Read More

Read More

Richard Scrope

Fund Manager

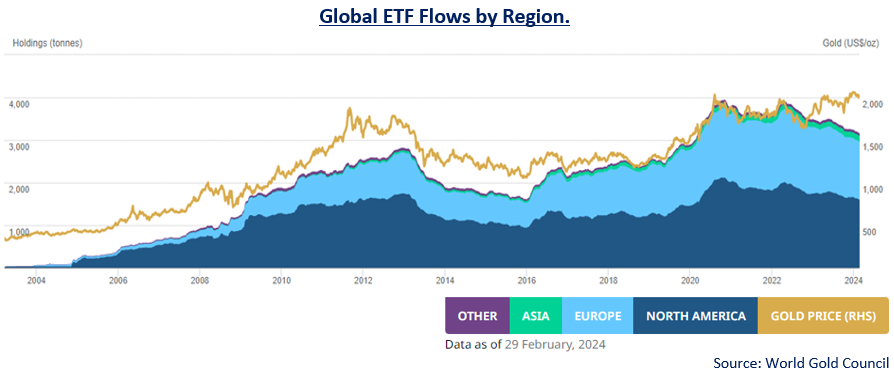

Despite the 15% rise in the gold price in the past couple of months, for the past nine months global gold ETFs have seen net outflows, led by North America and Europe. Asia, which is a small percentage of all ETF holdings, has in contrast seen net inflows for the past 12 months.

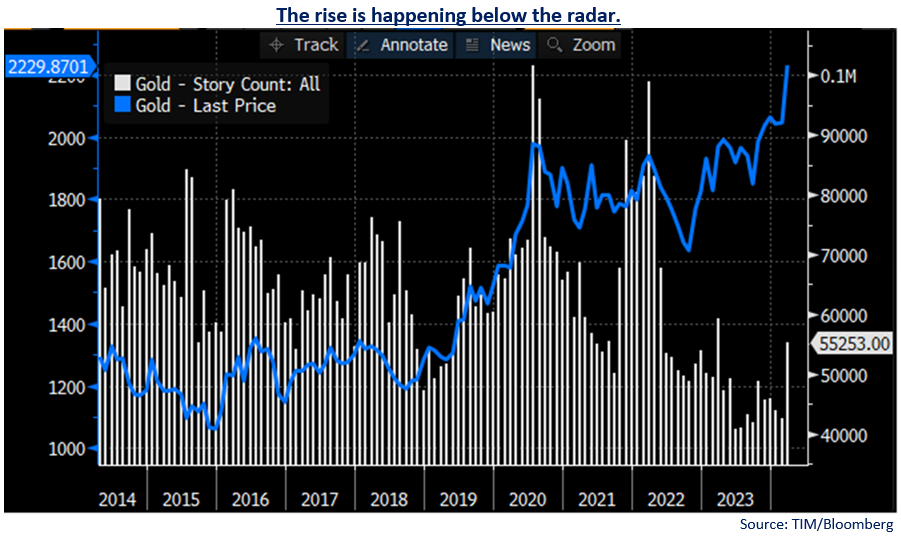

Normally, with such an increase in the price of precious metals, the goldbugs would be highlighting the benefits of gold, not only as a diversifying asset, but as a long-term investment given its enduring nature, however, this rally has drawn a surprisingly little amount of media attention, as shown by the news story count chart below. Whether the surging world equity markets, which continue to make new all-time highs, the hype around AI or the geo-political tensions in Ukraine and Middle East have diverted investors attentions is a matter of debate but there are some unusual dynamics in play.

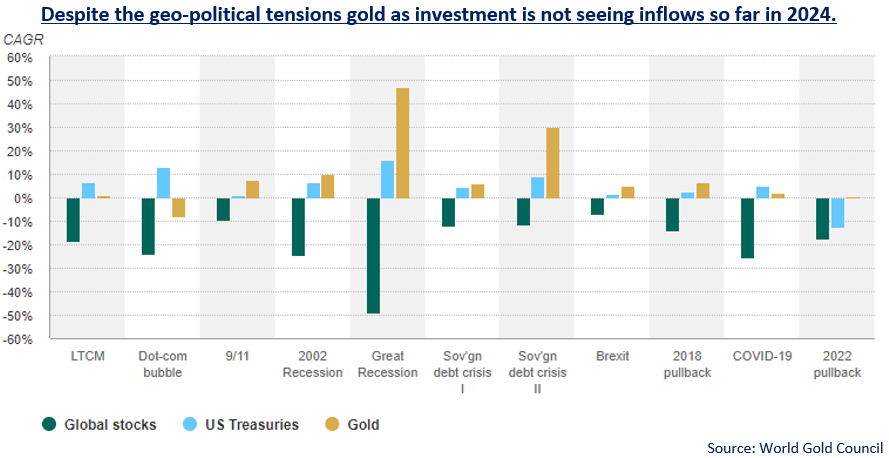

Naturally when equity markets are rallying, little attention is paid to the diversification and defensive nature of gold as part pf a portfolio, but as the chart below shows, in times of market stress, gold tends to be a good store of value.

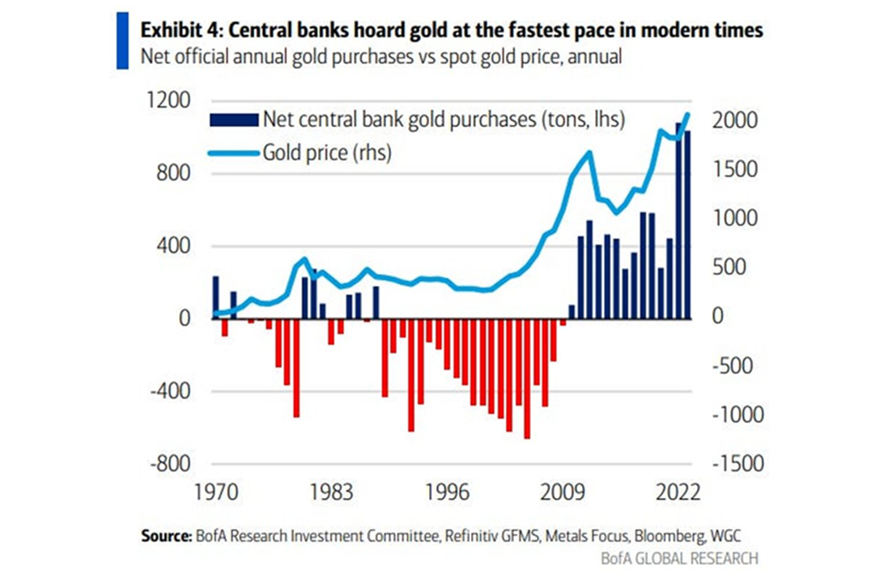

Demand for gold comes from a wide variety of sources, with 35% of annual demand coming from the jewellery sector, 39% is used by the investment industry, 19% by central banks and 7% is used by the technology sector. With the investment industry withdrawing assets from the marketplace, and anecdotally the Indian jewellery market stagnating, only central banks and the technology sector can be only logical reasons for the recent moves in the gold price. The data from Bank of America shows that since the Great Financial Crisis, central banks have been net buyers of gold, with a step up in purchases since the pandemic.

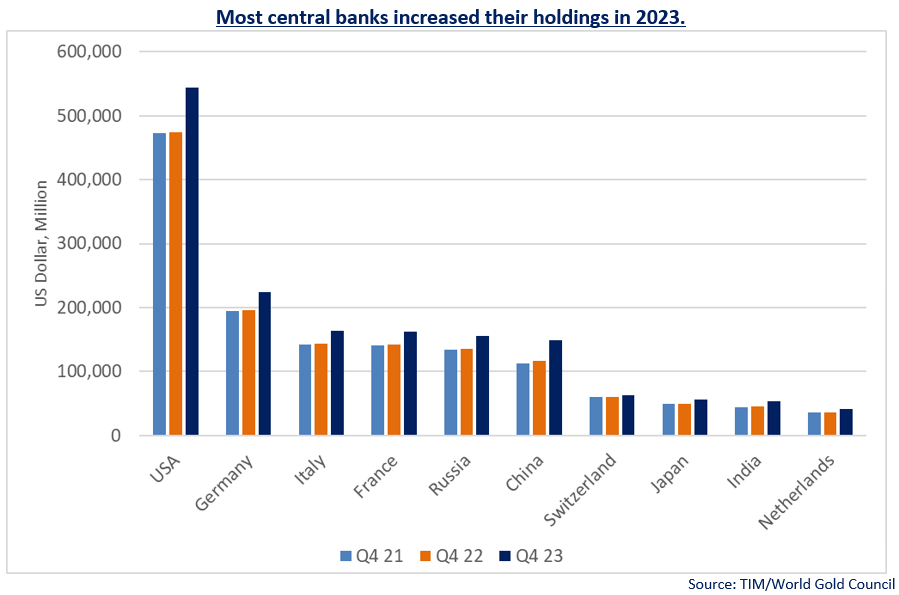

Looking at the data as to which central banks have been buying gold since the pandemic, it is notable that there have been net purchases from all the major holders of gold, and recent surveys show that 62.1% of central banks expect that over 15% of the reserves will be in gold and 24% of them expect to increase their holdings this year. Sadly, Gordon Brown sold the over half the UK’s gold reserves in 1999 at an average price of approximately $275/oz compared to $2,290 today, and today they have reserves of only 310 (vs 715 tonnes prior to Brown’s bottom) tonnes of the asset; the 17th largest holding globally.

Whether investors will return to buying gold remains to be seen, but there are anomalies that may lead them to be cautious, namely in the strength of the US Dollar, which normally has negative correlation to the gold price, and it is also noticeable that silver is also having its moment in the sun too.

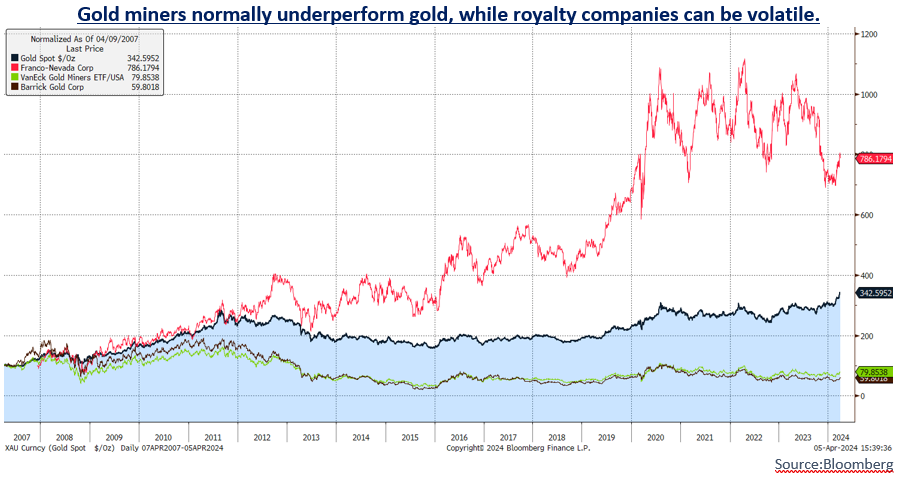

For many Fund managers getting exposure to the asset class is problematic as UCITS rules may prohibit them from owning the physical asset or ETFs and the gold miners have little correlation to the performance of gold. Royalty companies offer one source of exposure, but again the investor can be exposed to the volatility of political risk, but for investment managers who are not bound by the same restrictions, and we suggest that gold remains a good diversifying asset as part of a client’s portfolio.

WARNING: All information about the VT Tyndall Global Select Fund(‘The Fund’) is available in The Fund’s prospectus and Key Investor Information Document which are available free of charge (in English) from Valu-Trac Investment Management Limited (www.valu-trac.com). Any investment in the fund should be made on the basis of the terms governing the fund and not