Read More

Read More

Simon Murphy

Fund Manager

A year ago we made the point that, very much in keeping with the quote above, we are loathed to view the turn of the calendar as anything special in investment terms, it being just another day after all. However, we made an exception last year on the basis of a newly sealed Brexit deal, promising Covid-19 vaccine developments, resurgent M&A activity and more, which we concluded allowed us to ‘start the new year with a renewed sense of enthusiasm in our outlook for UK equities.’

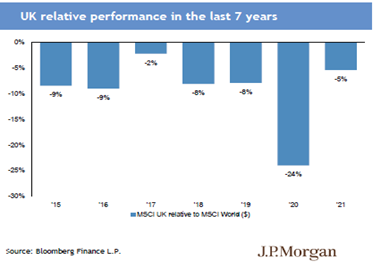

As it turned out, we shouldn’t really have bothered! Whilst UK equities made solid gains in 2021 they yet again lagged other geographies, as they have for several years now, the chart below highlighting the performance of MSCI UK relative to MSCI World since 2015.

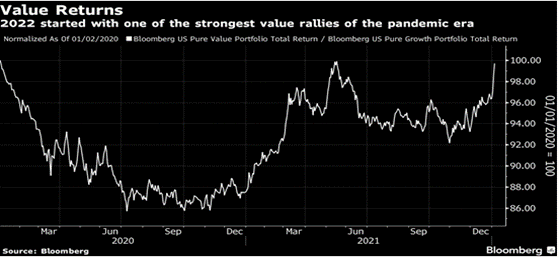

Brexit continued to create challenges for the UK in 2021, whilst the emergence of first Delta, then Omicron, meant the pandemic remained front and centre of everyone’s minds during the year. After an initial burst of enthusiasm for ‘value’ in January and February, markets reverted to ‘growth’ and ‘quality’ for much of the rest of the year, as they have for so many years now. Meanwhile, looking at fund flows shows the UK remained deeply unpopular with domestic and overseas investors alike.

This year we offer no ‘new year, new outlook’ type commentary. Rather, we move forward with the same broad outlook that we’ve held for some considerable time, which can be encapsulated as:

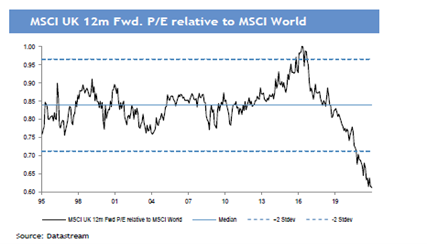

- The UK equity market looks highly attractive from a valuation perspective both absolute and relative to other geographies.

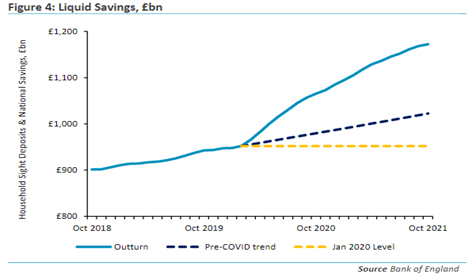

- The UK domestic economy is in good shape. Notwithstanding rising energy prices and (probably) taxes, households have significant excess savings and corporate balance sheets are robust. Labour and housing markets are healthy and financial conditions remain easy, even if interest rates rise gradually from here.

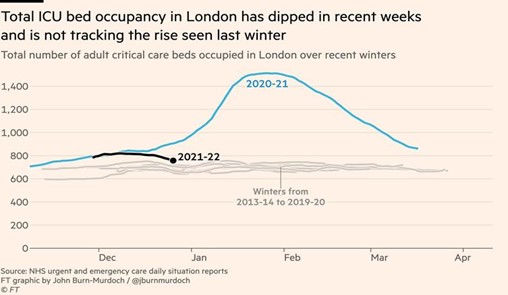

- We will, eventually, learn to live with Covid-19, as we do the several other coronaviruses that have been identified since the mid-1960s. The world will reopen again.

- We will continue to evolve and adapt our relationship with our hugely important trading partners in Europe.

- The disconnect in valuation, perception, and investor positioning in ‘value’ stocks relative to ‘quality’ and ‘growth’ is more extreme than at any point in our careers, with the exception of the ‘dot com’ mania of 1999/2000. This will, eventually, normalise.

We don’t intend to elaborate on these points in detail here, but rather offer a few interesting, relevant charts that we’ve seen recently that, to us at least, suggest we might be on the right track.

- Ok so the first one is easy - the UK market is cheap!

- Since the onset of the pandemic UK household liquid deposits have grown over £220bn or nearly 10% of UK GDP! Most definitely not a ‘normal’ outcome after a recessionary period, but extremely helpful in the context of rising living costs, energy prices etc.

- This is a hugely welcome development, one which seems to corroborate the initial findings from South Africa. Omicron is clearly highly transmissible but thankfully appears to be significantly less severe. Could we be getting closer to ‘endemic’ rather than ‘pandemic’?

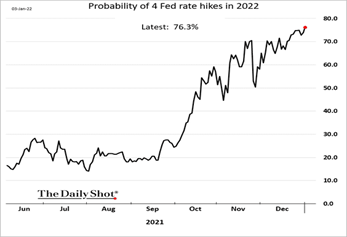

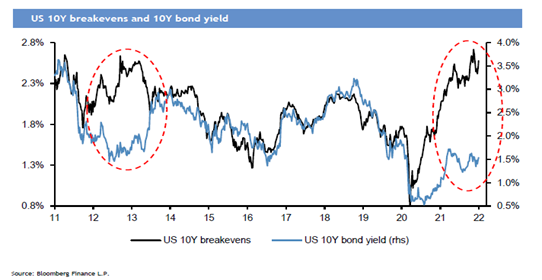

- Over the last few months, markets have become increasingly convinced that central bank bond purchasing is coming to an end and interest rates are going to rise. This has potentially profound implications for the cost of capital, valuations, factor performance and more.

- Indeed, 2022 has already seen a sharp improvement in ‘value’ performance as bond yields have risen. However, this happened at the start of 2021 too!

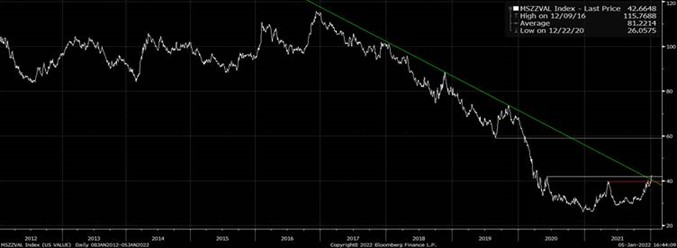

- The chart above is the Morgan Stanley ‘US Value Factor Long/Short Basket’. It suggests ‘good value’ companies are starting to outperform ‘bad value’ ones and, as can be seen, could have a long way to go given the scale of underperformance in recent years.

- Meanwhile the chart above gives some indication of where US 10-year bond yields could go if they were to reconnect with the 10-year inflation breakeven rate as they have historically. The latter could, of course, come down too!

As you might have gathered from our opening comments, we see no reason for radical reappraisal just because the date has changed, and you certainly won’t find a list of new year resolutions anywhere near our desk. However, we do, sincerely, wish all our clients and readers an extremely happy, healthy and prosperous 2022 and beyond.

WARNING: All information about the VT Tyndall Unconstrained UK Income Fund (‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free

of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund