiences. Innovation, differentiation, desirability and competitive moats are all key factors if a company wants to maintain and grow its market share and market corrections such as the one witnessed in January give investors the opportunity to add to holdings when these factors are being ignored by the market.

*Of the companies mentioned in the report, the VT Tyndall Global Select Fund holds positions in Microsoft, Amazon, Tencent and Apple.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not